Key Points:

- NZD/USD reaches key reversal point and declining trend line.

- 0.70 handle represents a critical inflexion point.

- Watch for a pullback towards the 69 cent handle in the coming days.

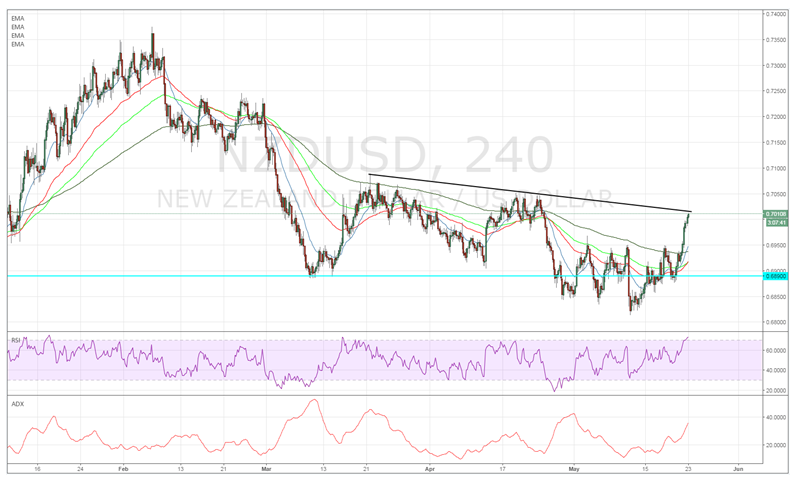

The Kiwi Dollar has faced some sharp swings over the past few weeks as the pair has reacted to a range of changing U.S. Dollar sentiment. Subsequently, the pair has largely rallied over the last trading session and finally reached the declining trend line. However, it remains to be seen if the pair can retain its current level and potentially rise above the key 70 cent handle.

In fact, taking stock of the 4-hour chart is particularly illuminating and actually demonstrates the strong rally that price action has undertaken over the past few days. However, the technical indicators are suggesting that momentum might actually be stalling for the bullish pair. In particular, the RSI Oscillator has now ticked into overbought territory which suggests that a pullback might be on the cards in the coming days.

In addition, price action is facing some stiff resistance around the 70 cent handle, which has been a key reversal point in the past. The level has been seen as a psychological zone of resistance and the market willbe watching the handle closely for any signs of a change in trend.In fact, given the historical validity of the declining trend line, any further gains will in all probability be limited.

Fundamentally, the Kiwi Dollar is also potentially over valued given that inflationary pressures and GDP gains are still within the recovery phase. Additionally, the only economic indicator largely supporting strong growth is the global dairy trade numbers, which have continued to improve over the past few months. Additionally, the U.S. economic data continues to point to tightening within the labour market which is likely to lead to monetary policy action from the Fed in the coming months. Subsequently, there are plenty of reasons to suggest that we might see additional moves to the short side in the coming weeks.

Ultimately, the most likely scenario for the pair in the coming session is an abject failure to breach the declining trend line and then a steady depreciation against the greenback. This is further supported by the various oscillators’ overbought status and the need for a period of moderation or a pullback to relieve the pressure. Subsequently, keep a close watch for a failure around the 70 cent handle and then a steady move lower back towards support around the 0.6900 mark.