Investing.com’s stocks of the week

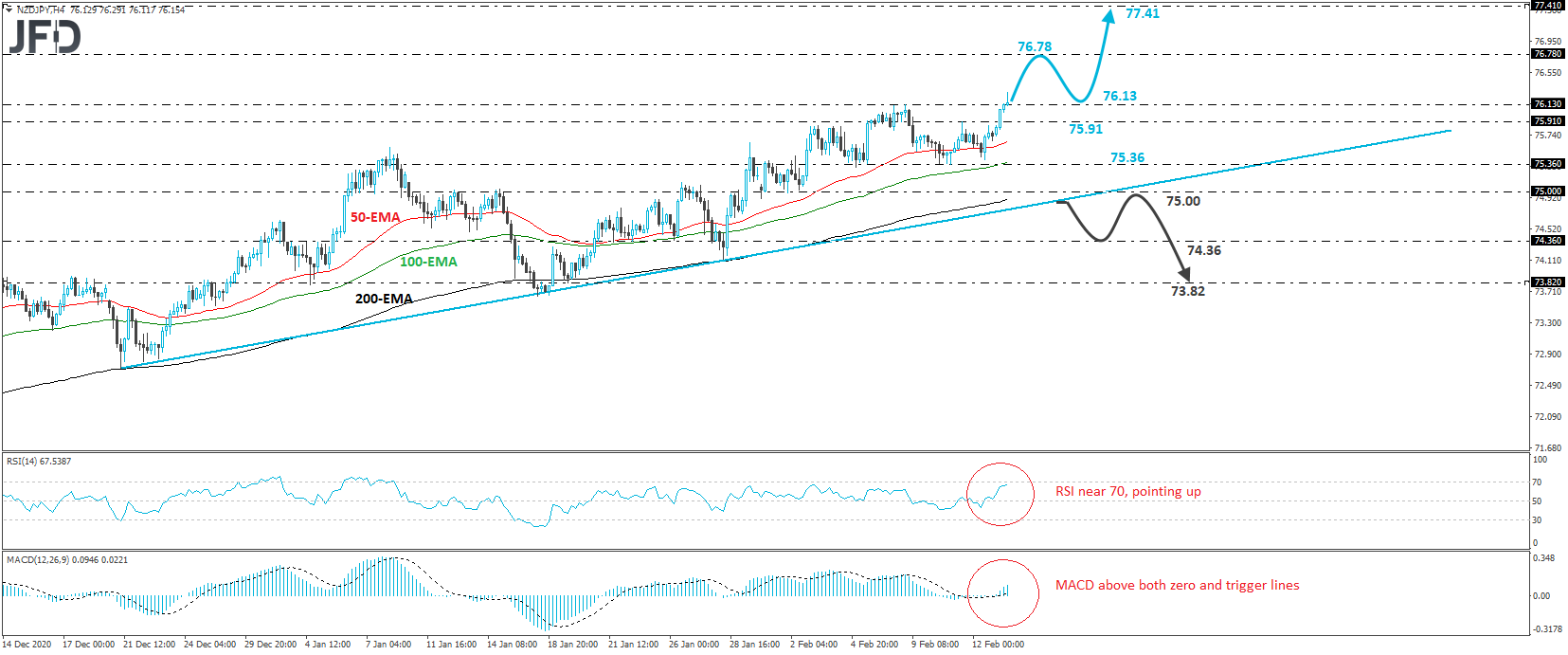

NZD/JPY traded higher during the European morning Monday, breaking above the peak of Feb. 9, at 76.13, thereby confirming a higher high. However, the rise did not last for long, as the pair retreated to trade back near that barrier.

Overall, the rate continues to trade above the upside support line drawn from the low of Dec. 21, and thus, we would consider the near-term outlook to be positive.

We believe that the bulls will regain control at some point soon and drive the rate further above the 76.13 barrier. They may get tempted to challenge the high of Mar. 21, 2019, at 76.78, the break of which may carry more bullish implications, perhaps paving the way towards the peak of Dec. 18, 2018, at 77.41.

Shifting attention to our short-term oscillators, we see that the RSI runs slightly below its 70 line and still points up, while the MACD lies above both its zero and trigger lines, pointing up as well. Both indicators detect strong upside speed and support the notion for further advances in this exchange rate.

In order to abandon the bullish case and start examining whether the bears have taken the upper hand, we would like to see a decisive dip below the low of Feb. 2, at around 75.00.

This may also take the rate below the aforementioned upside line, a move that may set the stage towards the 74.36 area, marked as a support by the lows of Jan. 22 and 26. If that hurdle doesn’t hold either, then we may see the slide extending towards the 73.82 territory, near the low of Jan. 19.