New Zealand currency continues to feel the deficiency of investor demand in view of the position of RBNZ on the monetary policy. The Reserve Bank of New Zealand adheres to a mild credit policy, keeping the volumes of economy stimulation measures and interest rate. In these conditions EUR and GBP appear to be preferable currencies, and assets are often transferred from NZD to yen.

Despite the radical fall of the US currency the downward dynamics of the pair remains. USD continues to grow as a result of low values in the main sectors of the economy and slowdown in the winding up of the stimulation program and the increase of interest rates. The US currency is under additional pressure from ambiguous decisions by the US President Donald Trump.

In the end of this and the beginning of the next trading weeks the economic calendar will be empty. The main releases are due in the second half of the upcoming trading week.

Today and in the beginning of the next week the pair is expected to fix in the lateral stage of consolidation in view of the absence of important macroeconomic releases. In the future the US currency is expected to consolidate somehow in view of locking in positions aimed against USD. Moreover, in the end of the current trading month the volatility of USD may increase because FOMC representatives are to make comments on future increase of interest rates, winding up of the stimulation program, and the prospects for the inflation pressure and labor market.

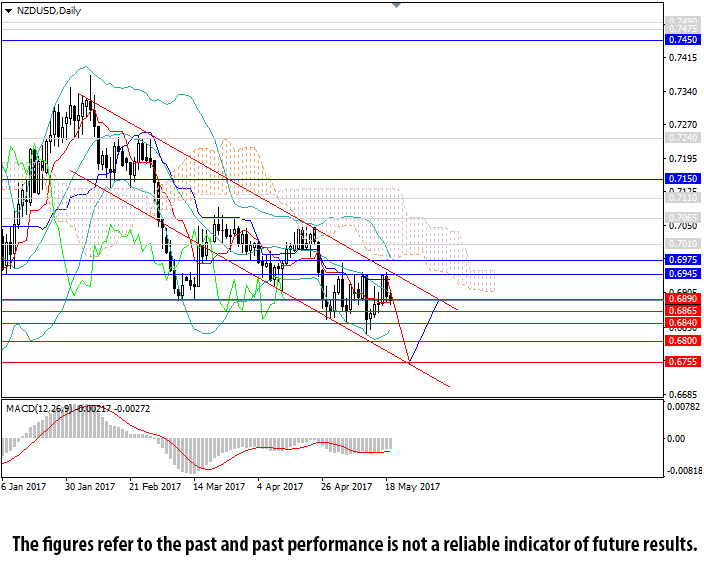

Technical indicators confirm the outlook: MACD keeps a good volume, and Bollinger Bands are still directed downwards. In view of this the pair is likely to remain in the downward trend, and the next target will be the level of 0.6755. An alternative scenario will be the fixation of the pair in the lateral consolidation stage.

Support levels: 0.6890, 0.6865, 0.6840, 0.6800, 0.6755, 0.6710, 0.6650, 0.6600.

Resistance levels: 0.6945, 0.6975, 0.7010, 0.7065, 0.7110, 0.7150, 0.7240.