The NZD/USD pair is experiencing a significant downturn, trading around 0.5996. Several factors influence this decline, including global political developments and domestic monetary policy expectations.

The recent announcement by US President Joe Biden that he will not seek re-election in 2024 has unexpectedly bolstered the US dollar. Biden's endorsement of Vice President Kamala Harris as his successor has introduced a new dynamic into the political landscape, generally favouring the stability of the US dollar.

Simultaneously, the New Zealand dollar is weakened by the looming possibility of interest rate cuts by the Reserve Bank of New Zealand (RBNZ). Market participants increasingly expect rate reductions beginning early in August following a weaker-than-expected Q2 inflation report.

This anticipation builds on the RBNZ's July decision to maintain the official cash rate at 5.5% per annum, coupled with hints that monetary policy might be relaxed if inflation pressures abate.

Adding to the pressure, recent trade data from New Zealand showed a surplus in June, primarily due to a sharper decline in imports compared to exports, suggesting potential economic softness.

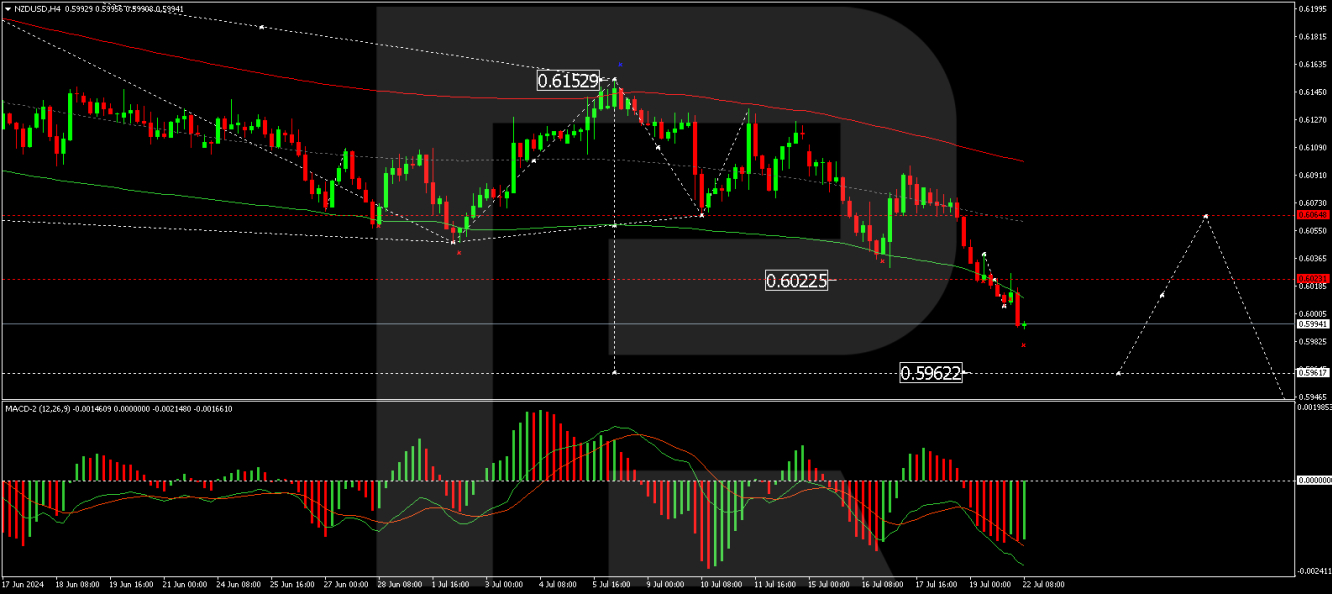

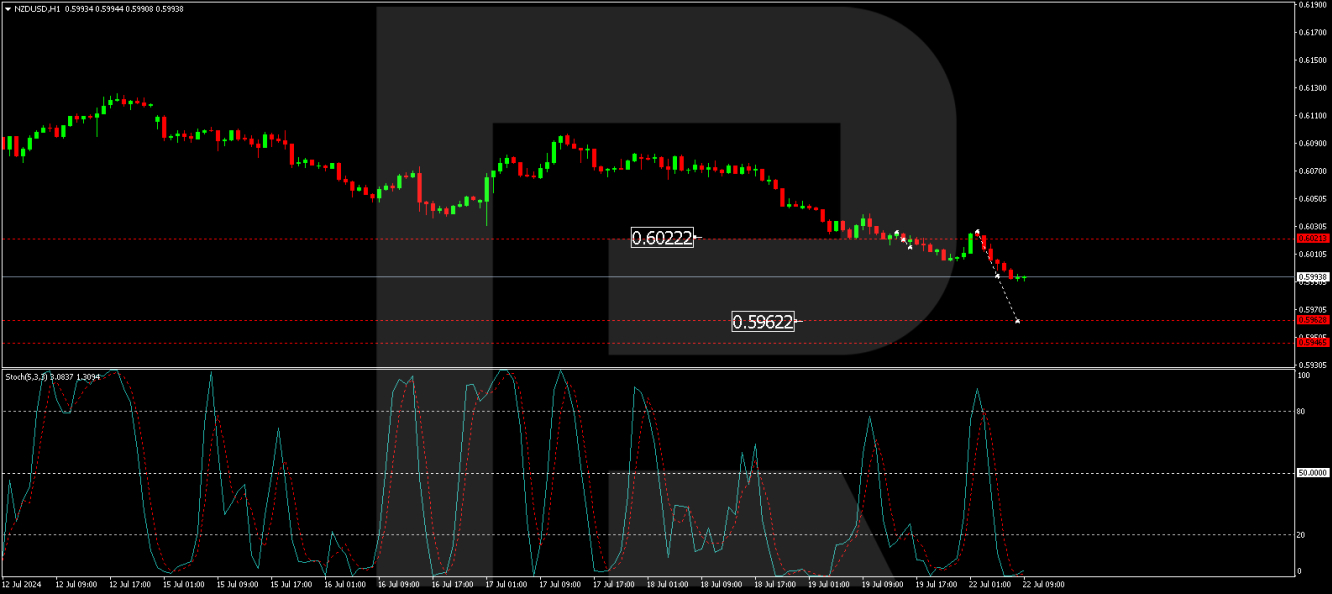

NZD/USD Technical Analysis

The pair has established a consolidation range around the 0.6022 level, with a breakout leading to a continuation of the downward trend. The immediate target is 0.5962, with the potential to extend towards 0.5946.

The MACD indicator supports this bearish outlook, as it remains below zero and points downwards, indicating sustained selling momentum.

Resistance was found at 0.6022, and the pair is extending its decline towards 0.5962. A corrective bounce to 0.6000 might occur before resuming the downward movement towards 0.5946.

The stochastic oscillator, currently below 20, suggests a potential brief recovery to around 50 before a likely resumption of the downward trend.

Investors and traders should closely monitor these developments, especially any further political news from the US and upcoming economic data from New Zealand. These factors could significantly impact the pair's movements in the near term.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.