NZD/CHF reached its highest levels in over 3 months in early trading on Tuesday. The pair was lifted by the positive retail sales report released late on Monday and a rise in ‘risk-on’ sentiment stemming from new momentum in US/China trade discussions.

The New Zealand dollar rallied after Stats NZ reported that retail sales increased by 1.6% in the third quarter, beating analyst expectations of 0.5%. The more important core retail sales measure which excludes car purchases, increased by 1.8%, exceeding market expectations of 0.6%.

Retail sales volumes were boosted by a strong demand for electronics such as appliances, mobile phones and computers. Retail statistics manager Sue Chapman of Stats NZ stated:

“Higher electronic sales volumes in the quarter coincided with some retailers promoting sales of big screen televisions before the Rugby World Cup in Japan, which started near the end of September.”

Meanwhile, the safe-haven Swiss franc was pressured following fresh signals that the United States and China were making progress towards ending their trade war. On Tuesday, China’s commerce ministry reported that Vice Premier Liu He, Trade representative Robert Lighthizer and Treasury Secretary Steven Mnuchin discussed issues relating to a ‘phase one’ trade agreement over the phone. The positive news came on the heels of Sunday’s announcement from China’s State Council that it would crack down on IP theft.

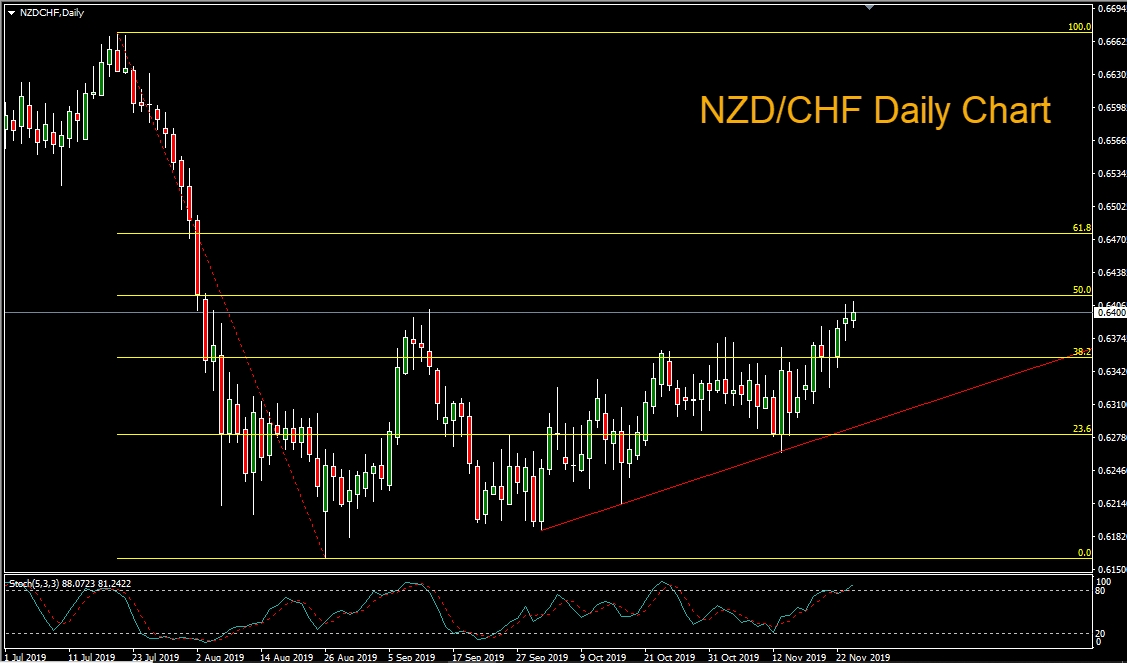

Looking at the NZD/CHF daily chart we can see that price has rallied to the highest levels since August 5th. The pair is currently trading near the 50% retracement level at 0.6415, which represents potential resistance overhead.