Investing.com’s stocks of the week

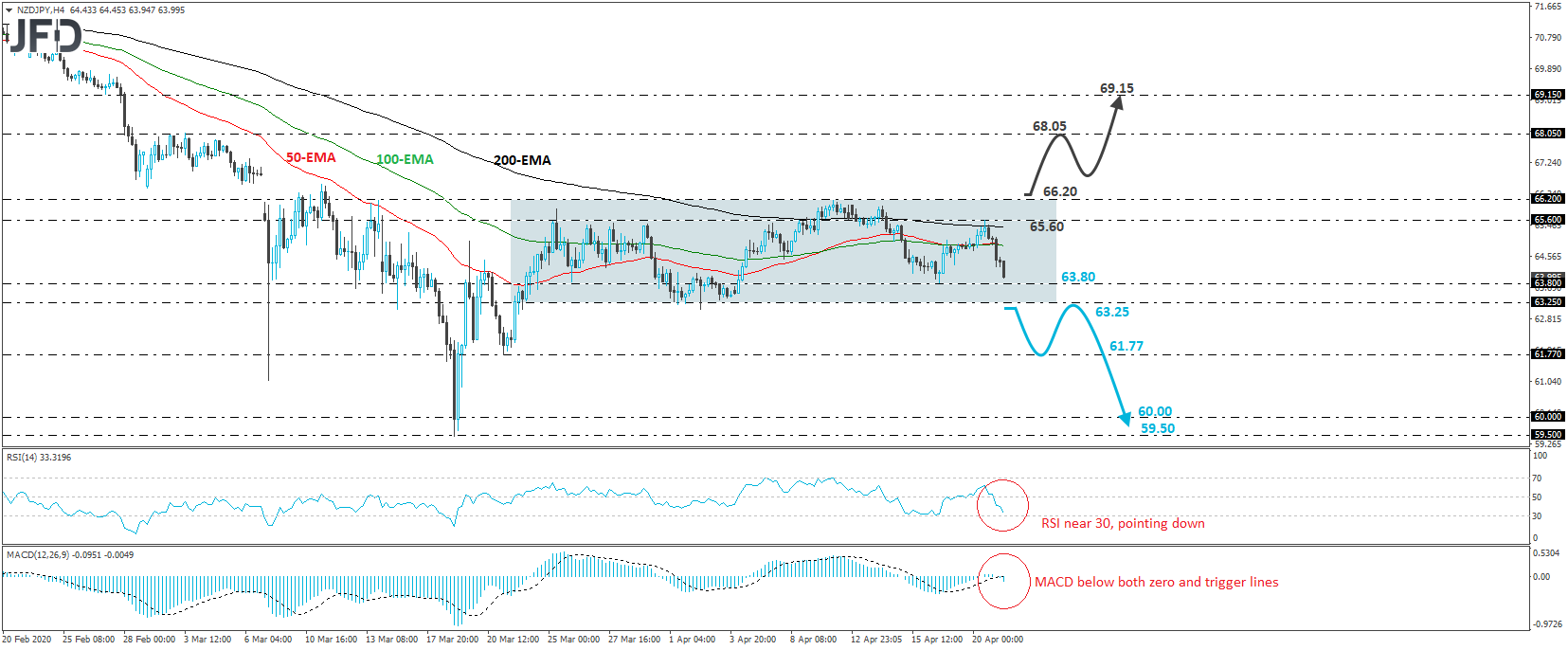

NZD/JPY traded lower today, after hitting resistance at 65.60 yesterday. Overall, the pair has been oscillating within a sideways range, between 63.25 and 66.20, since March 23rd and thus, we would adopt a neutral stance for now with regards to the short-term outlook.

At the time of writing, the rate looks to be heading towards the low of April 16th, at 63.80, but the move that could make us confident on larger bearish extensions is a decisive dip below the lower end of the aforementioned range, at 63.25. Such a move may wake up more bears, who could push the battle towards the low of March 23rd, at 61.77. If they are not willing to stop there, then another break lower could set the stage for declines towards the psychological figure of 60.00, or the 59.50 zone, defined as a support by the low of March 19th.

Taking a look at our short-term momentum studies, we see that the RSI runs below 50, points down, and looks to be headed towards its 30 mark. The MACD, has just crossed below both its zero and trigger lines. It points south as well. Both indicators detect downside speed and enhance the chances for NZD/JPY to break the lower end of its recent range.

In order to start examining whether the bulls have gained the upper hand, we would like to see the rate escaping the range through its upper bound, at 66.20. This would confirm a forthcoming higher high and may initially aim for the 68.05 zone, which provided resistance on March 3rd. If that level is also broken, then we may see the advance extending towards the 69.15 barrier, which is slightly below the peak of February 28th.