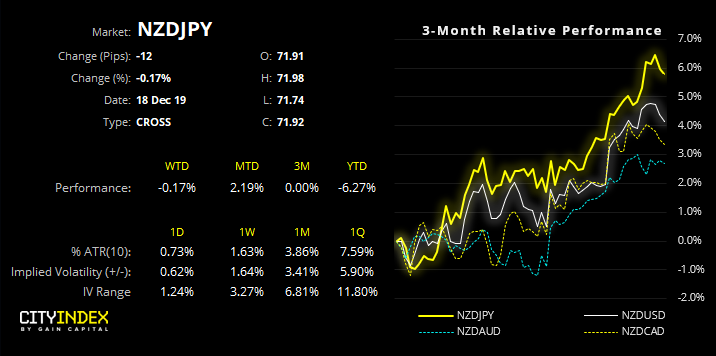

NZD/JPY is retracing from its highs towards a key level of support ahead of GDP data later today (tomorrow morning in Asia).

Like AUD/JPY, NZD/JPY can also be a great barometer of risk for FX traders. Yet with a divergent theme underway between the Australian and New Zealand economies, we could see the usually tight correlation between AUD/JPY and NZD/JPY decouple. And with economic data from NZ having the upper hand over AU, RBNZ likely to hold in Feb whilst RBA cut, we retain our bearish view on AUD/NZD and suspect we could see NZD/JPY break to new highs in due course.

Ultimately, with economic data generally improving for NZ then the core view remains bullish for NZD pairs, making them an ideal candidate for bulls to consider on pullbacks. NZD/JPY is one such pair.

A bullish channel has been evolving since the first half of October and momentum has provided shallow pullbacks, underscoring the trend’s strength. Friday’s bearish hammer showed signs of exhaustion at the top of the channel and a retracement is now underway. Yet with key support at 71.52 ahead of GDP data, we’re looking for NZD/JPY to bounce higher if does goes our way.

A Reuters poll shows Q3 GDP is expected to rise to 0.6% from 0.5% prior (or 2.4% YoY from 2.1% prior). Unless we see risk-off sentiment sweep through markets, GDP only needs to meet (or can slightly miss) expectations for it to remain firm. Unless we see a broad surge into the yen, it would likely take a strong GDP miss for NZD/JPY to break decisively low.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI