- Kiwi consolidates above .5800 ahead of Fed, BOJ decisions.

- Strong inverse correlation with USD/CNH remains intact.

- Momentum signals favour upside, but support must hold.

- A break below .5800 could trigger a return to range trade.

NZD/USD consolidated upon Monday’s bullish break on Tuesday, holding above 0.5800 heading into a busy day for central bankers, headlined by the Federal Reserve FOMC interest rate decision. While those events will guide the Kiwi’s near-term direction, the flightless bird has been taking its cues from the Chinese yuan recently, demonstrating a strong relationship against the US dollar. That means rather than analyzing New Zealand economic data, such as Thursday’s GDP report, traders would be better off keeping a close eye on developments related to the escalating trade spat between the United States and China.

Fed Impact

The Fed may guide slightly more dovish than market pricing remaining intact. If the view proves accurate, it may help promote upside for NZD/USD.

Kiwi: The True China Proxy?

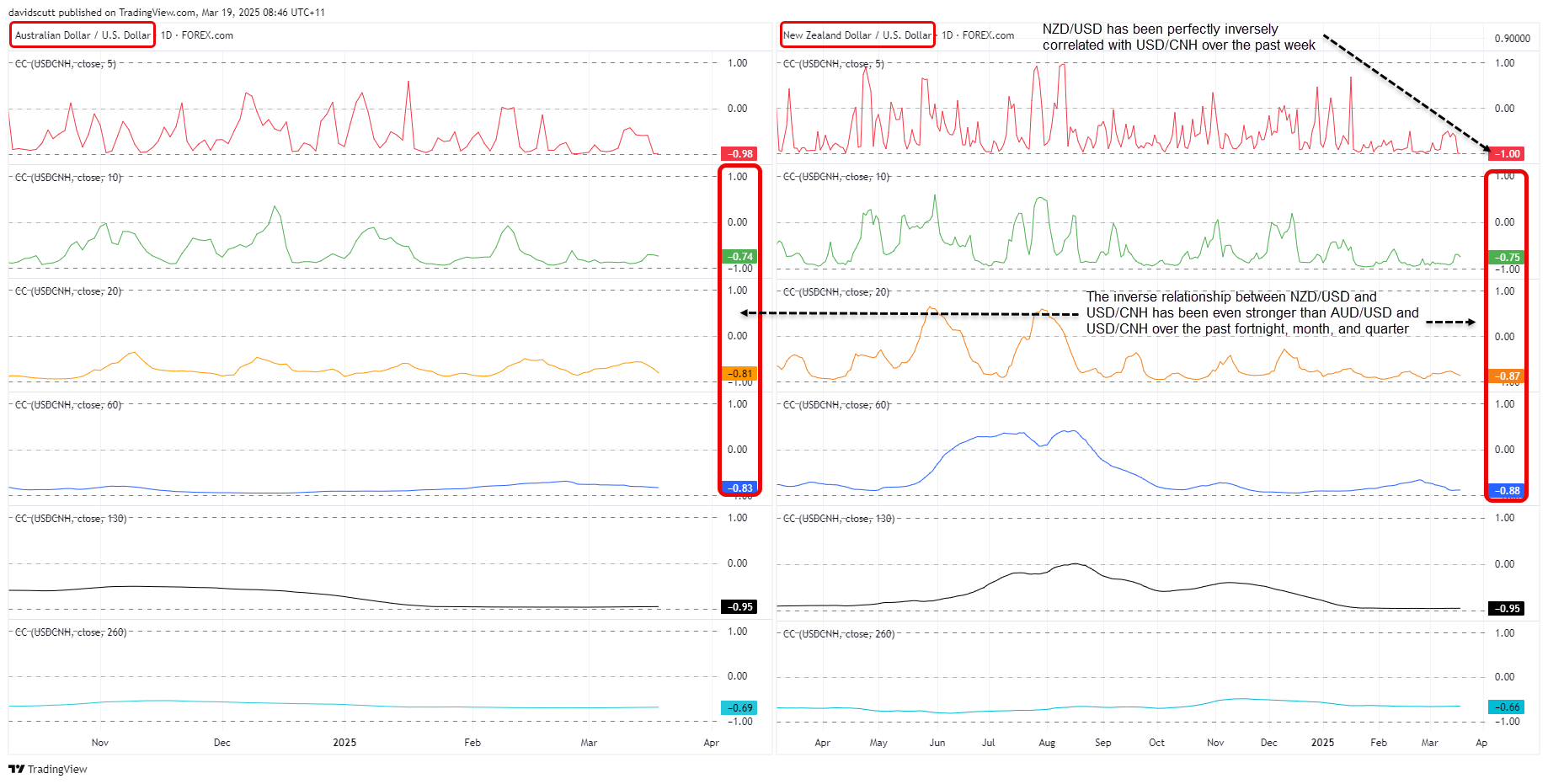

However, as the chart below shows, anyone trading NZD/USD should keep a close eye on the performance of the Chinese yuan against the US Dollar, given how strongly correlated they are over short, medium, and longer-term timeframes.

Source: TradingView

Over the past week, the correlation coefficient between NZD/USD and USD/CNH has been -1 on the daily timeframe, indicating a perfect inverse relationship. Where one has moved, the other has done the exact opposite every single time. That remarkable outcome tells you the Kiwi and yuan have been moving in lockstep against the U.S. dollar.

While the correlations are not quite as strong over longer timeframes, at -0.87, -0.88, and -0.95 respectively over the past month, quarter, and six months, it’s obvious the yuan is an important influence on NZD/USD movements. Its actually demonstrating a stronger relationship than with AUD/USD, which is often called a China “proxy” or “pure play.”

I looked at the technical setup for USD/CNH earlier this week and would encourage anyone trading NZD/USD or AUD/USD to take note of the support zone the pair is currently flirting with.

NZD/USD: Bullish Bias Intact

Source: TradingView

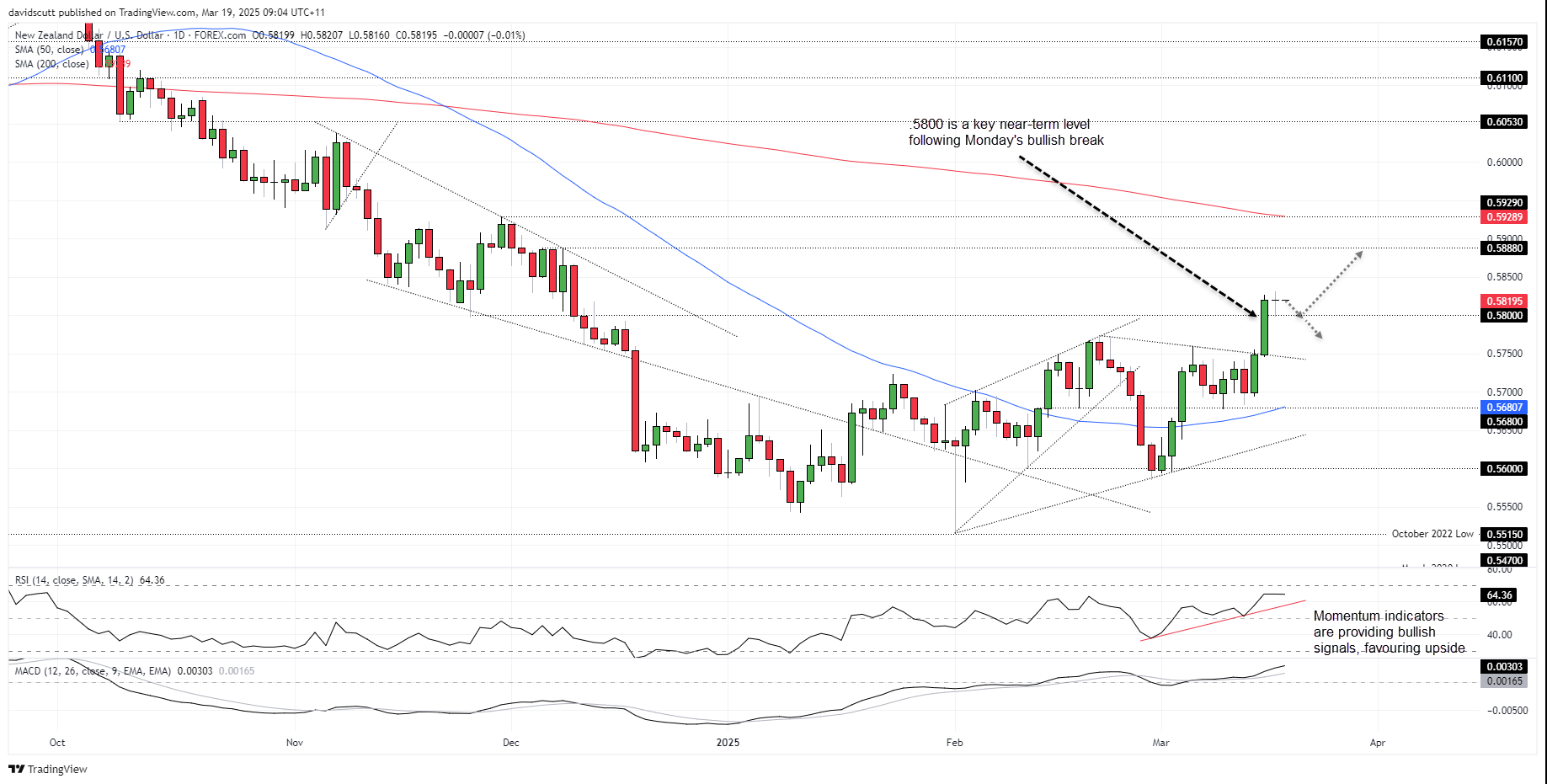

NZD/USD performed reasonably well on Tuesday despite the risk-off tone across broader markets, consolidating on the bullish break of wedge resistance on Monday that saw it move back above .5800. The retest and bounce off the level helped deliver a doji candle, suggesting traders are now awaiting the outcome of the Fed and BOJ decisions before deciding on the next move.

Given the prevailing price action and momentum signals provided by MACD and RSI (14), the near-term bias remains bullish, favouring upside over downside.

If .5800 continues to hold firm, it may be used to build bullish setups around, allowing for longs to be established ahead of it with a stop below for protection. .5888 and .5929 screen as potential topside targets, with the latter a sterner test for bulls as it coincides with the intersection of the 200DMA.

However, if .5800 were to buckle, it would invalidate the bullish bias, favouring a resumption of range trade between it and .5515 on the downside.