Most of the analyses of the Central Bank of Turkey’s rate hike last week concentrated on its impact on banks and corporates. There was surprisingly little mention of consumers.

Starting my latest Hurriyet Daily News (HDN) column with this sentence, I go on to explain why consumers might get hit worse than businesses and banks this year. Of course, businesses and banks are dependent on consumers, so they won’t go unscathed, either. Anyway, you can read the whole thing at the HDN website. I have a few points to make, but before that I would like to mention that I am paying homage to my favorite Coen Bros movie with the title:) I know it wouldn’t be most people’s first choice, but I like the humor- and George Clooney & John Torturro’s excellent acting, too, of course.

Anyway, moving on, I should say it is great to be vindicated so quickly: I had warned you when the business channel CNBC-e had released the preliminary January consumer confidence indices two weeks ago, and the final figures released today proved me right:

BTW, the latest lending rates data released today show that interest rates were continuing to creep up, although very slowly, before the rate decision.

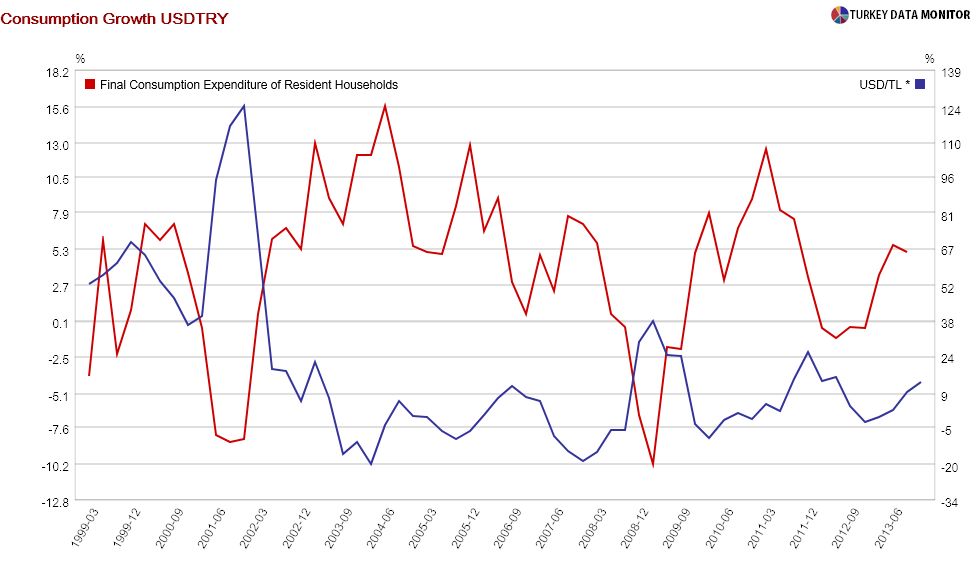

Moving on from empirics to theory, I wanted to emphasize that consumers would not have been spared if the Bank had opted for the weak lira (and destroying the balance sheets of firms with FX positions) rather than raising rates. As you can see in the graph below, there is a strong relationship between private consumption and the exchange rate (both are year-on-year changes of quarterly variables, USDTRY is average value in quarter):

USD/TRY" title="USD/TRY" width="474" height="242">

USD/TRY" title="USD/TRY" width="474" height="242">

Finally, it is important to note that the Bank has about 2 percentage points more room to raise rates if need be- without an official rate hike. That’s because the Bank can decide to switch from lending at the one-week repo (10 percent) to the overnight lending rate, which is 12 percent (11.50 percent for primary dealers).