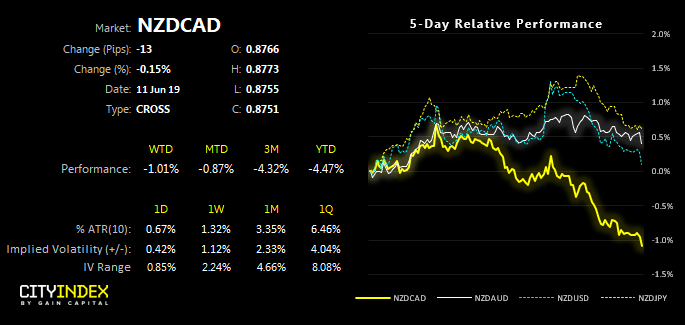

Near the end of April we flagged that NZD/CAD could be on the verge of a major breakdown. Recent price action remains constructive of that view.

Unsurprisingly, commodity currencies have felt the heat throughout the trade war. However, other factors have been at play to weigh on AUD, CAD and NZD with varying degrees such as global growth concerns, weak domestic data and, therefore, expectations for central bank easing. However, once again recent developments have seen the pecking order change among the three, where CAD is now the strongest of the three and NZD is the weakest.

- Aussie selling was given a reprieve on reports that Australia had narrowly avoided Trump’s tariffs on metals, giving AUD a tailwind just before RBA cut rates to a record low.

- The U.S.-Mexico deal announced over the weekend has provided support for CAD, as traders see a deal with a U.S. neighbour as ‘neighbourhood friendly’. Of course, this can change in a flash but for now, CAD remains the strongest of the three commodity currencies.

- In the current environment, NZD/CAD appears to be the better short over AUD/CAD

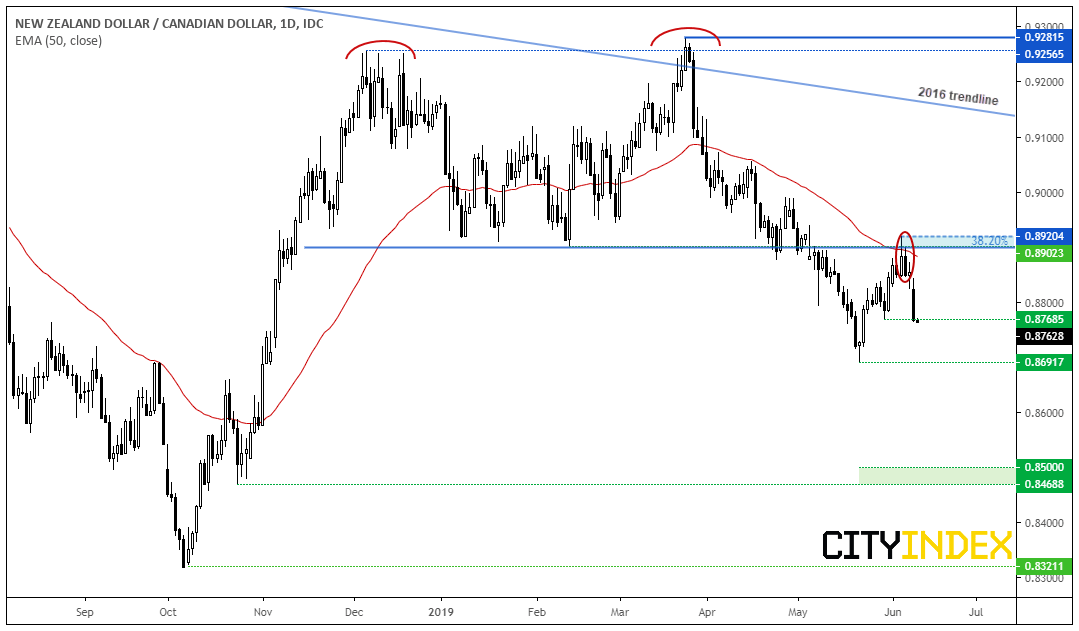

Following its failed upside break of the 2016 trendline, momentum has remained predominantly bearish and its breakdown has confirmed a multi-month double top pattern. If successful, the pattern projects an approximate target around 0.8500.

- Prices have retraced towards (and respected) the original breakout level and produced a 2-bar reversal at the 38.2% Fibonacci level.

- Bearish momentum has now realigned with the dominant trend, following its most bearish session in 11-week yesterday.

- From here, we’d expect bears to fade into rallies and target the 0.8692 lows ahead of another break lower.