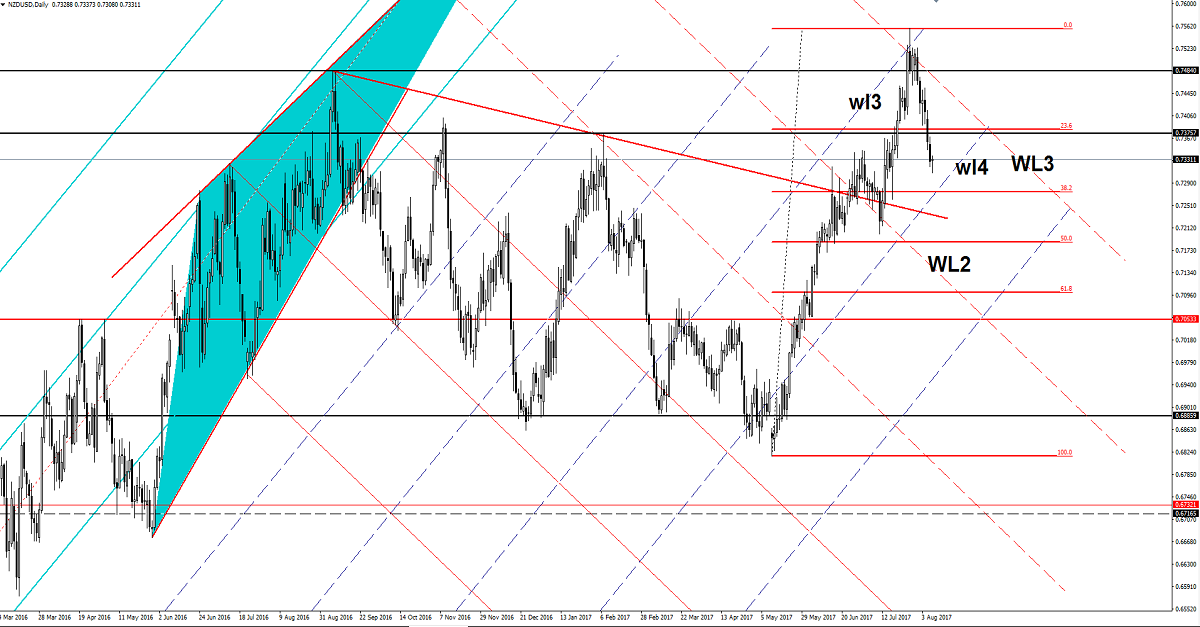

NZD/USD Into A Corrective Phase

NZD/USD focuses on correction right now and could drop much deeper if the US Dollar will resume the minor rebound. Price looks undecided right now, has squeezed in the last hours and has erased the earlier losses. Could decrease further as is still under selling pressure on the short term, is seeking for strong support and could find one very soon.

Price dropped as much as 0.7308 level on Wednesday, you should be careful because the fundamental factors will take the lead again. Technically is expected to drop further and I believe that only the fundamental factors could turn the price to the upside.

As already know, the Reserve Bank of New Zealand will publish the Official Cash Rate, which is expected to remain unchanged at 1.75%. The interest rate remains steady since since November 2016, when was decreased for the last time by 0.25%.

The RBNZ Rate Statement and the RBNZ Press Conference could bring a high volatility on the NZD/USD.

Price goes down and could reach and retest the fourth warning line (wl4) of the former ascending pitchfork. I’ve said in the previous articles that the perspective remains somehow bullish on the Daily chart as long as the rate stays above the warning line (wl4).

The correction is natural after the rejection from the confluence between the WL3 with the third warning line (wl3). A dovish RNZD will punish the Kiwi, which will depreciate versus all its rivals.

Only a valid breakdown will signal a major drop and a reversal because the current drop could be only temporary.

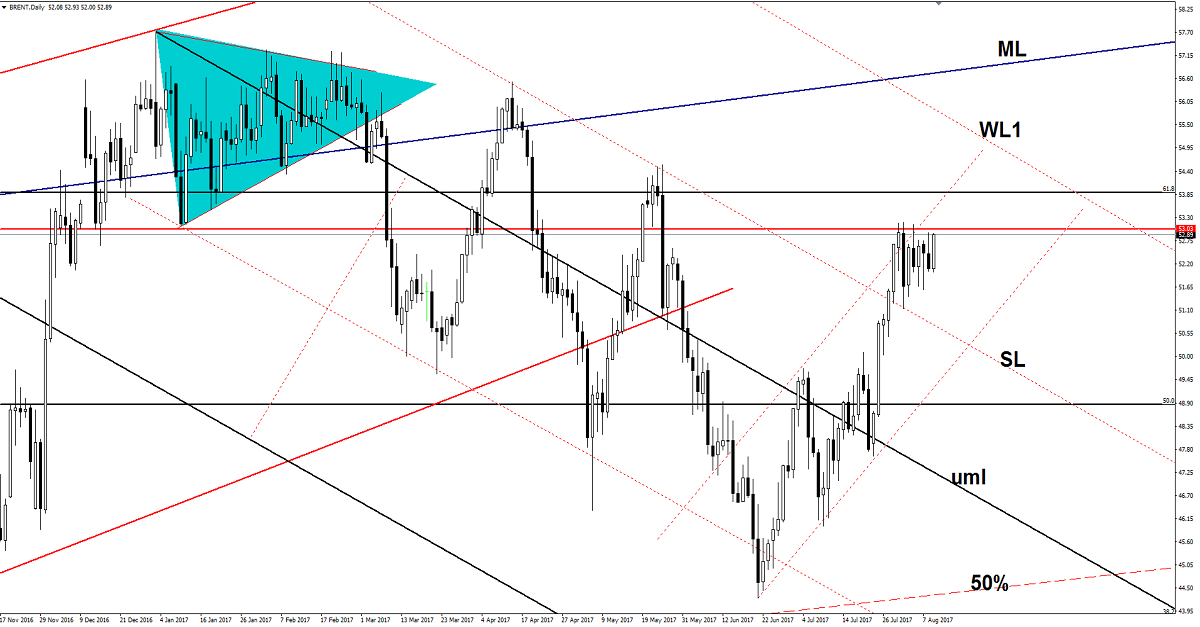

Brent Oil: Breakout Attempt

Price rallied on Wednesday again and looks determined to resume the upside movement, but needs to take out a major static resistance to do that. Is consolidation on the short term and tries to recapture more directional energy before will try to climb towards fresh new highs.

Brent jumped higher as the United States Crude Oil Inventories have dropped unexpectedly lower in the previous week, were reported at -6.5 million barrels, much lower versus the -2.6M estimated and compared to the -1.5M in the former reading period.

Only a valid breakout above the 53.03 will confirm a further increase, another rejection will bring attract the sellers again.

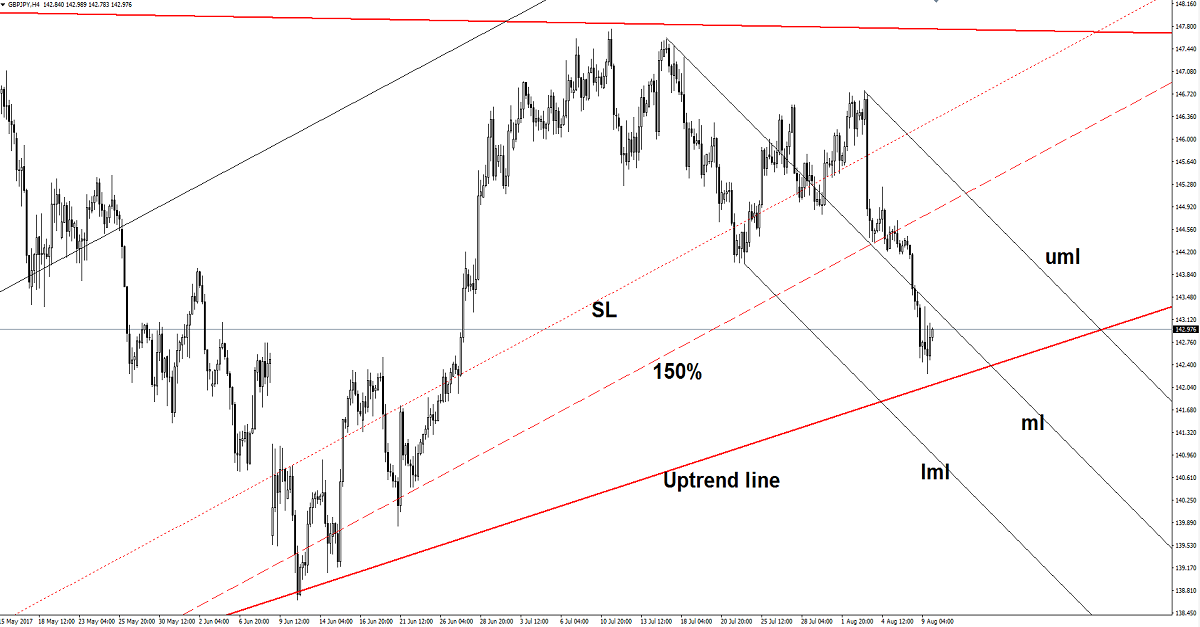

GBP/JPY Downside Paused

GBP/USD downside momentum was stopped right above a crucial support level. Has turned to the upside and is very close to reach and retest the median line (ml) of the minor descending pitchfork. Will drop further if the resistance will hold and will reject the price.

A major drop will come if will take out the dynamic support from the red uptrend line, while another leg higher will appear after the breakout above the median line and after a retest of the uptrend line.

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.