NZD/USD" title="NZD/USD" height="242" width="474">

NZD/USD" title="NZD/USD" height="242" width="474">

The Kiwi depreciated rather suddenly towards the latter end of last week, with the USD advancing following a Quantitative Easing (QE) taper, alongside other impressive economic releases. On the other hand, the Reserve Bank of New Zealand (RBNZ) refrained from increasing their interest rates in January, subsequently weakening the NZD.

The New Zealand economy is still being tipped for a bright future in 2014. For example, GDP expansion is predicted to be beyond 3%. New Zealand’s GDP has already expanded for 10 consecutive quarters, and there are no signs of this momentum ending soon. Despite the markets being initially disappointed with no interest rate hike, the RBNZ were still hawkish in admitting that their economy is growing faster than they expected and with inflation pressures building, they need to look at increasing their interest rates.

In fact, overnight, New Zealand’s unemployment rate fell to 6% for the first time in 5 years, with 24,000 jobs being created. Last night’s bullish unemployment report will only encourage further expectations, and a stronger case to expect a rate hike in March. An interest rate increase is inevitable to be honest, making New Zealand the first developed economy to raise rates since the financial crisis began.

The Kiwi began a reversal on Monday, withthe United States releasing disappointing Manufacturing ISM data. Manufacturing is a substantial contributor to US employment, and any noticeable slowdown in their manufacturing industry will be detrimental to Friday’s NFP.Further USD losses have since been encouraged, with congress yet to come to an agreement on raising the US debt ceiling, which is reinstalled on Friday.

The NZD/USD was also supported by the RBA’s (Reserve Bank of Australia) decision not to cut their own interest rate policies, despite Australia’s own economic disappointments which has seen the AUD/USD decline by nearly 10% in the past three months. With Australia and New Zealand being such close trading partners, the Kiwi can be directly influenced by Australia.

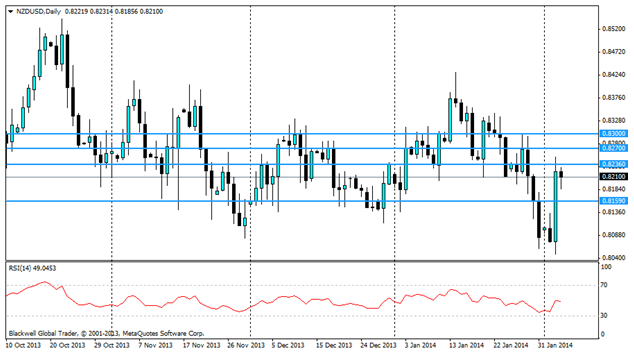

In reference to my technical observations for this currency pair,Monday’s USD losses saw this pair push past the previous 0.8159 support level, with last night’s positive New Zealand employment data touching the 0.8236 resistance level. Future resistance levels can be found at 0.8270 and 0.8300.According to the RSI, this pair recently approached the oversold boundaries and could now be looking to make upward progress.

Overall, although I personally think that the markets may have over-reacted following yesterday’s disappointing US manufacturing release, I do understand the high correlation manufacturing will have on job creation in the United States. We could possibly now witness some risk appetite in the markets before Friday’s NFP release, pushing the Kiwi back up to its previous levels.