The New Zealand dollar fell significantly on Wednesday after the RBNZ left the key rate at 1.75% and indicated the likelihood of interest rate cuts.

According to the RBNZ, "the outlook for the global economy continues to deteriorate". "Given the deterioration in the prospects for the world economy and the weakening of the impulse of spending inside the country, the more likely direction of our key interest rate will be its decline", the RBNZ said in a statement.

Now some economists predict that by the end of this year, the RBNZ will lower rates twice.

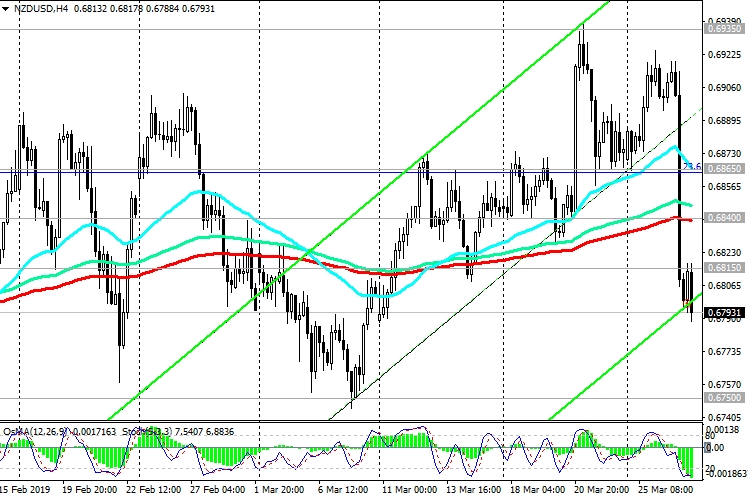

The NZD / USD fell by 1.6%, reaching a minimum near the level of 0.6793, breaking through the key support level of 0.6815 (ЕМА200 on the daily chart).

Indicators OsMA and Stochastic on the 4-hour and daily charts turned to short positions.

The negative scenario implies a further weakening of the New Zealand dollar, a breakdown of the support level of 0.6798 (EMA144 on the daily chart) and a decline to the support levels of 0.6750, 0.6700.

The breakdown of these support levels will mean the return of NZD / USD to a bearish trend.

If NZD / USD resumes upward trend, then growth targets will be resistance levels of 0.6865 (Fibonacci level 23.6% of the upward correction to the global wave of the pair's decline from 0.8800 level, which began in July 2014; wave minima are near 0.6260), 0.6935, 0.6980.

Support levels: 0.6798, 0.6750, 0.6700

Resistance levels: 0.6815, 0.6840, 0.6865, 0.6935, 0.6980

Trading Scenarios

Sell Stop 0.6785. Stop Loss 0.6825. Take-Profit 0.6750, 0.6700, 0.6630, 0.6575

Buy Stop 0.6825. Stop Loss 0.6785. Take-Profit 0.6865, 0.6935, 0.6980, 0.7060