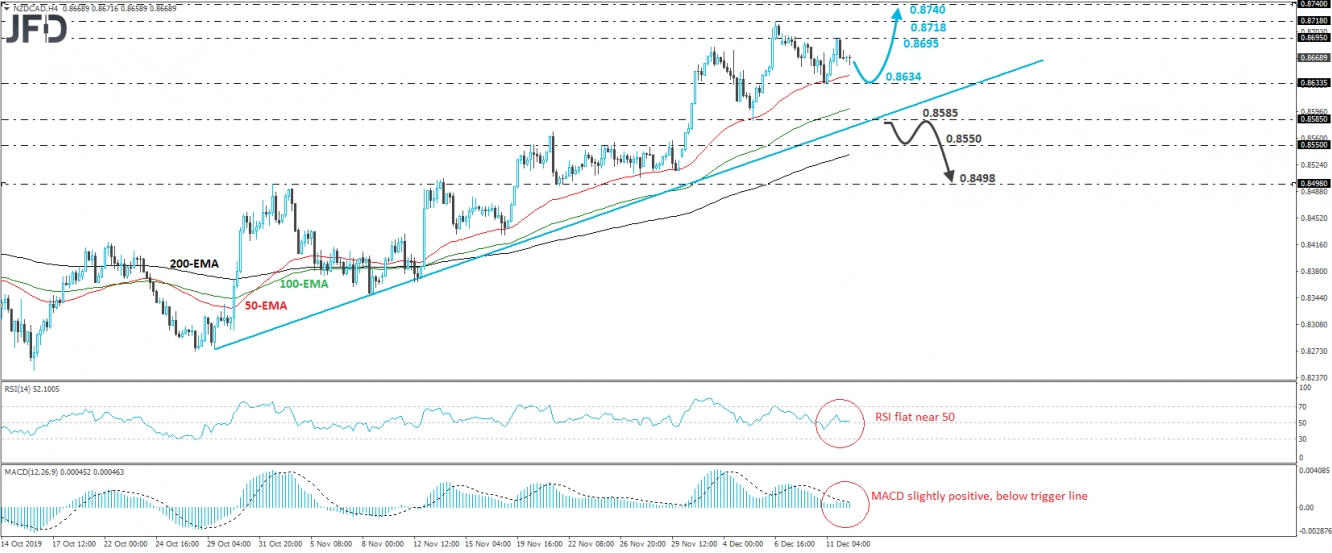

NZD/CAD traded lower yesterday, after it hit resistance near the 0.8695 level. However, even if the retreat continues somewhat more, as long as the rate continued to trade above the upside support line drawn from the low of Oct. 29, we will hold a somewhat bullish approach.

As we already noted, the rate may continue retreating for a while more, perhaps to test the 0.8634 barrier, or even the aforementioned upside line. The bulls may take charge from there and push for another test near the 0.8695 barrier, the break of which could aim for the high of Dec. 6, at around 0.8718. Another break, above 0.8718, could allow the advance to extend towards the 0.8740 hurdle, which is marked as a resistance by the high of July 30.

Taking a look at our short-term oscillators, we see that the RSI lies near its 50 line and points sideways, while the MACD, although positive, lies below its trigger line and looks ready to turn negative soon. This supports the notion that the current pullback may continue for a while more before the bulls decide to take charge again.

On the downside, a break below 0.8585 is the move that would make us abandon the bullish case. This would also drive the rate below the upside support line taken from the low of Oct. 29, and may initially aim for the 0.8550 territory, which provided resistance between Nov. 25 and 29. If that level is broken as well, then we could experience extensions towards the 0.8498 zone, marked by the lows of Nov. 21 and 22.