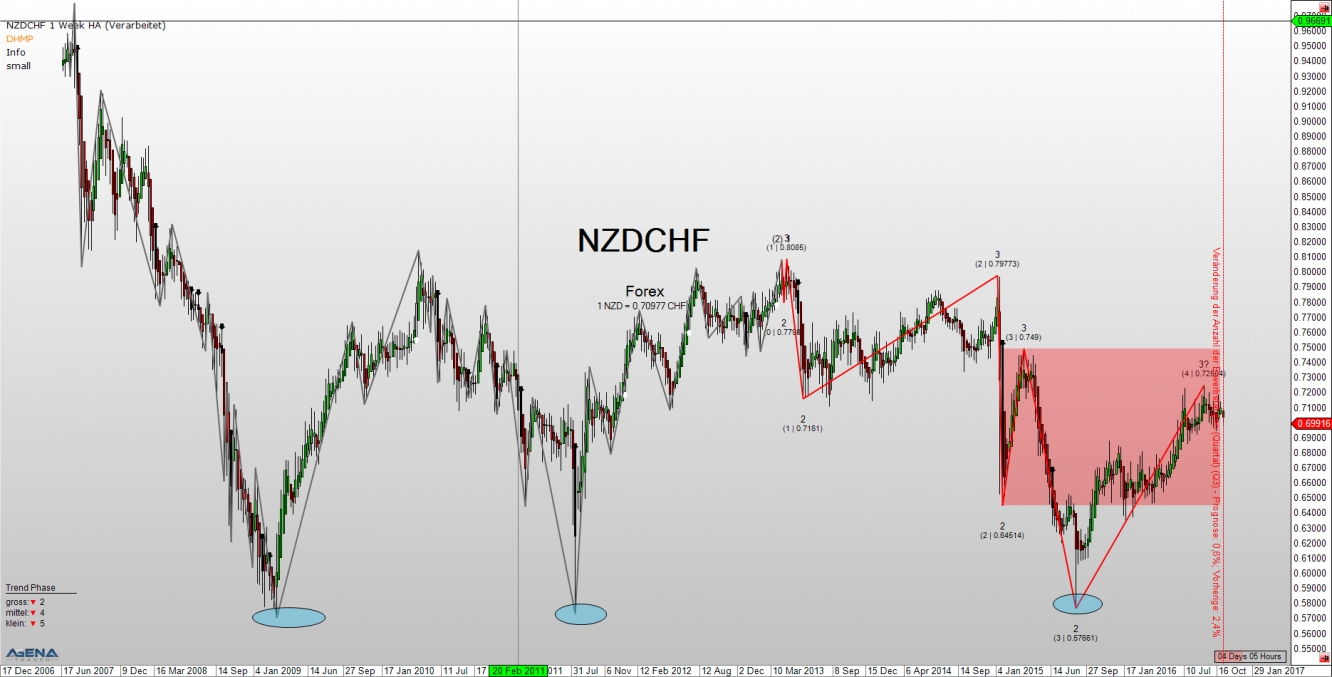

Weekly chart:

Since March 2009, NZD/CHF has managed more than once to find a bottom and enough buyers at around 0.58 CHF to drive the value back up each time. However, the upwards efforts in the area of 0.80 CHF have come to an end once more.

From the perspective of this big picture, we find an intact downtrend that is currently deep into the correction zone. But it is already the fourth correction, meaning that we must concede that this trend has a certain maturity. However, as long as the closing price does not exit the red box upwards, this downtrend will remain intact.

Daily chart:

The correction that we see in the weekly chart is showing itself in the daily chart in the form of an uptrend. This reached its last high at 0.72284 CHF; the accompanying correction zone runs between 0.68779 CHF and 0.63468 CHF on the lower side. At the moment, the price seems to be shifting into reverse gear and taking the path back into this green box. As soon as this is reached and reversal signals form there, a nice entry opportunity could become available.

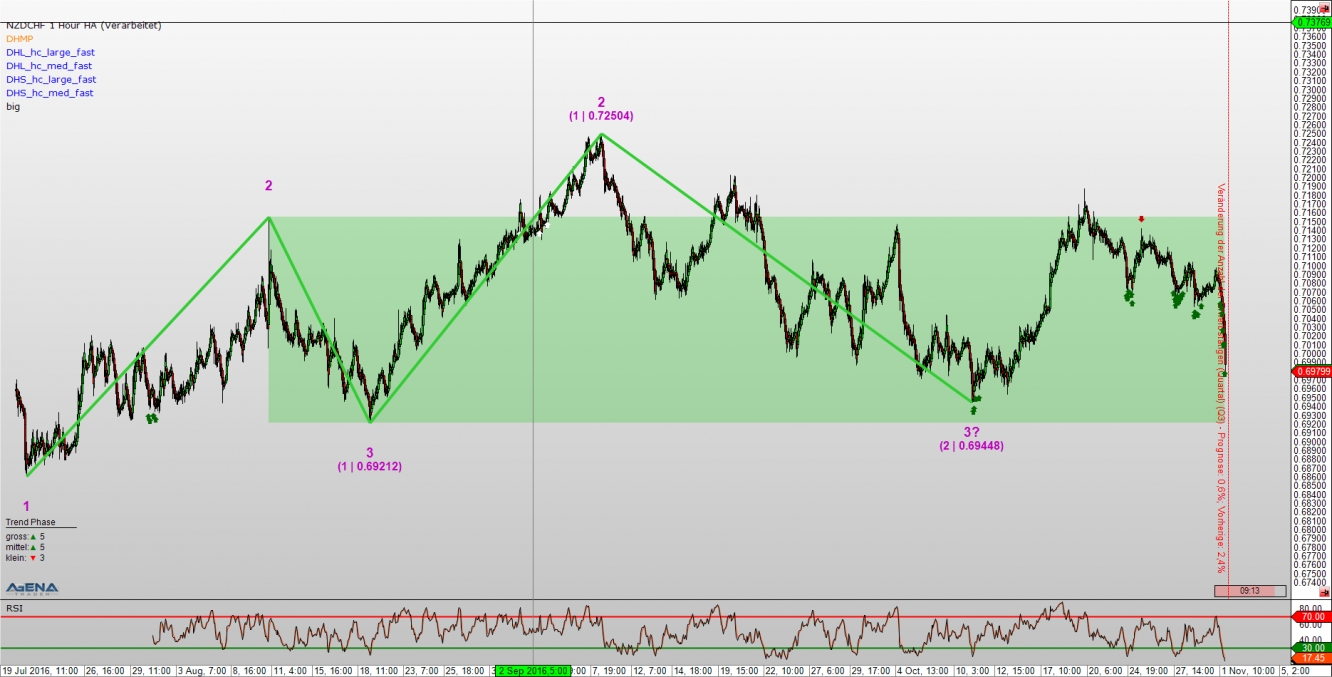

Hourly chart:

The hourly chart supports the scenario from the daily chart. We have a valid, young uptrend present with a correction zone between 0.71567 CHF and 0.69212 CGF on the lower side. At the time of writing, the price is nearing the lower area of this zone, but with this, it is also running into the oversold extreme area. The price should slowly balance out here, but should not exit the green box in a downwards motion in doing so, however. Only then could a lucrative entry opportunity also offer itself here.

IMPORTANT NOTE:

Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk.