In the period after 14:00 (GMT), data from the milk auction will be published. Two weeks ago, the dairy price index prepared by Global Dairy Trade came out with a value of +3.7% (against the forecast of +1.9% and an increase of 0.5% in the previous 2-week period). A significant part of New Zealand exports is dairy products, primarily milk powder. The increase in world prices for dairy products provides additional support to the New Zealand economy, increasing the level of export foreign currency earnings.

According to the forecast, it is expected that prices for dairy products rose again in the previous 2 weeks, and the price index will come out with a value of +1.6%. If the data coincides with the forecast or is better than it, then the New Zealand dollar will strengthen, including in the pair USD/NZD.

Meanwhile, the US dollar remains vulnerable after weak data on US industrial production came out Friday, as well as reports that U.S. President Donald Trump and Fed Chairman Jerome Powell met on Monday to discuss economic issues, including the strengthening of the U.S. dollar. Trump later said after a 30-minute meeting with Powell that he had protested that the Fed’s rate was still too high compared to the interest rates of competing countries. In his opinion, the interest rate in the United States should be lower than in these countries.

The New Zealand dollar resumed growth after last week the RBNZ unexpectedly did not change its policy and left the interest rate at 1.0%.

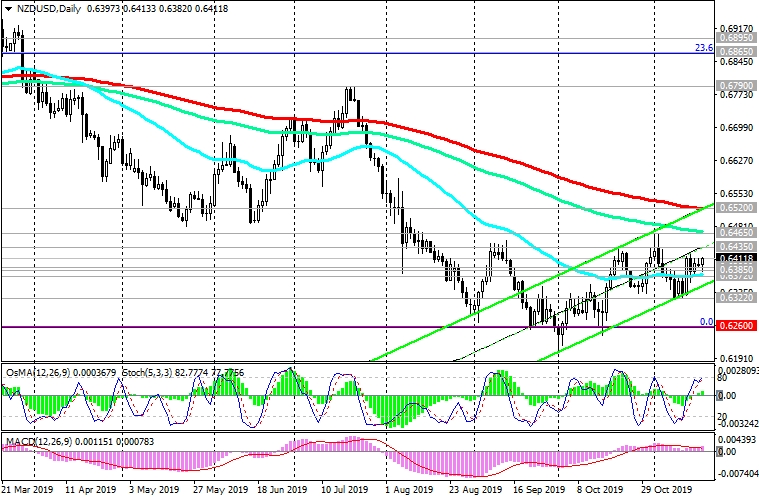

At the beginning of the European session, NZD/USD is trading near 0.6410, 0.6420, continuing corrective growth in the upward channel on the daily chart. The upper boundary of this channel runs near the 0.6520 and EMA200 level on the daily chart. The upward correction of NZD / USD is likely to be limited by the resistance levels of 0.6465 (ЕМА144), 06520 (ЕМА200 on the daily chart).

A breakdown of the support level of 0.6385 (EMA200 on the 1-hour chart) will be the first signal to resume sales of NZD / USD with targets at support levels of 0.6260, 0.6200, 0.6100.

Support Levels: 0.6390, 0.6385, 0.6372, 0.6322, 0.6260, 0.6200, 0.6100

Resistance Levels: 0.6435, 0.6465, 0.6520

Trading Scenarios

Sell Stop 0.6380. Stop-Loss 0.6425. Sell Limit 0.6465, 0.6520. Stop-Loss 0.6550. Take-Profit 0.6372, 0.6322, 0.6260, 0.6200, 0.6100

Buy Stop 0.6425. Stop-Loss 0.6380. Take-Profit 0.6435, 0.6465, 0.6520