Key Highlights

· New Zealand dollar corrected higher against the Japanese yen after trading as low as 79.90.

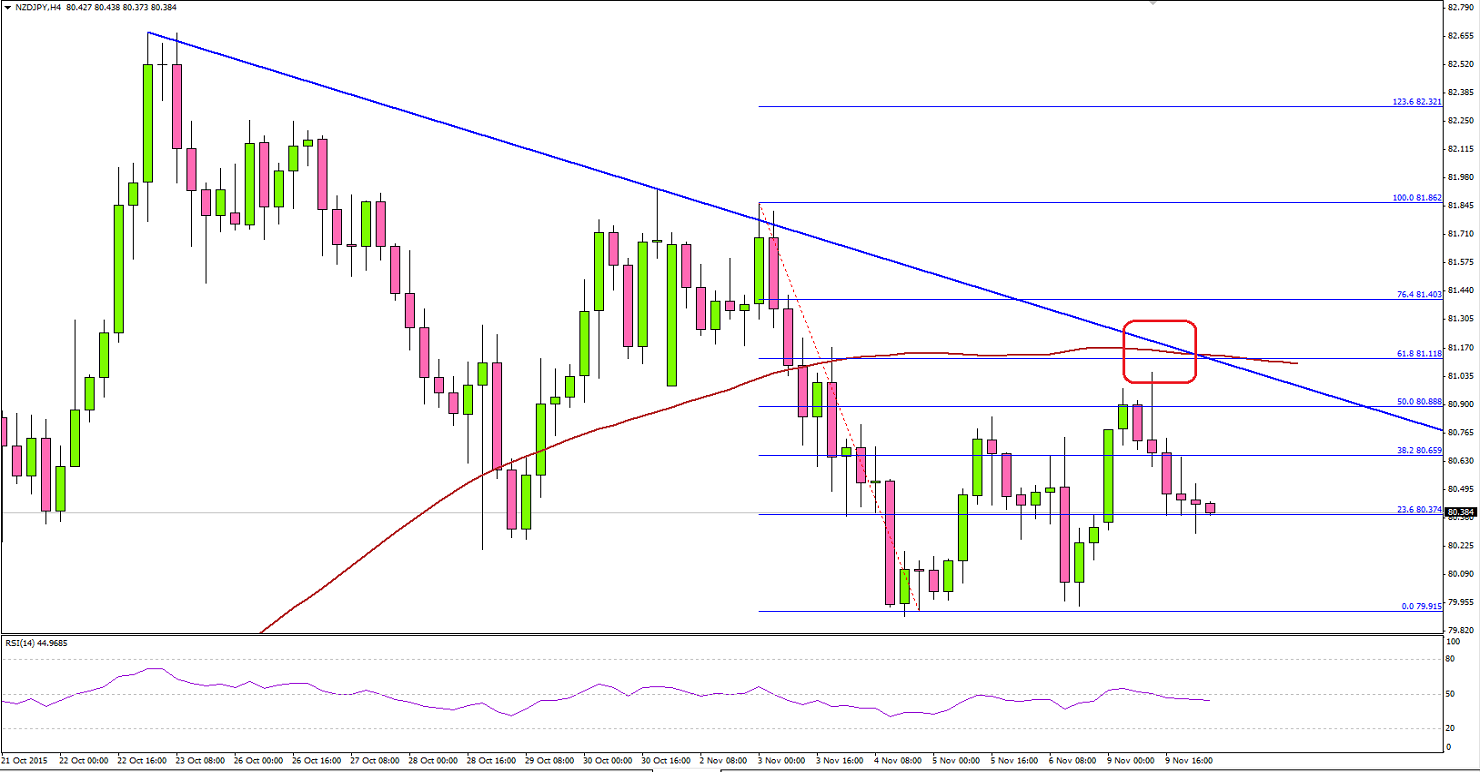

· The NZD/JPY pair is currently facing a tough resistance near the 81.00 area as the 100 moving average (4-hours) is sitting around it along with a bearish trend line.

· New Zealand Electronic Card Retail Sales as reported by Statistics New Zealand posted no change in October 2015, compared with the preceding month.

· Chinese Consumer Price Index is released by the National Bureau of Statistics of China and posted a decrease of 0.3%, more than the market forecast for October 2015.

NZD/JPY Technical Analysis

The New Zealand dollar continued to decline against most major currencies including the Japanese yen. The most important point is the fact that every correction was sold and it found major resistances. Currently, there is a bearish trend line formed on the 4-hours chart of the NZD/JPY pair.

Moreover, there are a couple of things aligned around the trend line like the 100 moving average and the 61.8% Fib retracement level of the last drop from the 81.86 high to 79.91 low. One key bearish point to note is the fact that the RSI (4H) moved below the 50 level, suggesting the fact that sellers are in control.

On the downside, the last swing low of 79.90-80.00 holds the key for the NZD/JPY pair. A break below it may encourage sellers more and ignite a solid downside ride. Let us see how the pair trades moving ahead, as there are barriers on the both side for NZD/JPY traders.