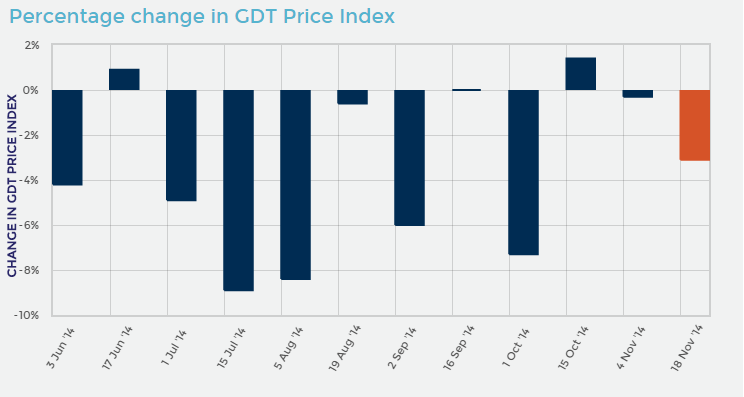

Last night's dairy auction came with no real surprises for the market; other than a further drop which was somewhat expected. The NZ economy relies heavily on its dairy export market, which accounts for over 20% of exports, and another drop spells more problems for the NZ economy in the long run as the primary sector is likely to suffer.

Source: Global Dairy Trade

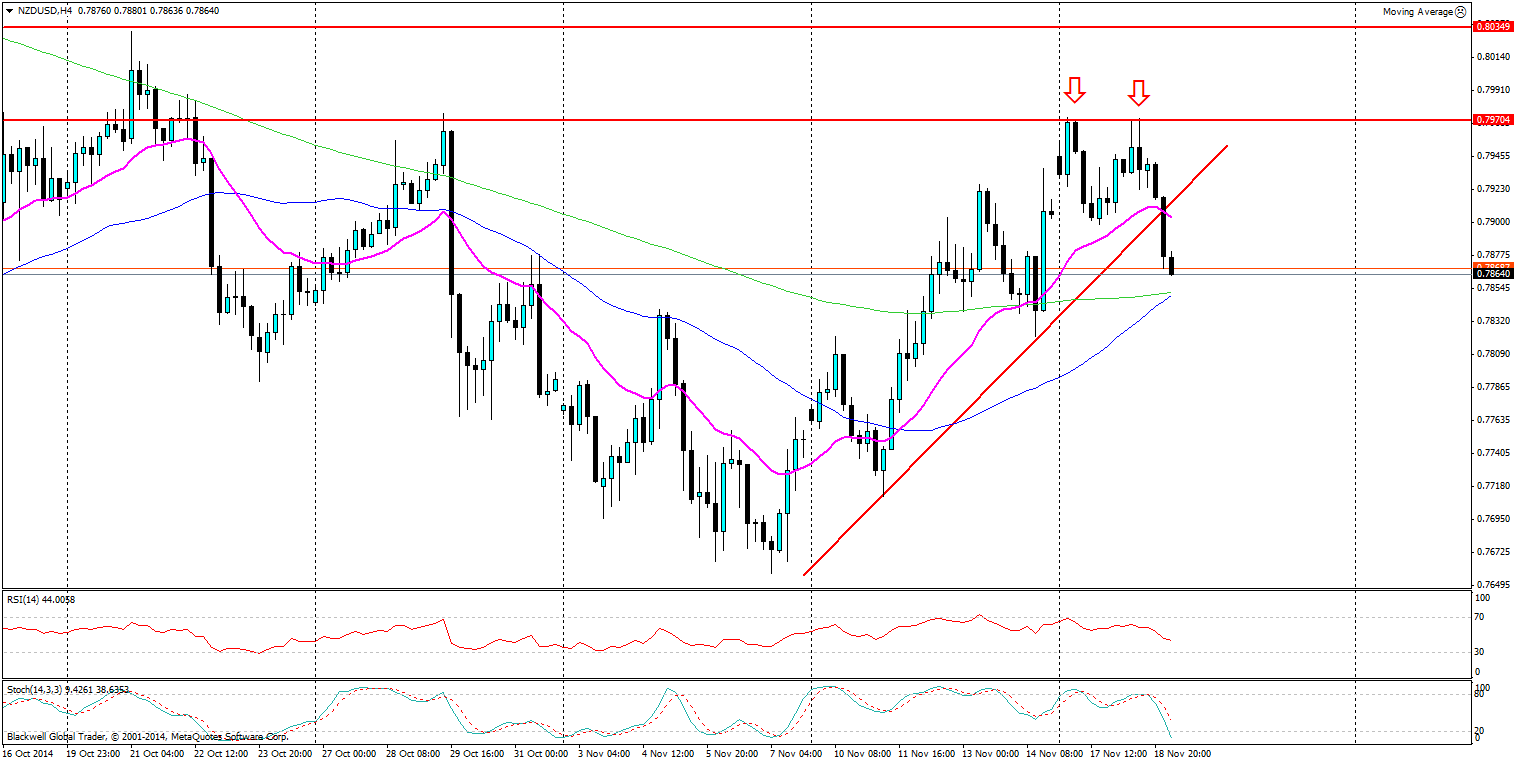

A quick look at the NZD on the charts shows some interesting moves and what is quite clearly a double top for the NZD/USD cross. The second such movement shows strong movements higher followed by 2 pinbar candles following strong rejection of the 0.7970 resistance level.

Source: Blackwell Trader (NZD/USD, H4)

The trend is your friend as they say and in this case the trend line has been firmly broken during the Asian session, showing that price action remains in the hands of technicals and the future is downward looking for the NZD/USD.

The second part of the NZD/USD is that people have to realize we get very strong waves when trading this pair. Previous waves had an impulsive wave, which was in turn followed by a brief corrective wave of generally 4-5 candles. If you’re looking to coming in on the NZD/USD it may be worth waiting for a slight pull back of 4-5 candles on the 4h and then jump in as this seems to be the regular pattern.

Either way the NZD/USD is currently weak technically speaking as well as fundamentally. The bears are looking to take charge here and a pullback may be a nice time to enter and ride the waves lower over the coming week.