The New Zealand dollar has continued to strengthen after the Reserve Bank of New Zealand’s (RBNZ) latest survey of inflation expectations was released on Wednesday. The survey revealed a steady climb in the number of businesses expecting inflation to rise over the coming years. The RBNZ will only raise interest rates after inflation has made a sustainable return to the higher end of its 1% to 3% target band. The unemployment rate is also expected to fall progressively in the years ahead, suggesting a change in RBNZ’s monetary policy is likely.

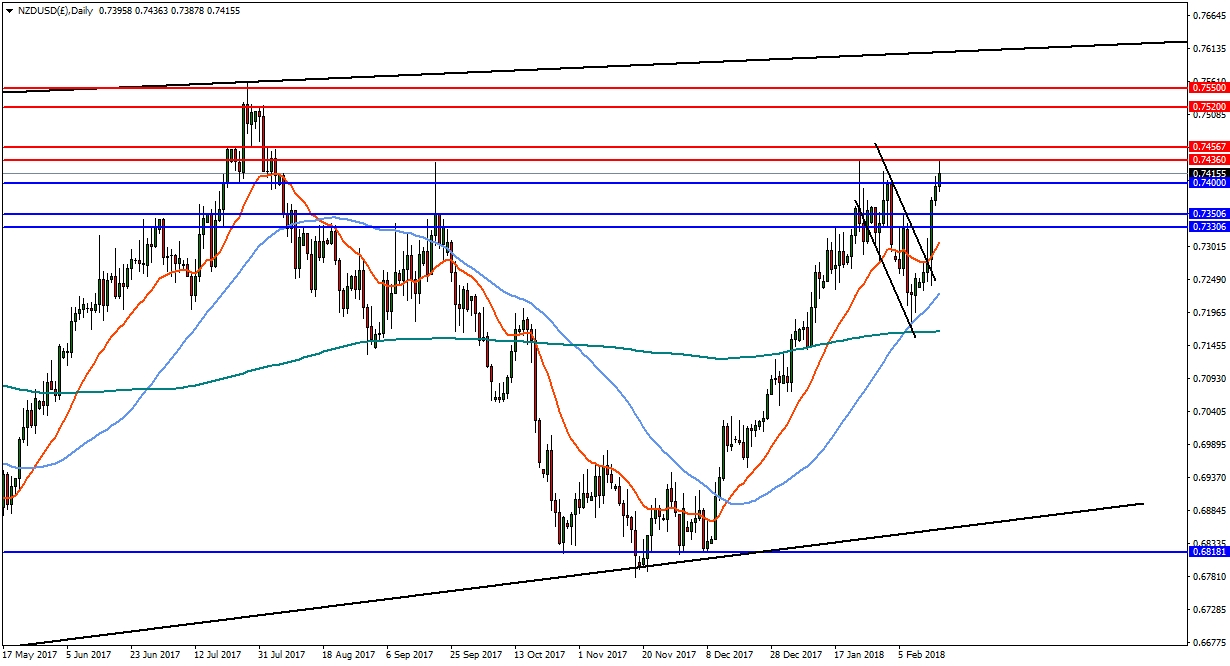

The continued decline in the U.S. dollar has helped the Kiwi climb for five straight days to highs at 0.7436. In the daily time frame, a break of 0.7436 would challenge resistance at 0.7547 before making progress towards June highs in the 0.7520-50 zone. However, any reversal will find initial support at 0.7400 followed by 0.7350.

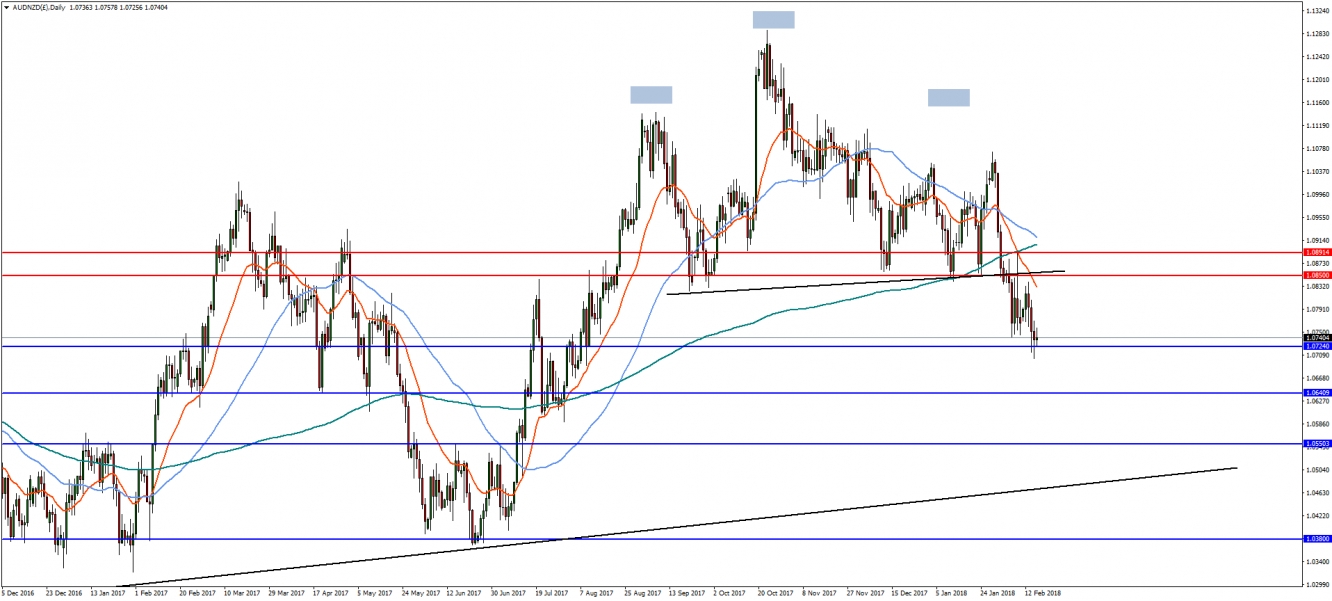

The AUD/NZD pair has broken a possible head and shoulders pattern with a measured target, which coincides with the June lows at 1.038. The breakdown was confirmed at the 1.085 neckline before the pair continued the decline to support at the 61.8% Fibonacci retracement level of 1.0724. Continued bearish momentum will find major support at 1.064, followed by 1.055. Only a reversal and move above the neckline at 1.085 would negate the bearish view, with initial resistance at 1.089.