Investing.com’s stocks of the week

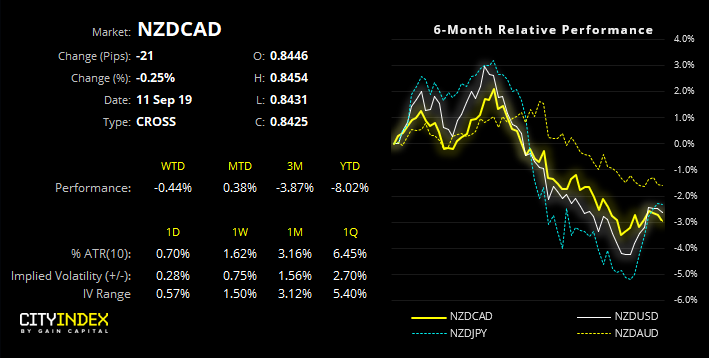

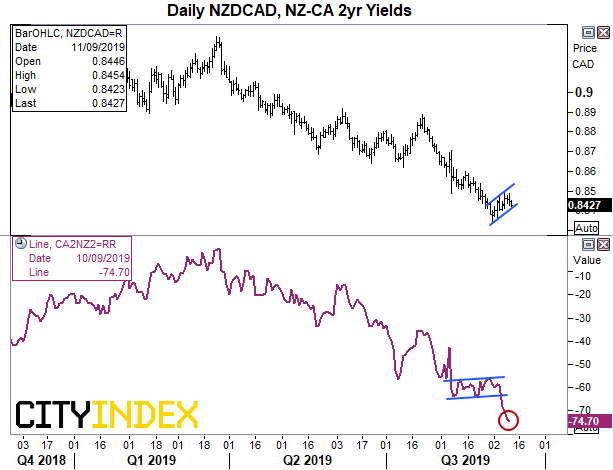

NZD/CAD has shed nearly 10% over the past 6-months, and its bearish trend structure suggests bears are preparing to push it lower still. Moreover, the yield differentials for NZD-CAD 2-year has broken to new lows which suggests further downside pressure for the commodity FX cross. Of course, this is helped by the fact that BOC’s base rate is 1.75% versus RBNZ’s 1%, providing greater demand for Canadian dollar (relative to NZD) from yield hungry investors. And Canada’s economic data continues to outperform expectations at a greater pace, relative to New Zealand’s.

A wider bearish channel remains intact on the daily chart and, whilst his could allow for a deeper correction in due course, we suspect it’s preparing for another leg lower. Prices have retraced from their lows yet stalled around a cluster of resistance below 0.8500, which comprises of the February low, a 38.2% Fibonacci level and of course the round number (and our original long-term bearish target) 0.8500.

Given the strength of the decline, it appears more likely the retracement is close to completion.