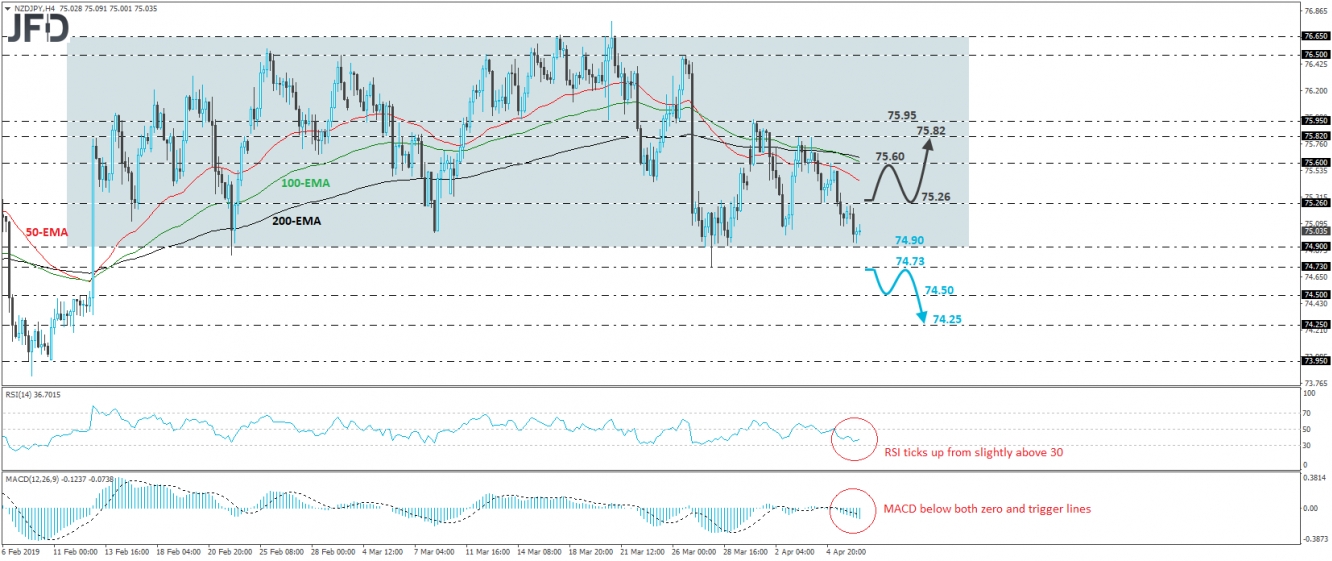

NZD/JPY traded lower during the Asian morning Monday but hit support slightly above the 74.90 hurdle and then it rebounded somewhat. Since February 13, the pair has been trading in a trend-less mode between that barrier and the 76.65 area and thus, despite the latest slide, we will adopt a neutral stance with regards to this pair’s near-term outlook.

Before we start assessing whether the bears have the strength to push the rate further south, we would like to see a decisive dip below the lower end of the aforementioned range, at 74.90, or even better, a break below 74.73, marked by the low of March 28. Such a move would signal the downside exit of the range and may initially set the stage for the 74.50 area, defined by the inside swing high of February 11th. If that level fails to stop the slide and breaks, then we may see the bears putting the 74.25 zone on their radars.

Looking at our short-term oscillators, we see that the RSI ticked up from slightly above its 30 line, while the MACD, although below both its zero and trigger lines, shows signs that it could start bottoming as well. These indicators suggest that a minor bounce may be on the cards before the next negative leg, perhaps for the rate to test again the 75.26 resistance barrier.

Now in case the 75.26 zone fails to stop the rebound, this may be a sign that traders want to keep this exchange rate range-bound for a while more. The recovery could then continue within the range, perhaps aiming for Friday’s high, at 75.60, the break of which could trigger extensions towards the 75.82 obstacle, marked by the peaks of Wednesday and Thursday. Our next resistance is at 75.95, defined by the high of April 1st and the inside swing low of March 26.