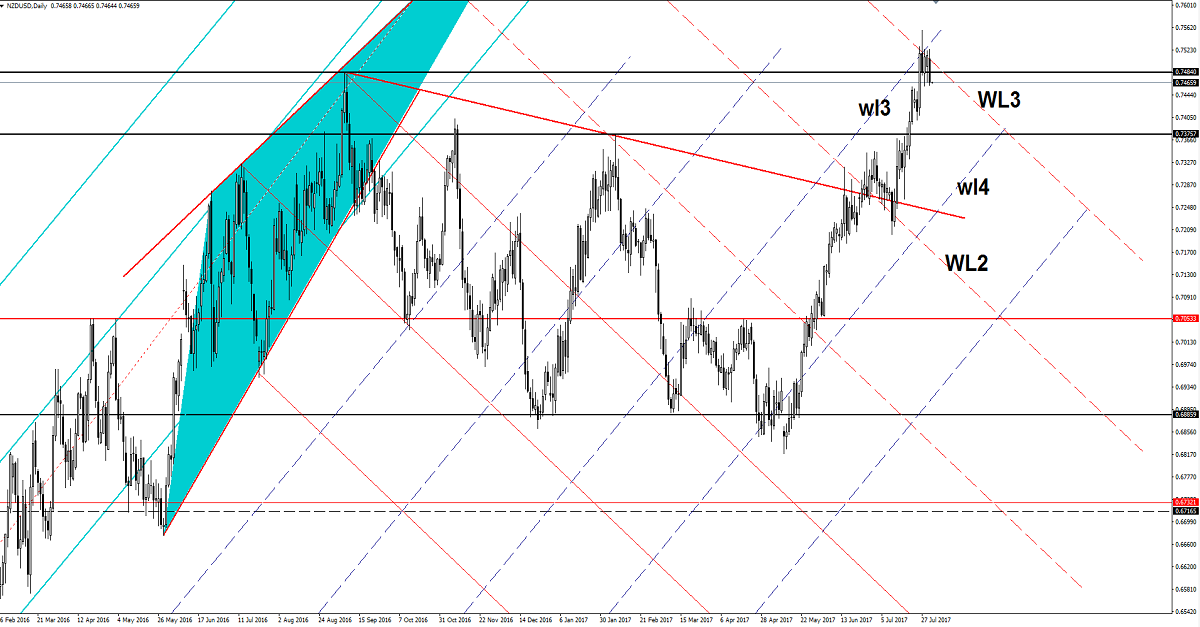

NZD/USD turned to the downside

The price dropped aggressively on Tuesday, erasing the Monday’s gains, we may have a selling opportunity if will come back to retest the resistance levels. It technically should drop on the short term after a false breakout above a major confluence area. The USD has managed to drag the price down only because the Dollar Index has managed to increase a little and to jump above the 93.00 psychological level again.

Unfortunately, the DXY is still pressured on the Daily chart, could still approach and reach the 92.49 static support despite the yesterday’s rebound.

You should know that the price will be driven by the fundamental factors later as New Zealand is to release high impact data, the employment change could increase by 0.7% in Q2, while the unemployment rate could drop to 4.8%, from 4.9% in the second quarter. The Labor Cost Index may increase by 0.5%, more compared to the 0.4% growth in the former reading period. The US is to release the ADP NonFarm Employment Change today, this event could bring a high volatility.

The price plunged in the last session and invalidated the breakout above the third warning line (WL3) of the major descending pitchfork. Now is trading under the 0.7484 static resistance, a retest of this level and the WL3 will bring us a perfect selling opportunity with first target at the 0.7375, the next one will be at the fourth warning line (wl4) of the former ascending pitchfork. I’ve said in the previous analysis that the perspective remains bullish as long as is trading above the wl4, a major drop will come only if it will take out the mentioned support. However a further increase will be confirmed only after a valid breakout above the WL3.

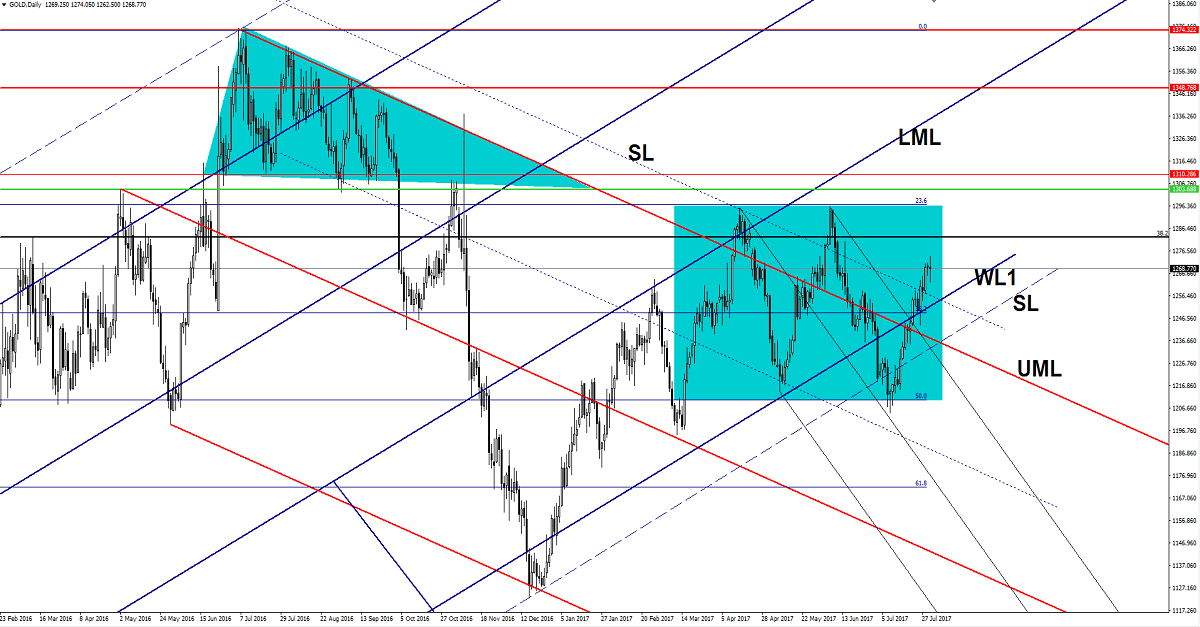

Gold expected to stabilize in the green zone

We had some volatility on gold on Tuesday, but now looks undecided even if the perspective is bullish on the short term. It could shine further if the dollar index will hit new lows, it is expected to approach and reach the 38.2% retracement level and the 23.6% retracement level. A retest of the warning line (WL1) will bring us a good buying opportunity.

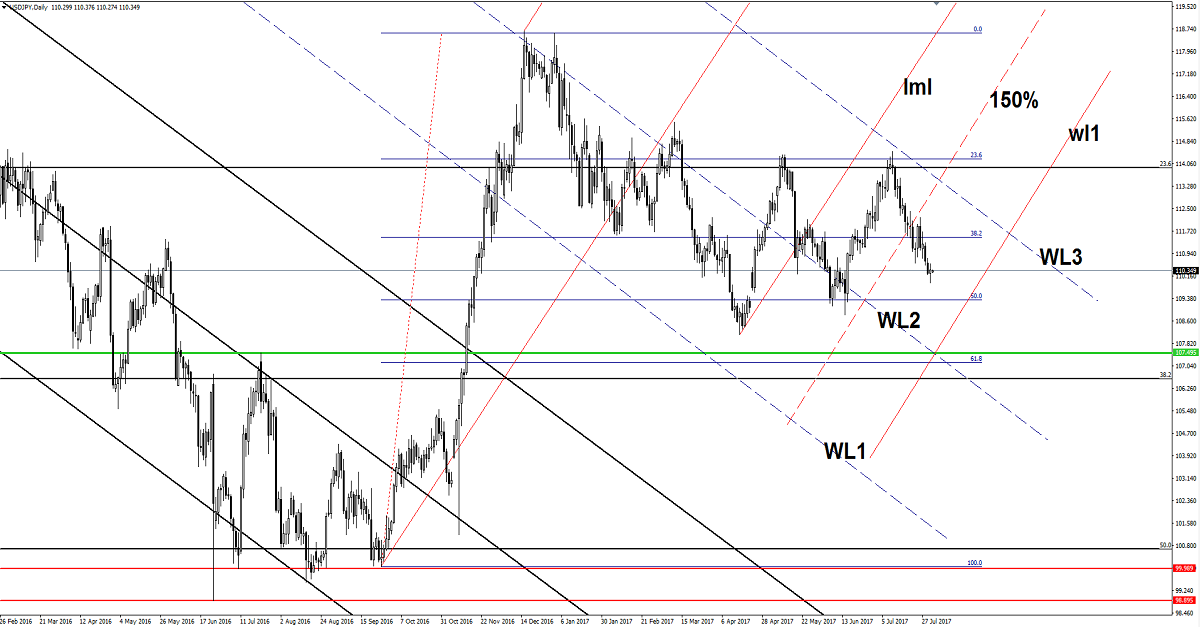

USD/JPY losing momentum

The pair continues to move in the range between the 23.6% and the 50% retracement levels. Personally, I still believe that will reach and retest the 50% retracement level and the warning line (wl1) of the ascending pitchfork. We’ll have a clear direction only after a valid breakout from this extended sideways movement.

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.