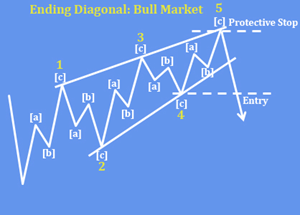

NZD/JPY was trading higher for the last year, but the price action and wave structure overlapped, so it looks like bulls are running out of steam within a wedge shape. In the chart below, the ending diagonal is a reversal pattern labeled with waves 1-2-3-4-5, where each leg is made of three sub-waves (A)-(B)-(C).

From the Elliott wave perspective, we can see a completed final wave (C) of 5 of an ending diagonal within wave C after the recent break below the trendline support and through the bearish level. The move came due to BoJ's intervention and lower stocks due to hawkish Fed policy.

Technically speaking, NZD/JPY can head much lower after a rally, where the 84.23 breakdown point can be new resistance.

An ending diagonal is a special type of pattern that occurs at times when the preceding move has gone too far too fast. A small percentage of ending diagonals appear in the C wave position of A-B- C formations. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.