Wall Street responded well to Trump’s move to suspend Mexico tariffs, but the good mood could evaporate after he threatened to slap more tariffs on China goods if China President Xi won’t meet him at the upcoming G-20 summit.

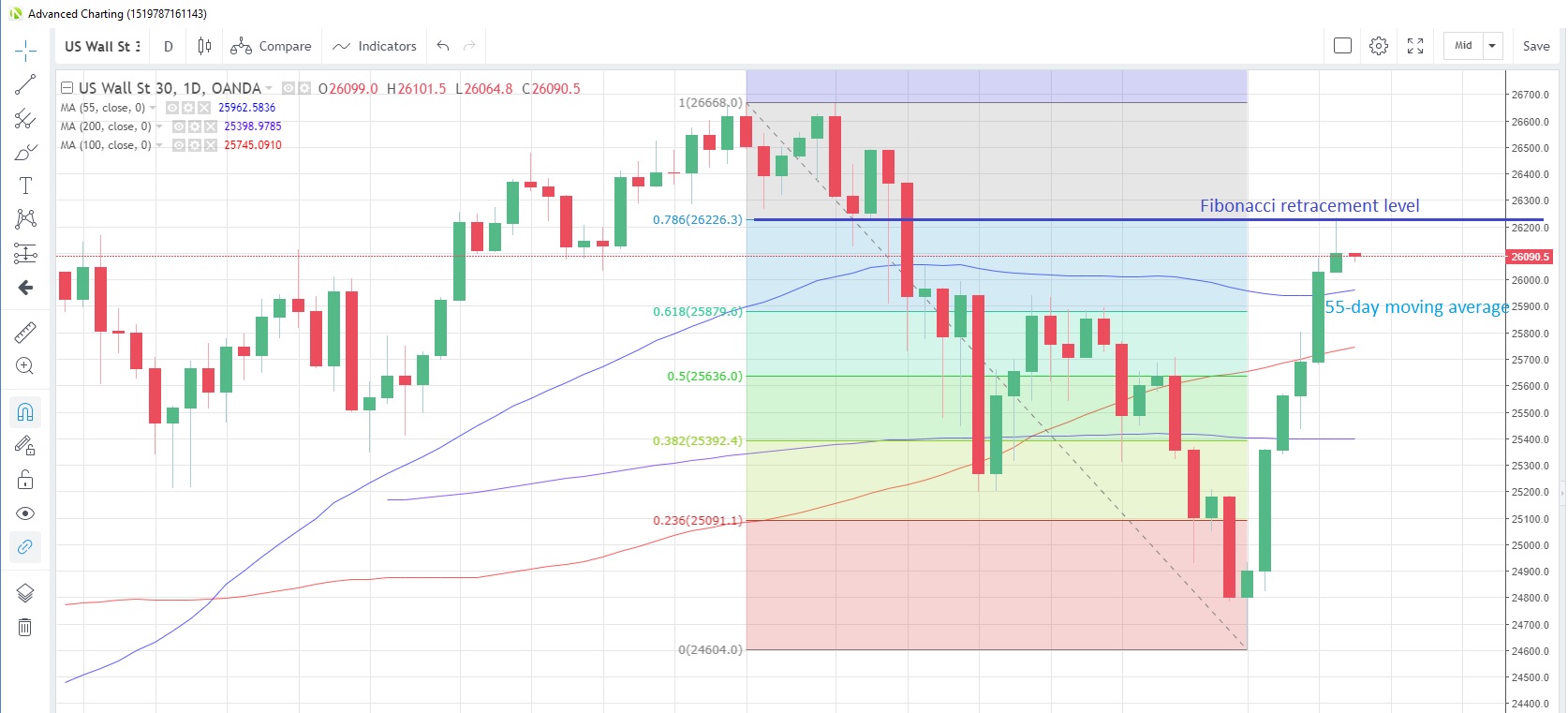

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index advanced for a sixth straight yesterday but is little changed in early trading this morning

- The index tested the 78.6% Fibonacci retracement of the April-June drop at 26,226 but failed to close above it. The 55-day moving average is at 25,962

- U.S. producer prices are seen rising 2.0% y/y in May, the latest survey of economists shows, a slower pace than the 2.2% recorded in April.

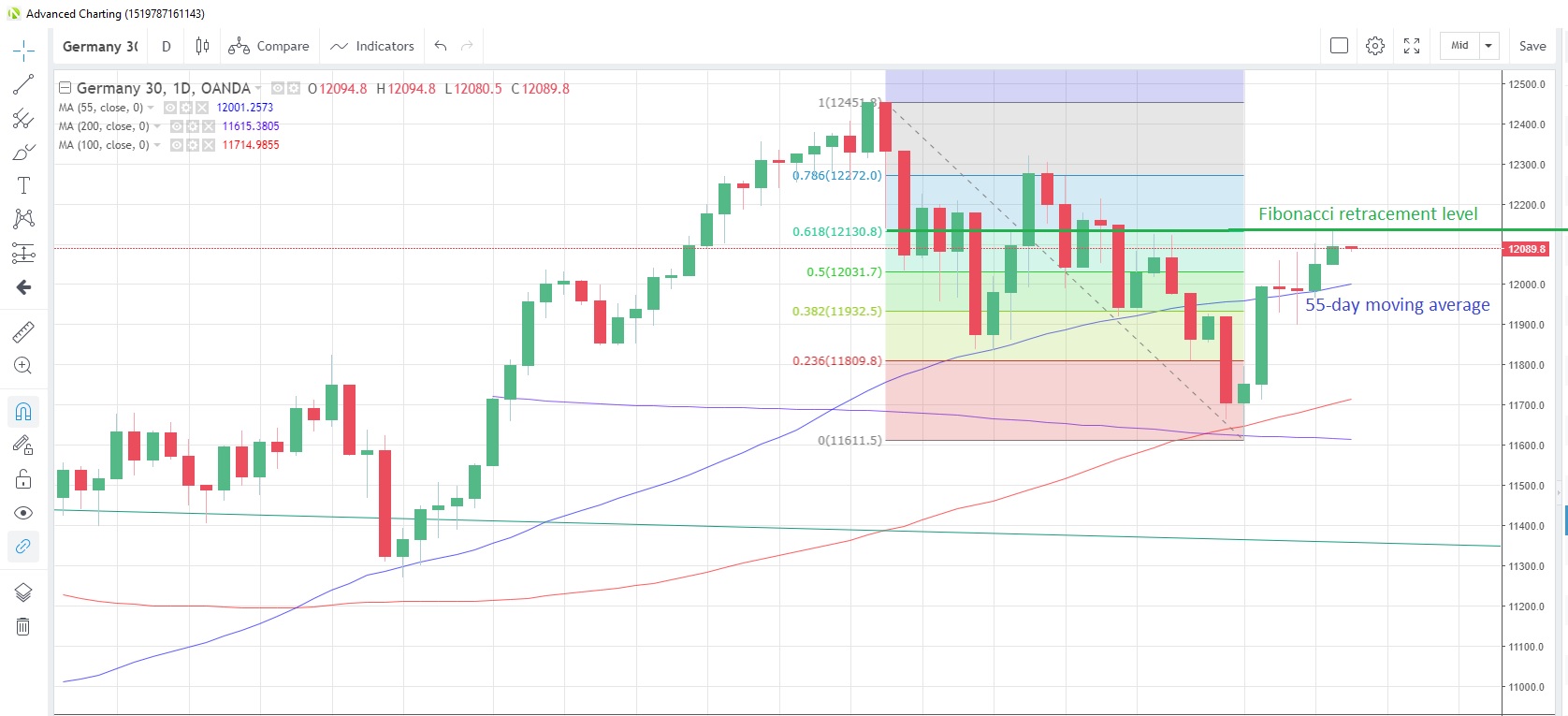

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index touched the highest in nearly two weeks yesterday and has opened flat this morning

- The index is rising toward the 61.8% Fibonacci retracement of the May-June drop at 12,131. The 55-day moving average is at 12,001 and has supported prices on a closing basis since June 3

- The Euro-zone Sentix investor confidence index is expected to tumble to 1.4 in June from 5.3 in May, according to the latest survey of economists.

WTICOUSD Daily Chart

Source: OANDA fxTrade

- West Texas Intermediate touched the highest level this month yesterday but then reversed direction to snap a two-day rising streak

- The index’s decline from mid-April has stalled near the 61.8% Fibonacci retracement level of the December-April rally at $51.47

- Weekly stockpiles data from the American Petroleum Institute are due today. Last week saw an increase in inventories of 3.55 million barrels.