- RBNZ survey may be key for NZD/USD moves on Monday

- Market pricing split between 50bps and 75bps rate cut for Nov 27

- Last survey showed inflation expectations near RBNZ's 2% target

- Survey released 3 pm in Wellington (1 pm AEDT)

Overview

Survey of Expectations (M14). It’s release name lends itself to be overlooked as a key NZD/USD driver. But that assumption would be a mistake. This forgotten RBNZ survey often packs a punch when many least expect it, reflecting that, unlike other central banks, its sole mandate is price stability.

Having cut interest rates by 75bps already this cycle, and with the market wavering between pricing a 50 or 75bps cut when the RBNZ next meets on November 27, Monday’s latest iteration has the potential to be a major market mover.

What is the Survey of Expectations?

The RBNZ Survey of Expectations asks professional forecasters and business leaders to provide insights on inflation, interest rates, GDP, and unemployment. With 30-50 respondents, it focuses on forecast-based expectations rather than public opinion.

What did respondents say last time?

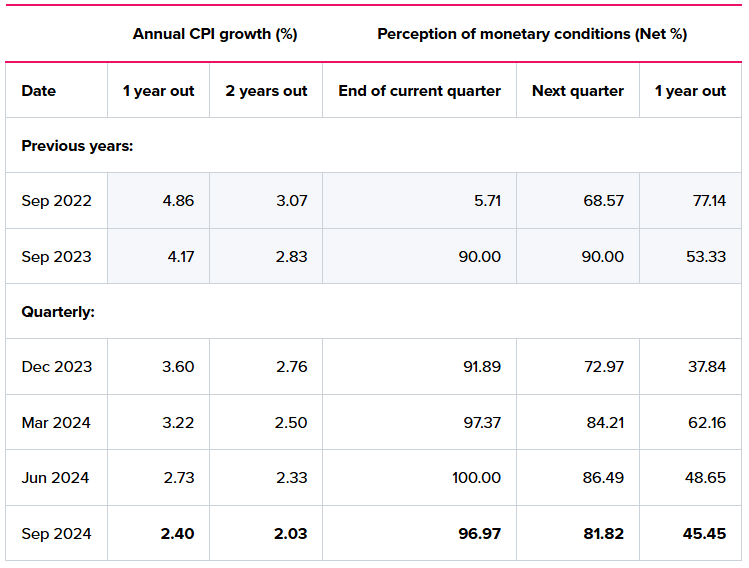

When released in August, year-ahead inflation expectations fell 33bps to 2.40%. Expectations looking two years ahead declined 30bps to 2.03%, almost exactly at the midpoint of the RBNZ 1-3% inflation target. It’s the latter markets tend to focus on given monetary policy works with a lag.

Source: RBNZ

RBNZ inflation forecasts

In the August monetary policy statement, the RBNZ had inflation gradually declining back to the 2% midpoint of its target by mid-2026. It’s forecast to remain there until the end of the forecast period in Q3 2027. The views were premised on the cash rate falling to 3.85% by end-2025 and 3.13% by end-2026.

RBNZ cash rate pricing

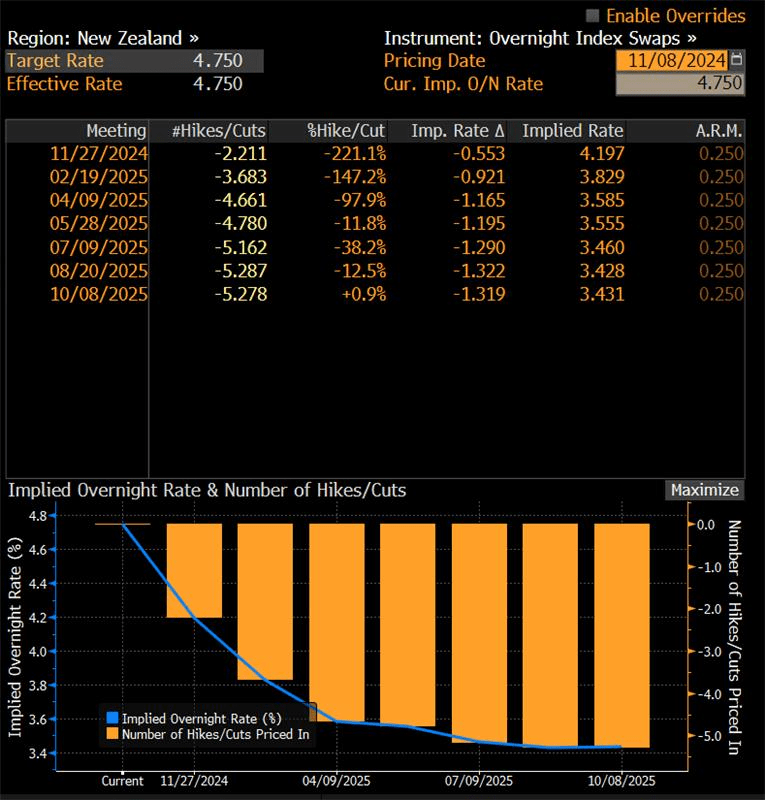

The graphic below from Bloomberg shows implied RBNZ cash rate expectations based on overnight index swaps markets. Just over five 25bps rate cuts are priced over the next year with the cash rate seen at 4.2% by end- 2024 and 3.43% by October 2025. It’s now 4.75%. 55 basis points of easing is priced for the November 27 meeting, implying a one-in-five chance of a 75bps cut.

Source: Bloomberg

NZD/USD technical setup

Source: TradingView

The US election, Fed interest rate decision and China stimulus announcement on Friday created a string of large candles on the daily timeframe last week, decimating many minor technical levels along the way. With those events now in the rearview mirror, this week may deliver more reliable price signals for traders.

Having established a minor uptrend from the lows stuck last Wednesday, NZD/USD has fallen through it in early Asian trade on Monday (NASDAQ:MNDY), pointing to the potential for renewed downside risk. However, RSI (14) and MACD continue to provide bullish signals on momentum, raising questions as to whether the move will stick. The readthrough remains that buying dips may prove to be more successful than selling rips and bearish breaks near-term.

Levels to watch include:

Resistance: .6040, .6053 and 200-day moving average

Support: .5912, .5850