The NZD/USD pair has extended its upward movement into a third session, reaching 0.6106 amid growing weaknesses in the US dollar.

Negative shifts in US economic indicators, particularly June's disappointing private sector employment data from ADP and uncertain PMI signals, have supported the New Zealand dollar's recent gains. These factors have fuelled speculations about a possible interest rate cut by the Federal Reserve later in the year. However, such predictions should be approached cautiously, as the Fed has indicated it will only consider rate cuts after accumulating substantial supportive data.

Recent minutes from the Fed's meetings suggest that while inflation is trending towards the target, the movement is not yet pronounced enough to justify immediate rate cuts.

Looking ahead, the Reserve Bank of New Zealand (RBNZ) is expected to maintain its key rate at 5.5% during its upcoming meeting, marking the eighth consecutive hold at this level.

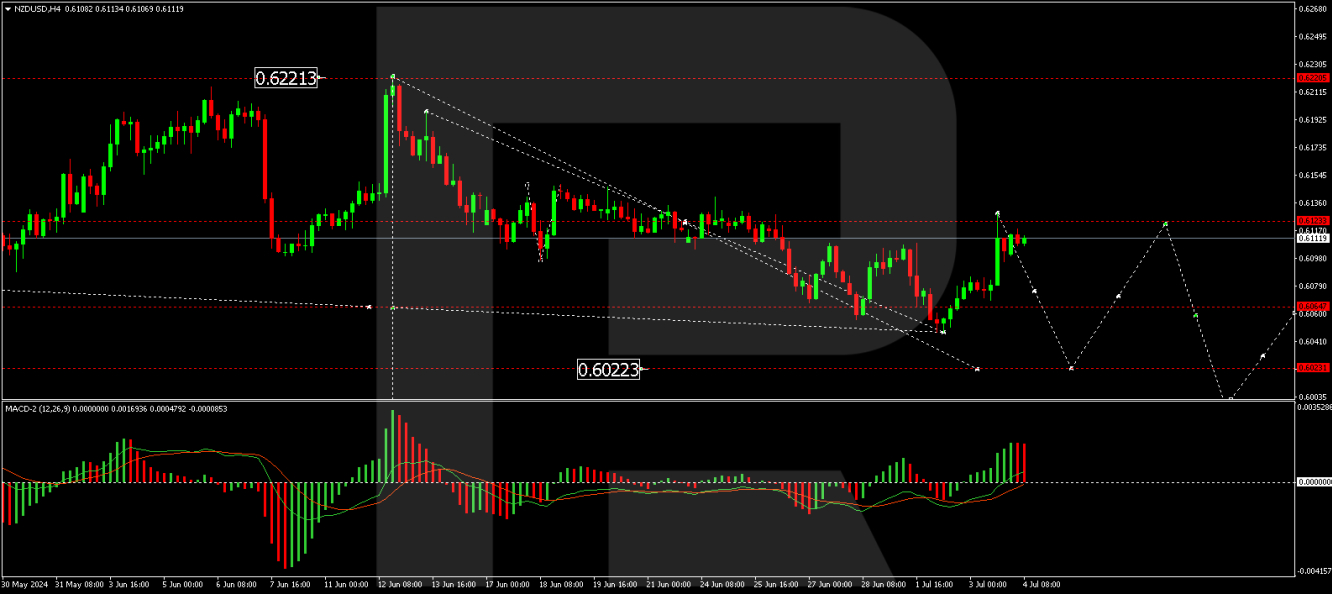

Technical Analysis of NZD/USD

The NZD/USD pair recently completed a downtrend to 0.6048 and corrected back to 0.6128. Currently, the market is likely forming a consolidation range below this level. A breakout downwards could initiate a new decline towards 0.6022, aligning with technical indicators. The MACD supports a bearish outlook as its signal line is below zero, suggesting further declines.

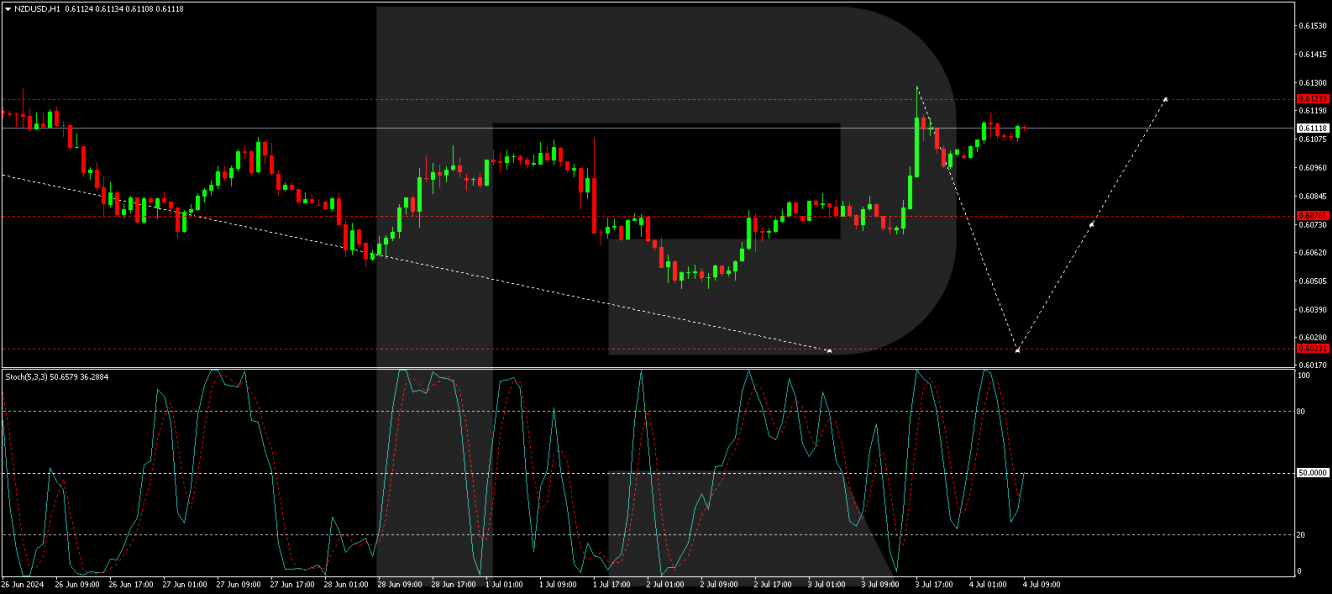

On the hourly chart, after finding support at 0.6048, NZD/USD surged to 0.6077 and consolidated. Following an upward break, the pair reached 0.6128. We now anticipate the formation of a new consolidation range below this peak. Should the price break lower, we expect a return to 0.6077, potentially extending to 0.6022 if the downward momentum continues. This bearish potential is underscored by the Stochastic oscillator, poised to descend further from the 50 mark to 20.

Market Outlook

Investors will closely monitor upcoming economic releases and central bank communications, particularly from the RBNZ and the Fed, which could significantly influence the trajectory of NZD/USD. The balance between local economic stability and global USD dynamics will be crucial in determining the near-term direction of the pair.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.