Talking Points

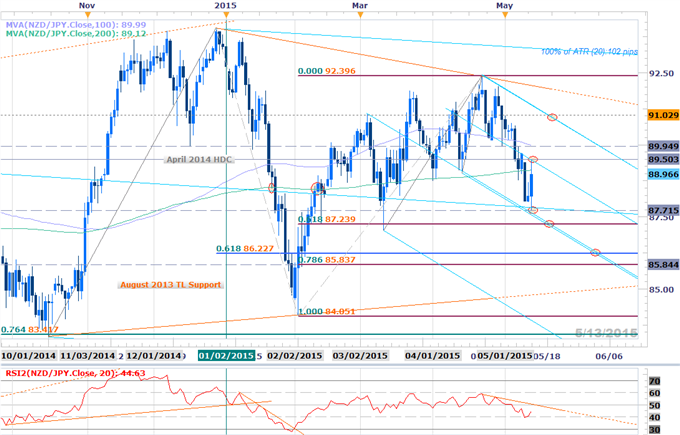

- NZD/JPY Critical 180pip range in focus

- 89.50 key targeted resistance / bearish invalidation

- Event Risk on TapThisWeek

NZD/JPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- AUD/JPY posts outside day candle off key support

- Key range in focus 87.70–89.50

- Breach targets 89.95 backed by the upper median-line parallel / May ORH at 91.03

- Support break targets 87.24, ML support & 86.23

- Daily RSI rebound at 40 could suggest another push higher before we turn

- Pending resistance trigger in play- break would validate the reversal play higher

- Event Risk Ahead: New Zealand Manufacturing PMI & Retail Sales Ex Inflation

NZD/JPY 30min

Notes: NZD/JPY broke out of a near-term ML formation off the highs today with the rally coming into resistance at the confluence of a broader median-line off the March/April highs & a basic 38.2% retracement of the decline at 89.50. This level is also defined by the April high-day close and more recently the 4/13 & 5/6 closes and will serve as our near-term bearish invalidation level.

Bottom line: we’ll be looking initially for a break below 88.76 (last week’s low) to put the short-bias back in play targeting 88.20 & key support into 87.70/75 (note the daily ML & the intraday 1.618% extension). Note that the pending support trigger extending off the weekly low in momentum remains in play. A breach above today’s high invalidates the short-side with such a scenario targeting 89.95-90.05, 90.60 & the upper MLP / 91.30.Caution is warranted heading into event risk this evening with Kiwi Business Manufacturing PMI & Retail Sales Ex Inflation on tap. A quarter of the daily ATR yields profit targets of 24-27 pips per scalp.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.