ASIA ROUNDUP:

- AUD Business Confidence came in above expectations, at 8 vs 7 forecast to diverge from consumer confidence in face of a 'tough budget'. The AUD/USD rallied to test 0.940 resistance but remains capped within this range.

- JPY Current Account Balance its highest since Aug '13 to see USD/JPY trade to a 4-day low.

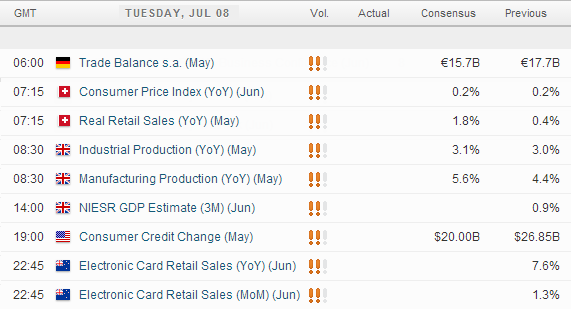

UP NEXT:

- GBP: Halifax HPI is expected to come in at a slightly lower rate, but keep in mind that previous release was a decade-high at +3.9%. So a slightly negative reading just denotes a slight slowdown from previous month, not a reversal.

- GBP: Manufacturing Production m/m has been positive for 5-month now but at a moderatly slowed pace. However y/y is expected to come in much higher which could be GBP bullish if at or above +5.6%

- GBP: NIESR GDP attempts to predict the government the GDP he quarterly number so any shortcomings here could be GBP bearish

TECHNICAL ANALYSIS:

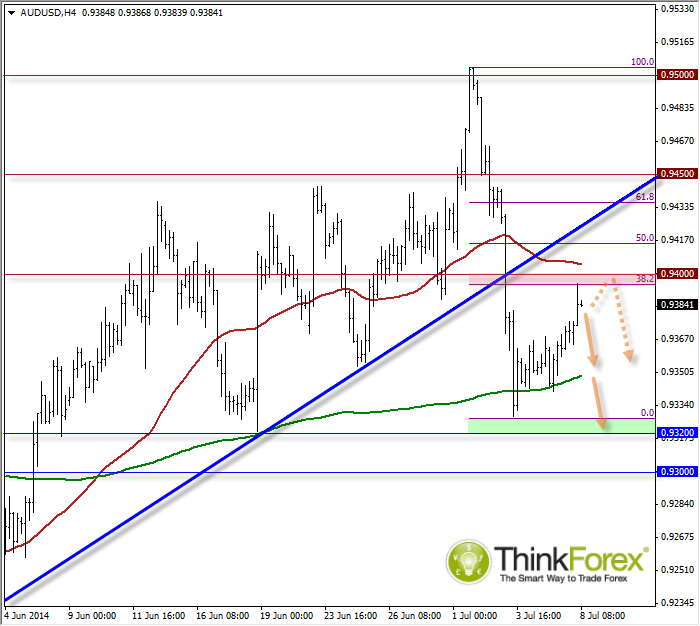

AUD/USD: Potential Dead-Cat Bounce below 0.940

The rationale for this setup is fairly straight forward - price has rejected the 0.950 with a surprise sell-off, to be followed by sheepish (shell-shocked) price action awaiting the next catalyst. Today's NAD Business Confidence has provided a little 'hurrah' to the bulls, but stalled below 0.940 resistances, which I suspect bears will be eyeing up as a better price to get short again.

0.940 has been tested several times over the past few months and is also the 38.2% retracement (And Daily Pivot R2, not pictured).

Notice how the recent candle has closed half way up the range so there is a chance we may see another pop higher, which may provide a better short signal (such as a Hanging man which fails to close above 0.940).

As for targets the 200 period eMA could be an initial target with 0.9320 as a 2nd target.

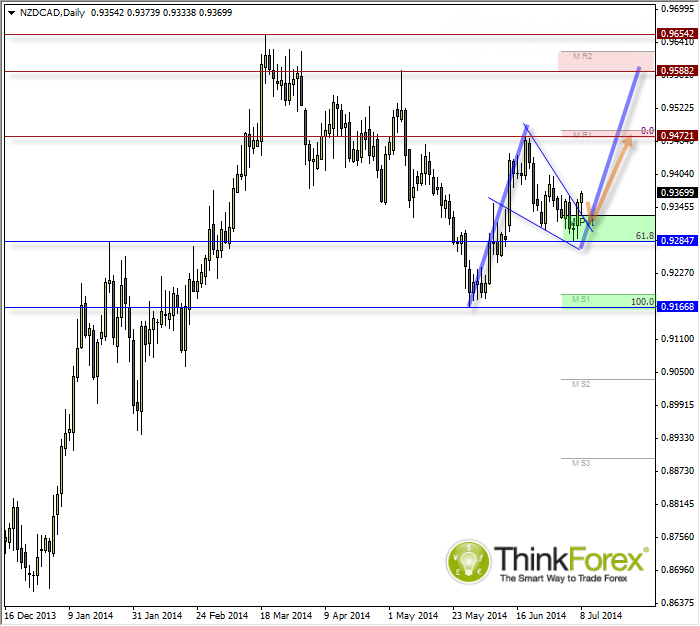

NZD/CAD: Potential bullish breakout

Whether you consider this a bullish flag or wedge is up for you to decide, but the main focal point is we have already respected 0.928 support (also 61.8% fibs) with a Morning Star Reversal candle pattern on D1. Today’s candle has broken above the highs of the 3-day pattern to suggest a bullish breakout is imminent.

You could hope for a further retracement towards the green buy zone and place a buy-limit to increase reward/risk ratio or seek bullish setups within intraday timeframes to eventually target 0.9470 highs.