- NZD/USD continues the bearish correction

- Technical oscillators are mixed

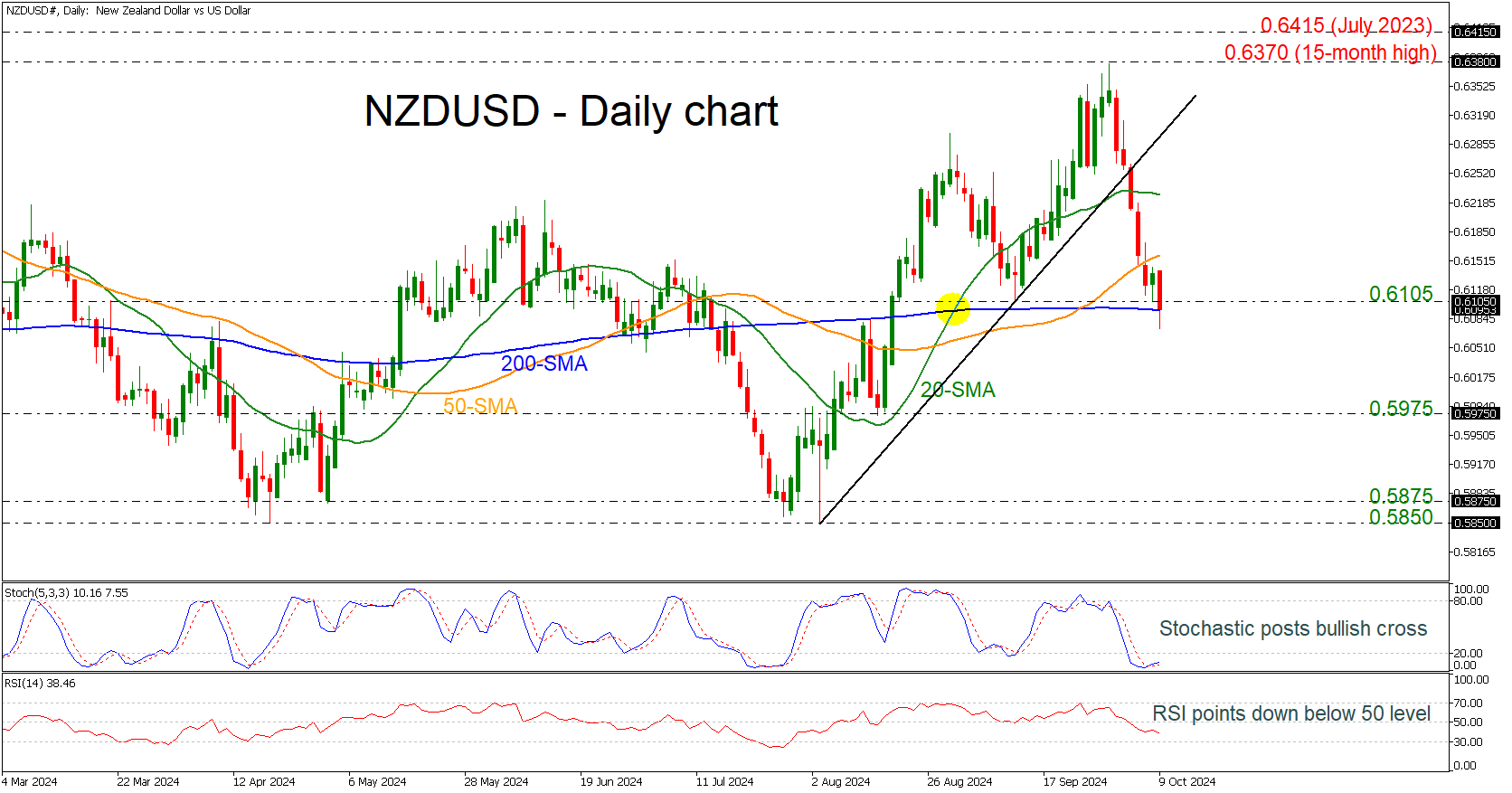

NZD/USD plunged significantly after the RBNZ’s decision to cut interest rates by 50 bps. The pair remained closed to the 0.6100 round number and is holding near the 200-day simple moving average (SMA), which is acting as a strong support level.

The technical oscillators are showing some contradicting signals. The stochastic oscillator is pointing upwards in the oversold area after a bullish cross within its %K and %D lines; however, the RSI is pointing down below the neutral threshold of 50.

If the market retreats further, the next support to pause the bearish action is coming from the previous troughs on August 15 at 0.5975. Moving lower, the support area of 0.5850-0.5875 may halt the steep negative momentum.

On the other hand, a potential rebound off the 0.6105 barrier may send the pair up to the 50-day SMA at 0.6160 and the 20-day SMA at 0.6225. More increases may take the bulls back towards the 15-month peak of 0.6370 and slightly higher to 0.6415, registered in July 2023, adding some optimism for upside pressure.

To sum up, as long as the market remains above the 200-day SMA, the bias remains positive despite the aggressive selling interest in the last few days.