DXC Technology (NYSE:DXC) recently announced a collaboration with product and pricing control solutions provider Zafin. The deal is aimed at launching a standardized data connector between DXC’s core banking solutions — Hogan and Celeriti Digital Banking-as-a-Service — and Zafin’s cloud-based platform. This will allow DXC’s core banking customers to keep pace with the changing demands of the marketplace.

Notably, Celeriti was a result of an IP partnership between DXC’s parent company CSC, and HCL Technologies, combining CSC’s banking software and HCL’s expertise in product engineering and application implementation. On the other hand, Hogan is high performance core banking software featuring real-time processing, scalability and lower total cost of ownership. Both the solutions are part of DXC’s Open-Banking strategy.

As the market is rapidly moving to an open-banking model, the collaboration is expected to further boost DXC’s open-banking solutions portfolio, and help in customer acquisition.

Moreover, this collaboration is expected to ultimately enhance its Global Business Services segment, through which it provides software and solutions for the banking sector.

Rationale Behind the Collaboration

Regulators have tightened their policies for banks since the global financial crisis, with primary focus on ensuring fair outcome for clients. Moreover, competition from digital banks and other new entrants is disrupting the dominance of traditional banks.

The priorities and preferences of ‘digital native’ consumers are remolding the financial services market. The growing entry of digital-only challenger banks is eating up market share of traditional banks with their unique and flexible models.

For instance, in March 2018, challenger bank Monzo had half a million current accounts, within six months of first offering these to its customers. Two other such banks, Tandem and Atom, have more than 21,000 and 17,000 accounts, respectively.

Per a study by Oracle (NYSE:ORCL), majority of consumers within the age of 20-52 prefer to use digital banking, and 69% of all consumers want their financial portfolio to be accessible digitally.

These give us a rough idea about the changing structure of the financial services marketplace. With the new solution by DXC and Zafin, users can quickly change their product and pricing approach at low operational risk, without much implementation costs.

The technical agility and interoperability between DXC’s banking solutions and Zafin’s product and pricing control solutions will allow banking clients of the former to get easily accustomed to the changing financial industry.

Zacks Rank & Stocks to Consider

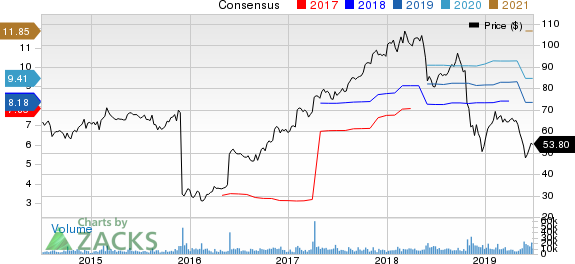

DXC currently has a Zacks Rank #4 (Sell).

Few better-ranked stocks in the broader Computer and Technology sector are j2 Global, Inc. (NASDAQ:JCOM) , Infineon Technologies (OTC:IFNNY) and Cirrus Logic (NASDAQ:CRUS) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for j2, Infineon and Cirrus is projected to be 8%, 3.4% and 15%, respectively.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

j2 Global, Inc. (JCOM): Free Stock Analysis Report

Infineon Technologies AG (IFNNY): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

DXC Technology Company. (DXC): Free Stock Analysis Report

Original post

Zacks Investment Research