The New Zealand dollar has been looking a little rough as of late after pushing to remarkable highs after the recent interest rate rises which have seen the RBNZ push rates by 25 basis points during the last two meetings – to the current 3.00%. With a big push past the 87 cent level and up towards the 88 cent mark, we quickly saw that markets were not looking for anything much higher, and since then we have seen a slow degradation of the high flying Kiwi.

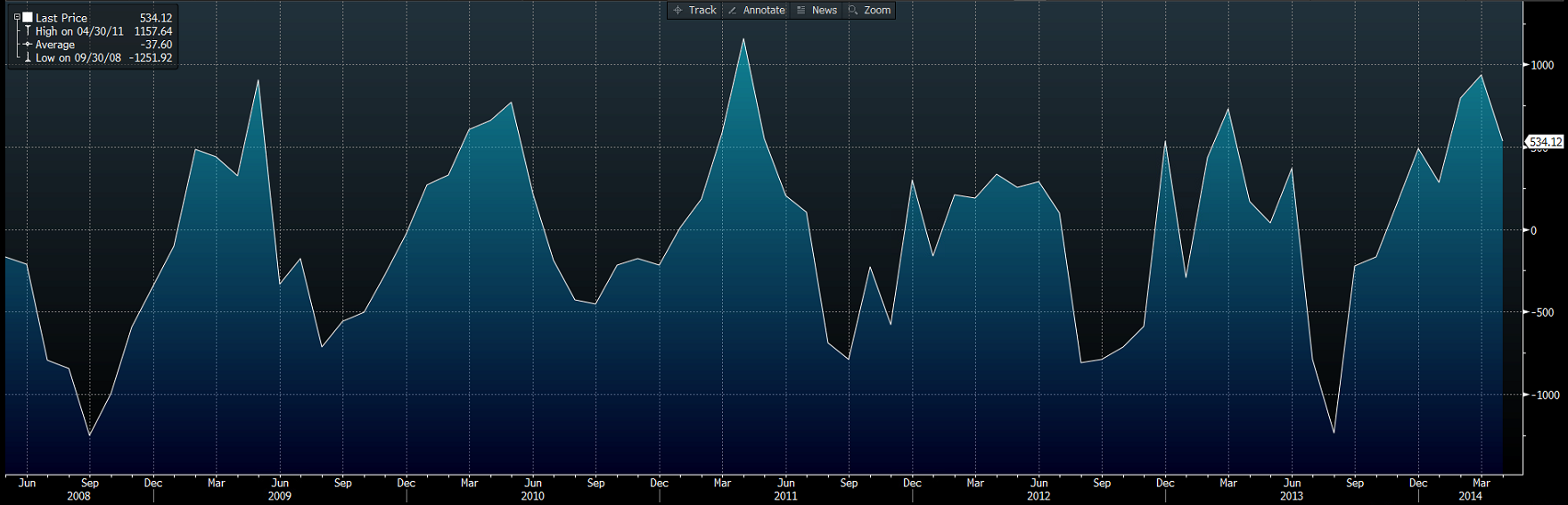

Today on the markets, it came as no shock when NZ trade balance was down and so were imports and exports. Coming into the winter months, New Zealanders tend to spend less and start to hunker down a bit.

The pullback was certainly expected by the market at 651M but exceeded that forecast by coming in at 534M. While markets normally punish such weak results, the reaction from the NZD/USD was more muted as it was expected to be worse for wear.

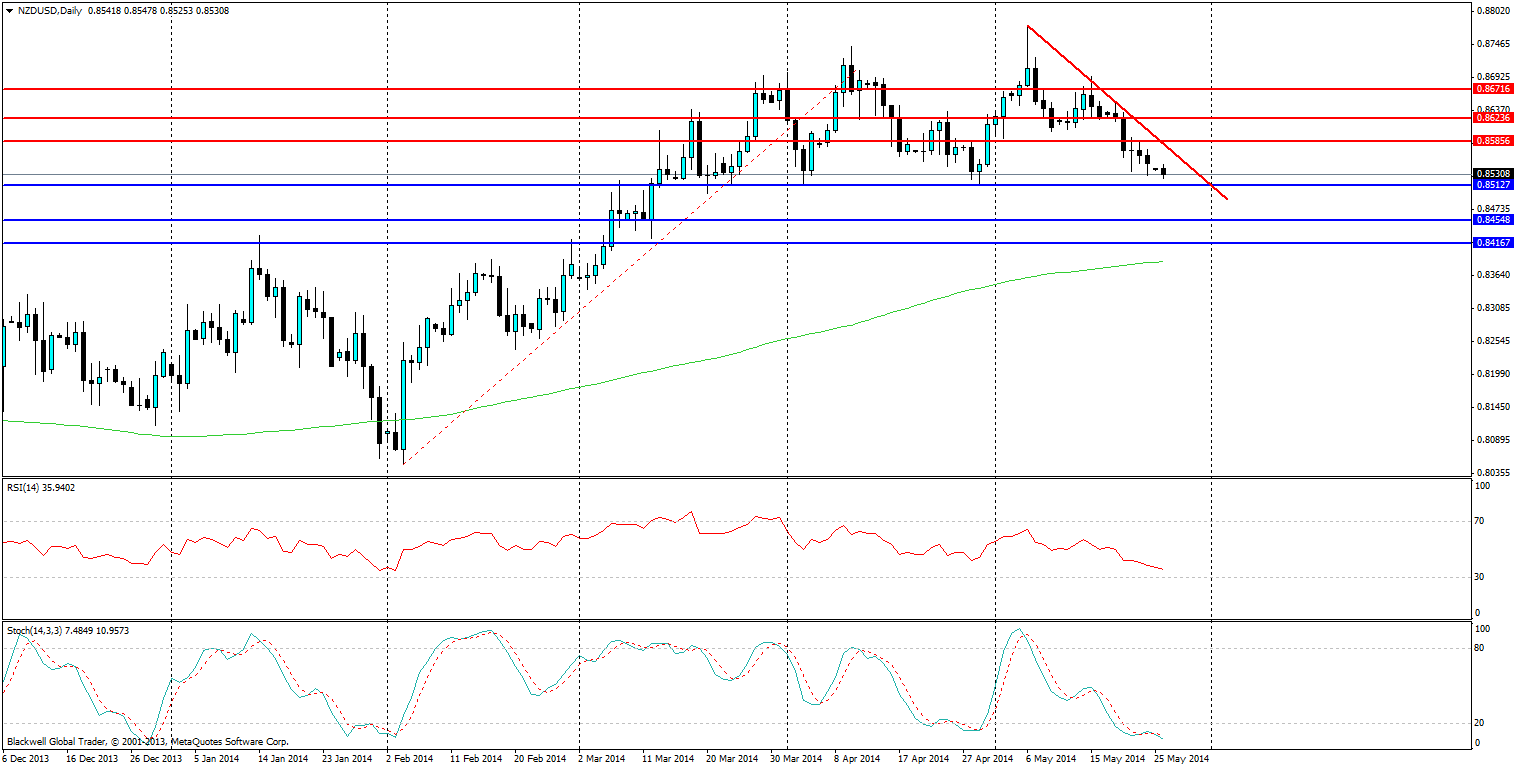

While the NZD/USD is weak, can it go lower in the short term?There are key levels to watch for; the first being the major support line at 0.8512. Markets will be seeking to target this key point in the short term and we may see some pullbacks from this point.

However, the key trend line is likely to hold in the medium term and we will be looking to see if this point breaks. If so, we would change our stance to strongly bearish.

Some key points as to why this may be possible in the future despite the current strong economy is the commodity sector, with major banks now forecasting a downgrade on the milk payout scheme for the economy, as current dairy prices have been falling as of late in the global auction system.

Either way, in the short term, we expect to see the support line tested before a slight pullback. On the long term outlook, we will be watching to see if the trend line holds from any pullback and if the market will continue in a bearish manner.