On Friday, the trades are "on the side" of the dollar while investors are waiting for publication (at 12:30 GMT) of data from the U.S. labor market. In June, unemployment is expected to remain at the level of 3.6%, while the number of jobs outside the U.S. agricultural sector increased by 165,000, after +75,000 in May.

This is strong data that will support the dollar with the confirmation of the forecast and will force the Fed to wait a little with the rate decrease.

In the American economy, things are not so bad in comparison with other economies, and American consumers continue to actively spend money.

If the growth of new jobs again turns out to be less than 100,000, and unemployment rises, then the markets will take this as a signal to the Fed in the direction of lowering the rate, and by 50 basis points at once. In this case, the pressure on the dollar will resume with a new force.

Meanwhile, the Eurodollar has been declining since the opening of today's trading day. The EUR/USD pair is trading at the beginning of the European session, near the 1.1260 mark, 23 points lower than the opening price of today's trading day. Weak macro statistics, received at the beginning of the European session from Germany, had a negative impact on the euro.

In May, orders in the manufacturing sector of Germany decreased by 2.2% compared with April, and compared with the same period of the previous year - even more, by 8.6%. The German economy is the locomotive of the entire European economy, and its slowdown will increase the pressure on the ECB towards the adoption of additional incentive measures in the coming months.

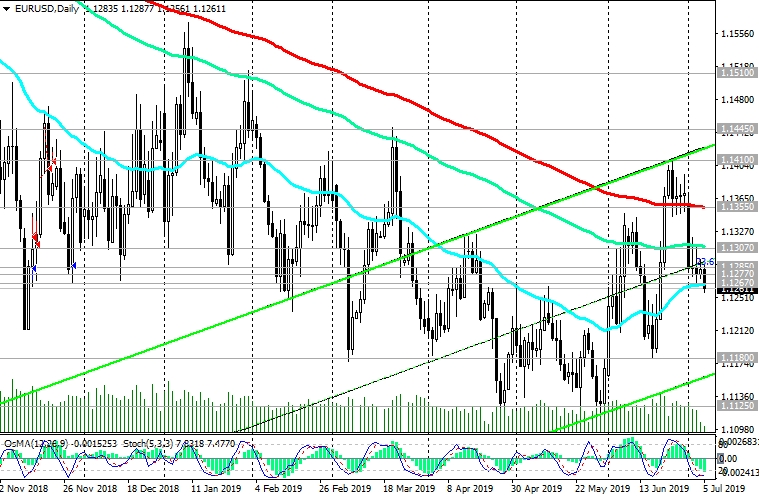

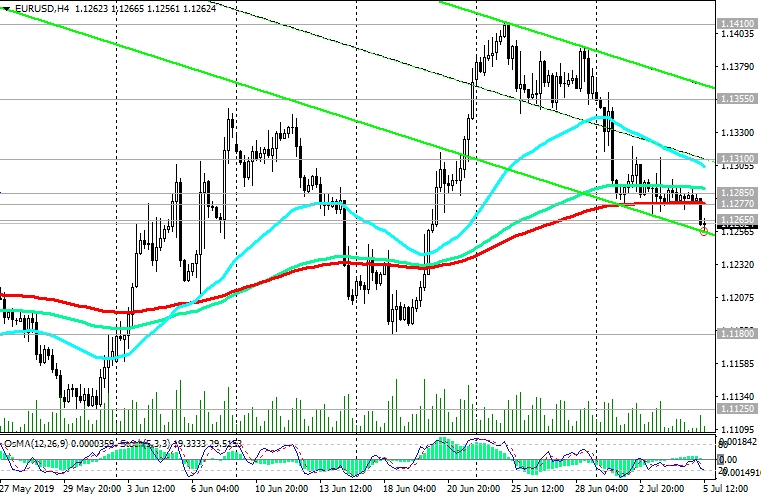

EUR/USD broke through two strong support levels of 1.1285 (Fibonacci 23.6% of the correction to a fall from 1.3900, which began in May 2014), 1.1277 (ЕМА200 on the 4-hour chart) and continues to decline.

The breakthrough of the support level of 1.1265 (ЕМА50 on the daily chart) will provoke a further decline of EUR/USD to the targets located at the support levels of 1.1180 (June lows), 1.1125 (minimums of the year).

Below resistance levels 1.1355 (ЕМА200 on the daily chart), 1.1410 (monthly maximum)

short positions are preferred.

Support Levels: 1.1265, 1.1180, 1.1125

Resistance Levels: 1.1285, 1.1310, 1.1355, 1.1410, 1.1445, 1.1510, 1.1600

Trading Scenarios

Sell Stop 1.1255. Stop Loss 1.1295. Take-Profit 1.1200, 1.1180, 1.1125

Buy Stop 1.1295. Stop-Loss 1.1255. Take-Profit 1.1310, 1.1355, 1.1410, 1.1445, 1.1510, 1.1600