- New Zealand’s economy contracts 1% in Q3, following a revised 1.1% drop in Q2

- Markets price a 91% chance of another 50bps RBNZ rate cut in February

- NZD/USD plunges over 2%, marking its largest drop since May 2023

- Kiwi trades near .5600, with potential to revisit October 2022 lows at .5515

Summary

New Zealand is not only in recession but a deep one, increasing the risk of further large-scale interest rate cuts from the Reserve Bank of New Zealand. Combined with the Fed’s hawkish rate cut delivered earlier in the session, the news has seen NZD/USD suffer its largest one-day decline since May 2023, leaving it at more than two-year lows.

Kiwi Economy Going Down the Gurgler

There is no other way to describe New Zealand’s Q3 GDP report than ugly. The economy contracted 1% following a 1.1% drop in Q2 that was originally reported as -0.2%. Markets were looking for a smaller contraction of 0.2%, the same level forecast by the RBNZ less than a month ago. Oops!

Rather than the economy contracting 0.4% over the year, it was more than three times larger at 1.5%. That’s not only a recession but a deep one, especially when you consider New Zealand’s rapid population growth.

GDP per capita fell 1.2% in Q3. It was the eighth consecutive quarterly fall in the series. Real gross national disposable income, a measure of living standards, declined 0.8% from three months earlier. That's not great news.

RBNZ Pressured to Slash Rates Further

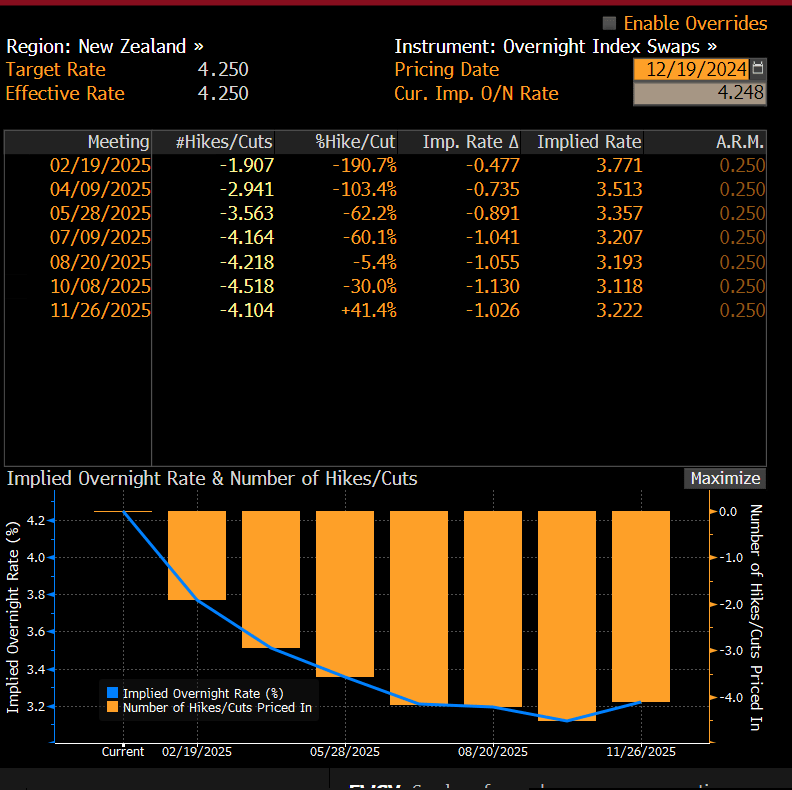

The horror show has seen traders strengthen their conviction that the RBNZ will follow up the 50bps rate cuts delivered in October and November with another in February, putting the implied probability at around 91%.

A total of 100bps of cuts are priced for 2025. Before today’s data that looked reasonable, but the risk now is the RBNZ will deliver more.

Source: Bloomberg

Already under pressure thanks to the Federal Reserve’s hawkish rate cut as the FOMC removed 50bps of easing from its 2025 forecast, the GDP report saw NZD/USD sink like a stone.

It declined more than 2% on Thursday, logging the largest percentage decline since May 2023. It now trades at levels last seen in October 2022. The Kiwi, a flightless bird, is well and truly grounded.

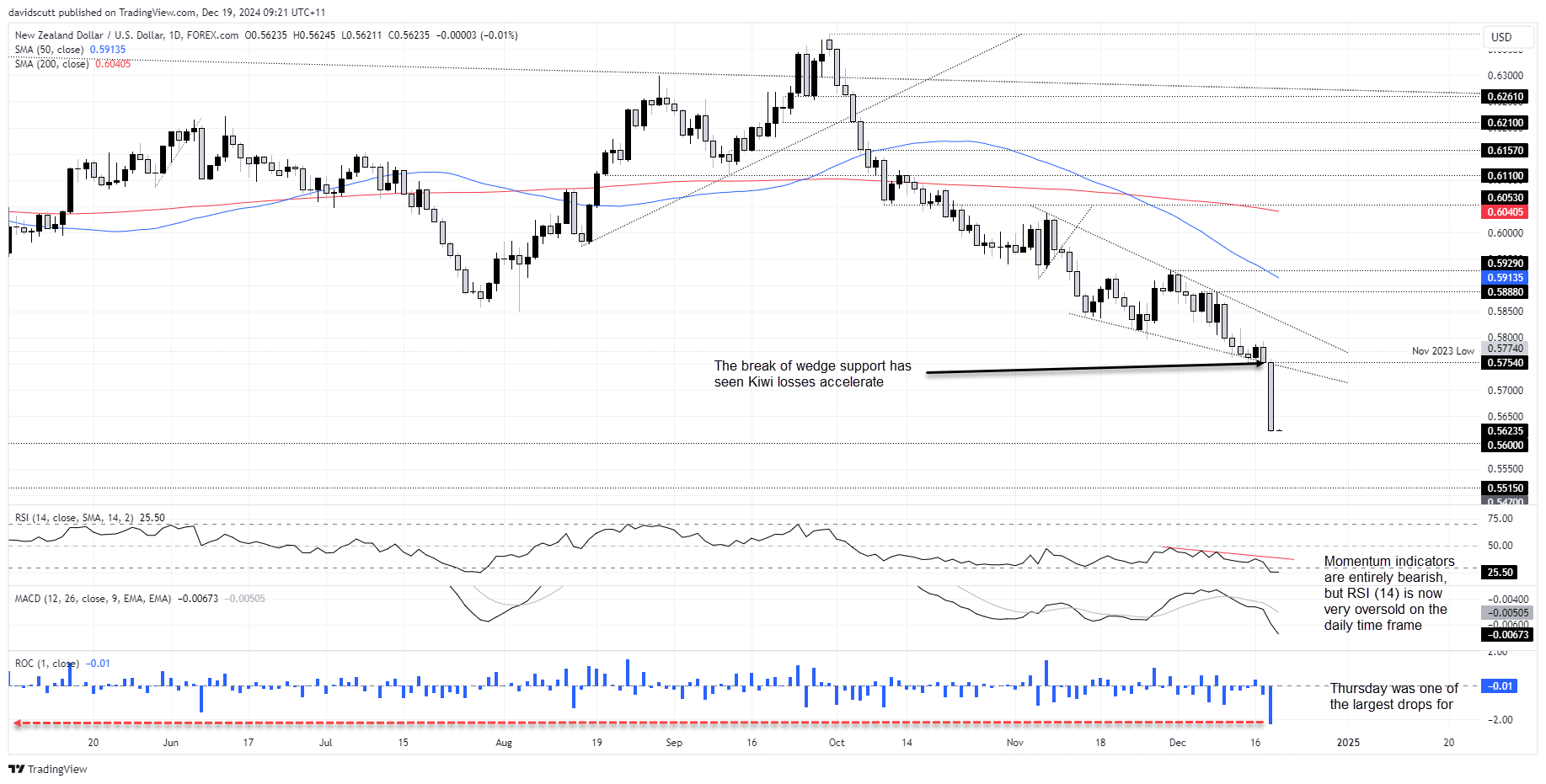

NZD/USD Belted, Bruised and No Sign of a Bounce

Source: TradingView

As flagged earlier this week, the break of wedge support has seen NZD/USD losses accelerate, bringing a potential retest of.5600 on the radar. If that minor level were to buckle, we’re talking about a possible return to .5515, the lows struck in October 2022. On the topside, resistance may be encountered at .5754, even if the price is unlikely to return their near-term.

RSI (14) and MACD are generating bearish signals on momentum, although the former is very oversold on the daily timeframe, increasing the risk of a sudden squeeze. Traders should look for obvious bottoming signals on shorter timeframes to determine when one may occur, but the prevailing bias remains to sell rips near-term.