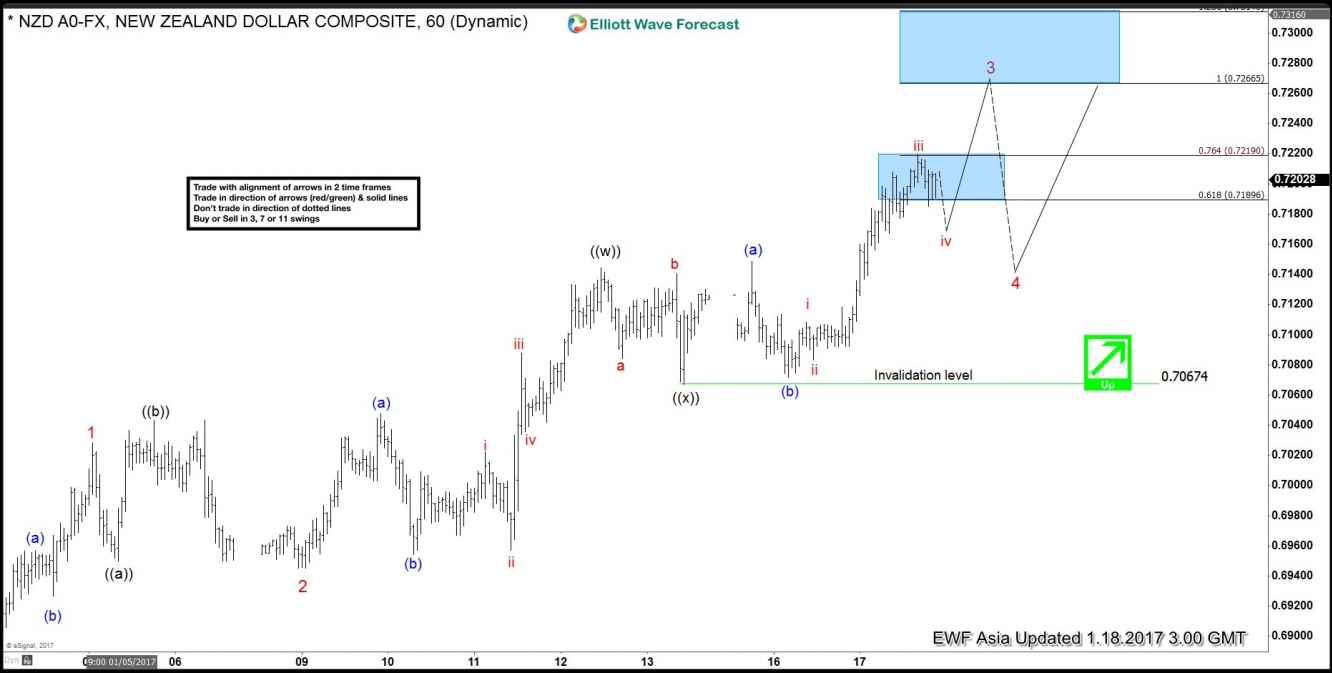

NZD/USD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse when pair is still in wave 3.

Rally to 0.7043 is labelled as wave 1 and dip to 0.6945 is labelled as a FLAT wave 2. Up from there wave 3 remains in progress towards 0.7266 - 1.7315. Once wave 3 is complete, expect the pair to pull back in wave 4 to correct the cycle from red 2 low and turn higher in wave 5 to complete a 5 wave move up from 12/23 (0.6857) low.

Proposed wave 4 pull back should unfold in 3, 7 or 11 swings and would typically complete between 23.6 - 38.2 Fibonacci retracement of wave 3. Wave 4 pull back should not retrace more than 50% of wave 3 as per the new guidelines that we have introduced ourselves and also not overlap with wave 1.

This means proposed wave 4 pull back, when seen, should stay above 0.7043 for the idea of impulse to remain valid. If wave 4 pull back retraces more than 50% of wave 3 or gets below 0.7043, that would mean move up from 0.6857 low is no longer an impulse but could still be wave 4 of a diagonal higher. If the pivot at proposed red 2 (0.6945) low gives up, that would suggest cycle from 0.6857 low ended as an ABC (zig-zag)