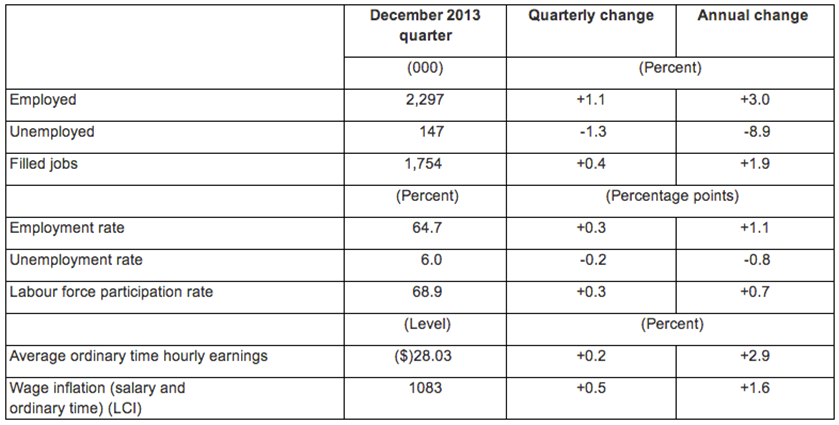

The New Zealand economy got another boost, as recent employment data was well above expectations.

Certainly,the data is extremely promising. What is more impressive though, when we look at the numbers, is how good they actually are. The labour participation rate increased for the month of December, and even with a higher participation rate, New Zealand still had a decrease in unemployment. This bodes very well for the NZ economy, though a lot of people were certainly picking a strong result from the NZD as can be seen in today’s daily charts.

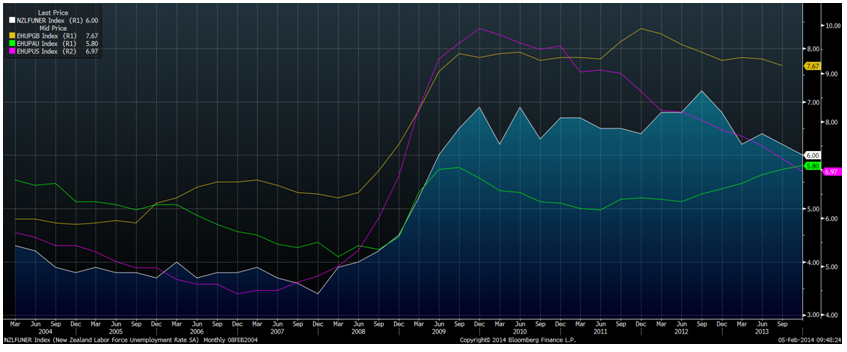

Either way the unemployment data augurs well when compared to various other nations globally, like Australia, UK and the U.S. What’s important to note though is that New Zealand’s GDP is also expected to be of significant growth all through 2014. Many economists are forecasting around 3.4% for the year of 2014, on the back of a strong economy and the Christchurch earthquake rebuild, which has helped to boost the economy significantly and will continue to do so over the next few years.

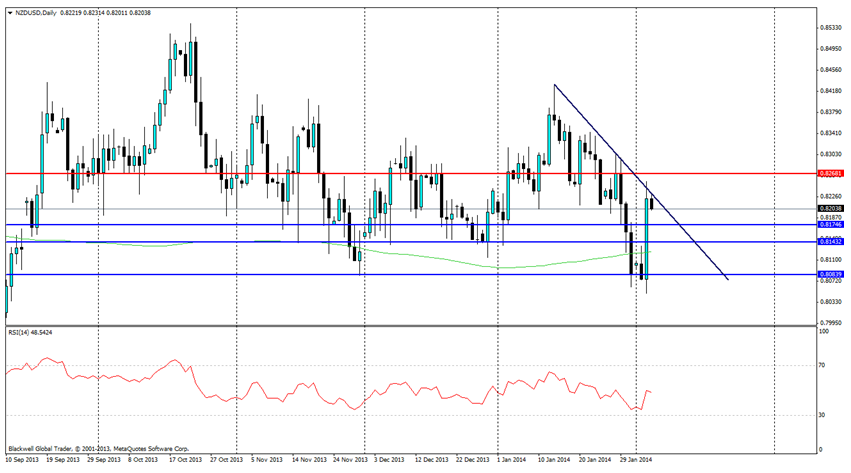

The NZD/USD charts show an interesting situation though when you take a closer look.

NZD/USD Daily" title="NZD/USD Daily" height="242" width="474">

NZD/USD Daily" title="NZD/USD Daily" height="242" width="474">

Currently, there is a bearish trend line in play, and to be honest I expect to see this remain in play all the way down to the 80 cent mark at least. Current support and resistance lines were blown out of the water by the aggressive nature of the candle overnight and continuing on from this morning’s market movement.

Due to the aggressive nature of the candle, it certainly looks overextended and in this case, a pullback is very much in the works, if not, further downward pressure in the following days. Support levels can be found at 0.8174, 08143 and 0.8083, while resistance should be expected to be on the trend line.

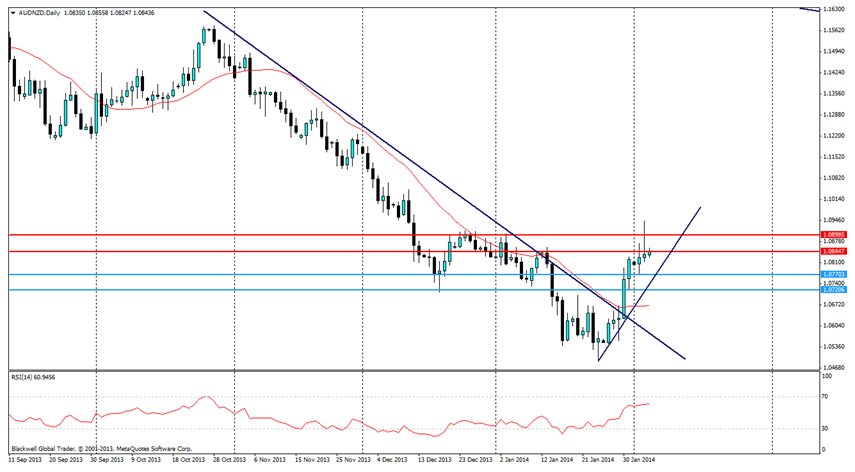

My current outlook on the NZDUSD is still bearish given the strength of the trend line and how it has held up against the recent positive economic data. A movement lower is to be expected, the AUDNZD charts also suggest that despite the data, the Kiwi is starting to lose a little razzle dazzle.

AUD/NZD Daily" title="AUD/NZD Daily" height="242" width="474">

AUD/NZD Daily" title="AUD/NZD Daily" height="242" width="474">

The AUD/NZD certainly pulled back on yesterday’s unemployment data, however the momentum is still strong across the board for the AUD as buying pressure, as can be seen on the RSI, is still very strong. I wouldn’t look for any bearish signals until there is a breakthrough on the current bullish trend line. Additionally, strong resistance will be found at 1.0898 as this looks likely to be a strong ceiling for the currency pair, if not, it provides pull backs to the current trend line.

Employment data overnight has been positive for New Zealand but despite that, markets are now looking to pull back on the Kiwi dollar and we should certainly expect to see movements in the coming days.