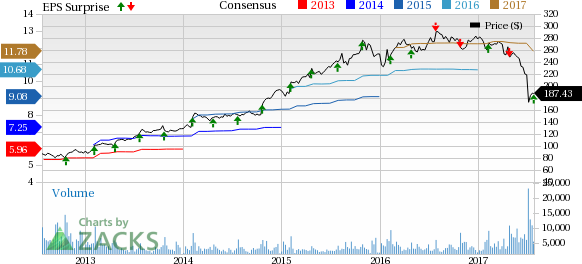

O’Reilly Automotive Inc.’s (NASDAQ:ORLY) reported adjusted earnings of $3.10 per share in the second quarter of 2017, beating the Zacks Consensus Estimate of $2.90. Net income improved 10% to $283 million (12.3% of sales) from $258 million (11.8% of sales) in the second quarter of 2016.

Quarterly revenues went up 5% to $2.29 billion from $2.18 billion a year ago. Revenues were almost on par with the Zacks Consensus Estimate. Comparable store sales increased 1.7% in the reported quarter compared with a 4.3% rise in the prior-year quarter.

Gross profit rose 3% to $1.2 billion (52.4% of sales) from $1.13 billion (51.8% of sales) a year ago. Selling, general and administrative expenses increased 6% year over year to $743 million (32.4% of sales) from $702 million (32.3% of sales). Operating income increased 8% to $457 million (or 20% of sales) from $425 million (or 19.5% of sales) a year ago.

O'Reilly Automotive, Inc. Price, Consensus and EPS Surprise

Store Information

During the second quarter of 2017, O’Reilly opened 50 stores across the country and closed down four. Total store count was 4,934 as of Jun 30, 2017. Sales per weighted-average store decreased to $463,000 from $466,000 in the second quarter of 2016.

Share Repurchases

During the second quarter of 2017, O’Reilly repurchased 3.5 million shares for $852 million, reflecting an average price of $245.26 per share.

Since the inception of the share repurchase program in Jan 2011, O’Reilly has repurchased a total of 62.3 million shares for $8.20 billion, indicating an average price of $131.80 per share.

Financial Position

O’Reilly had cash and cash equivalents of $26.5 million as of Jun 30, 2017 compared with $398.3 million as of Jun 30, 2016. Long-term debt was $2.6 billion as of Jun 30, 2017 compared with $1.9 billion as of Jun 30, 2016.

In the second quarter of 2017, net cash flow from operations increased to $333.8 million from $325.6 million a year ago. Also, capital expenditures rose to $116.9 million from $116.4 million in second-quarter 2016. Free cash flow in the period was $207.8 million compared with $193.8 million in the second quarter of 2016.

Guidance

For the third quarter of 2017, O’Reilly projects earnings per share in the range of $3.10-$3.20. The company expects consolidated comparable store sales to increase 1–3%.

For full-year 2017, the company expects earnings per share in the band of $11.77-$11.87 compared with the previous expectation of $12.05-$12.15.

O’Reilly projects consolidated comparable store sales increase in the range of 1-2% during the year. The company anticipates revenues in the band of $8.9-$9.1 billion compared with the previous expectation of $9.1-$9.3 billion. For 2017, the gross margin guidance is in the range of 52.5-52.9% and operating margin is expected to be 19.1-19.5% compared with the previous estimate of 20.1-20.5%.

O’Reilly reiterated its capital expenditure to be within the range of $470–$500 million. However, for 2017, it expects free cash flow to be between $830 million and $880 million compared with the range of $930-$980 million expected earlier.

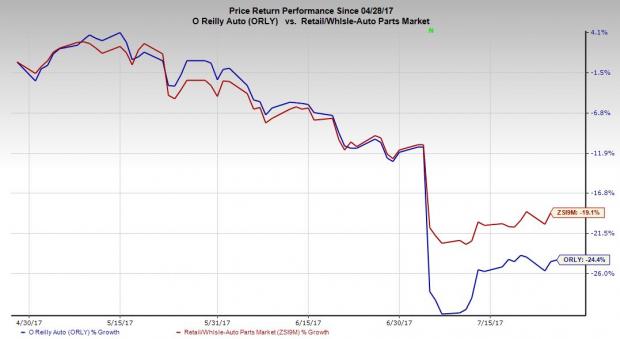

Price Performance

O’Reilly shares have lost 24.4% in the last three months, substantially underperforming the 19.1% decline of the industry it belongs to.

Zacks Rank & Key Picks

O’Reilly currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked companies in the auto space are Allison Transmission Holdings (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Daimler AG (OTC:DDAIF) , all stocks sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has expected long-term growth rate of 11%.

Volkswagen has expected growth rate of around 17.3% over the long term.

Daimler has expected long-term growth rate of 2.8%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Daimler AG (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

O'Reilly Automotive, Inc. (ORLY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research