First Critical Resistance: 0.7098

Second Critical Resistance: 0.7160

First Critical Support: 0.6965

Second Critical Support: 0.6822

Overall Sentiment: Slightly Bullish

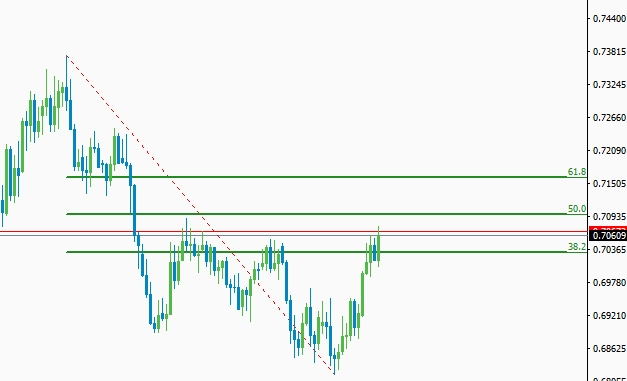

The NZDUSD pair broke the critical resistance level at 7036 which is also the 38.2 percent Fibonacci retracement level drawn from the high of 0.7370 to the low of 0.6822.The recent performance of the U.S economy is not up to the market and FED have already postponed their interest rate hike decision. Most likely we will see a rate hike in the month of June, so we can expect a bullish run from the kiwi in the upcoming days.

The first critical bullish target for this pair is at 0.7098 level which is the 50 percent retracement level. A clear break of this level will lead this pair towards the next critical resistance level at 0.7160 level. The professional traders will look for bearish price action confirmation signal to shot this pair at the 61.8 percent retracement level.

NZD/USD daily technical analysis

The pair is most likely to give excellent short trading opportunity in the upcoming days but we need to wait for the perfect candlestick pattern to execute high-quality trades in the market. But if the bullish momentum fails to push the pair upward then we will see a sharp drop in the price towards the first critical support level at 0.6965. We will cautiously wait in the sideline until the market present perfect trading opportunity.

Fundamentally the US dollar is not doing well as most of the investors are shorting the green bucks for quick short term profit in the global market. Most importantly Mr.Trump administration has created an extreme level negative U.S consumer sentiment which is directly affecting the dollar bulls in the market. Considering all the parameters we might see decent bullish movement in the NZD/USD pair towards the 61.8 percent retracement level in the upcoming days.