NZD/USD: RBNZ keeps rates steady and issues a dovish statement

Macroeconomic overview

The Reserve Bank of New Zealand held the official cash rate steady at 1.75%.

RBNZ Governor Graeme Wheeler warned the "protectionist risk" posed by the Trump administration is a major hazard.

"The biggest risk I think is the protectionist risk," Wheeler told reporters at a press conference. "It's unfortunate that a lot of this rhetoric is taking place at a time when we've seen the slowest growth in merchandise trade volumes in the past five years seen since the early 1980s." New Zealand, which is heavily reliant on international trade, was a key backer of the Trans-Pacific Partnership abandoned by Trump. "Let's say for example the U.S. really did get serious about imposing 45 percent tariffs on China for example or large tariffs on Mexico," Wheeler said. "That would have serious implications, I believe, for the global economy."

Wheeler said the bank had adopted a neutral policy stance, having previously been in an easing mode after cutting the official cash rate three times last year. The bank's official forecasts did not show a rise in rates to 2 percent until March 2020. Markets had been pricing in a rise around late 2017 or early 2018 and quickly moved to push that out by a few months.

Assistant Governor John McDermott said that the market's reaction to the rate decision was "exactly what we wanted" and the bank was "not trying to fake the market on the kiwi," with its policy outlook.

McDermott said the bank's focus had shifted to external risks, including U.S. protectionism, and away from domestic issues as the local economy grows faster than almost any other developed nation. Record migration, strong consumer spending and a boom in home building has all combined to support activity. The dairy industry, New Zealand's major goods exporter, also enjoyed a recovery in prices recently.

Inflation, however, has been uncomfortably low. After reaching only 0.4% for most of last year, it achieved 1.4% in December, just inside the RBNZ's target band of 1 to 3%. Wheeler said inflation was expected to return to the midpoint of the target band only "gradually." Indeed, the bank's official forecasts did not see inflation reaching 2% until June 2019.

We think that inflation will reach 2% much earlier and dovish RBNZ statement was aimed to weaken the kiwi.

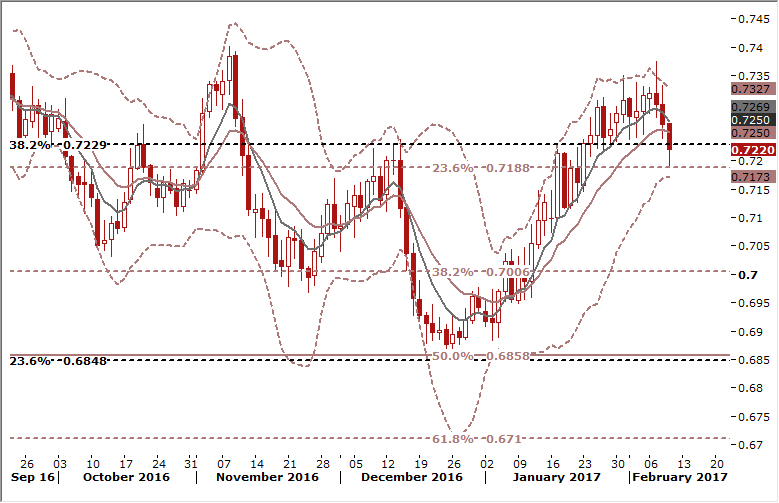

Technical analysis

Long upper shadow on Tuesday’s candlestick, followed by two daily drops suggest that the short-term outlook turned to bearish. However, we know that this situation was caused by expectations for the RBNZ statement that turned out to be even more dovish than anticipated.

We expect a much faster rise in New Zealand’s inflation than the RBNZ and suppose that the dovish statement was a kind of currency intervention by the RBNZ. That is why market expectations may quickly come back to pre-statement levels. We think that technical analysis signals may wrong-foot us this time, so we focus mainly on fundamental analysis.

Trading strategy

We think that an overnight fall was only a short-term reaction to dovish RBNZ statement and we used this drop as an opportunity to buy the NZD/USD. Our lowered NZD/USD bid at 0.7200 was filled today. We are long for 0.7400.