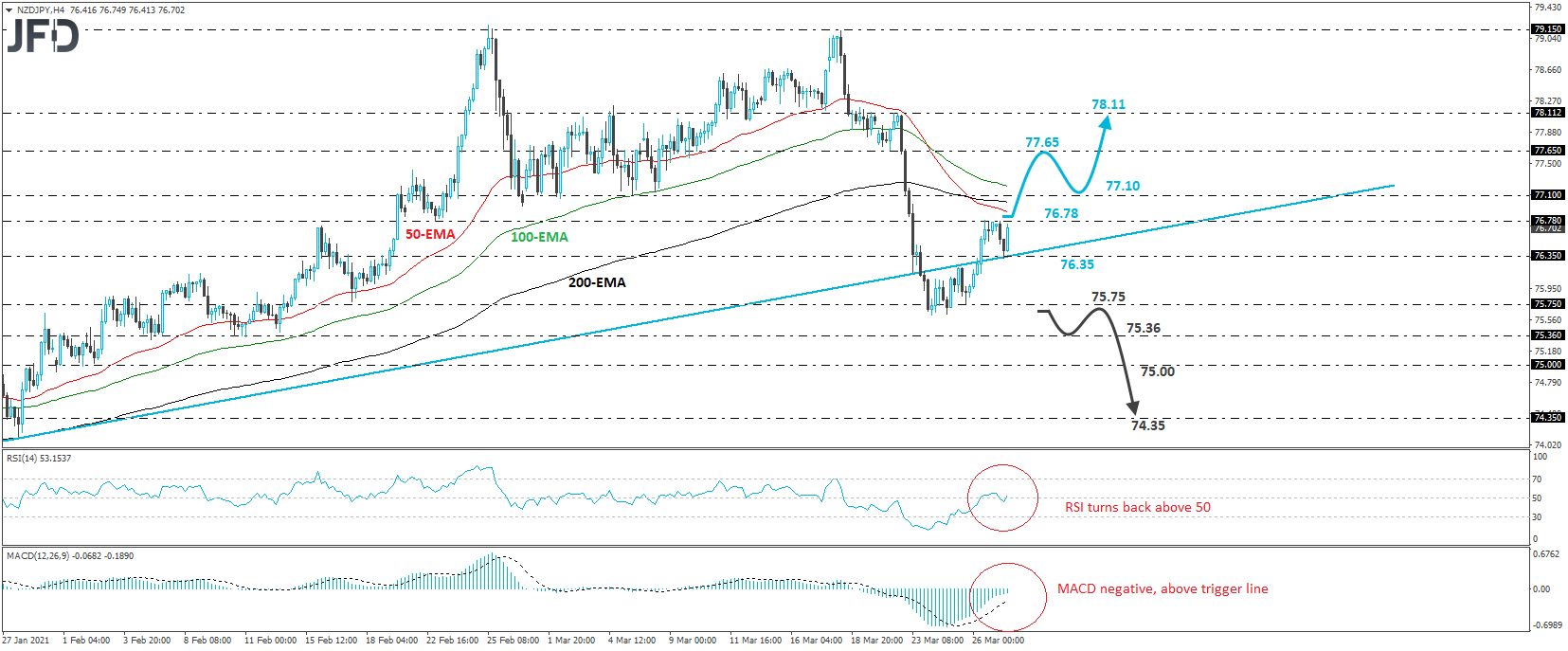

NZD/JPY traded higher on Thursday and Friday, returning back above the upside support line drawn from the low of Dec. 21. Then, the rate hit resistance at 76.78, pulled back, hit that upside line as a support and then it rebounded again. In our view, the return back above that upside line turned the short-term outlook back to a cautiously positive one.

If the bulls are strong enough to stay in the driver’s seat, we could soon see them overcoming the 76.78 barrier and challenging the 77.10 zone, which provided strong support between Feb. 26 and Mar. 8. If that zone is not able to stop the recovery, then its break may see scope for advances towards the 77.65 hurdle, marked by the inside swing low of Mar. 22, the break of which could carry extensions towards the high of that day, at around 78.11.

Shifting attention to our short-term oscillators, we see that the RSI rebounded and moved back above its 50 line, while the MACD, although negative, lies above its trigger line, pointing up. It could obtain a positive sign soon. Both indicators suggest that the rate may start picking upside momentum soon, which supports our view for some further short-term advances.

On the downside, we would like to see a dip below 75.75 before we start examining the bearish case again. This may initially pave the way towards the 75.36 area, which provided strong support between Feb. 5 and 12, the break of which may target the psychological zone of 75.00. Another break, below 75.00, could set the stage for larger bearish extensions, perhaps towards the 74.35 area, which provided support between Jan. 21 and 27.