Yesterday the pair significantly fell amid strengthening in the US dollar, which was supported by a decline in the pound and euro due to weak data that came out in the eurozone and UK. In addition, the US dollar remains supported by expectations of monetary policy tightening in the US in the nearest future.

At the same time, the New Zealand dollar was pressured by poor macroeconomic statistics from the country. The Current Account in the second quarter of the year shrank by 0.945 billion NZD while economists predicted a fall of only 0.411 billion NZD. The Current Account – GDP ratio for the same period declined by 2.9% that was 0.2% worse than expectations of experts.

Tomorrow attention needs to be paid to data on the GDP for the second quarter of the year in New Zealand that could have a substantial impact on further dynamics in the pair.

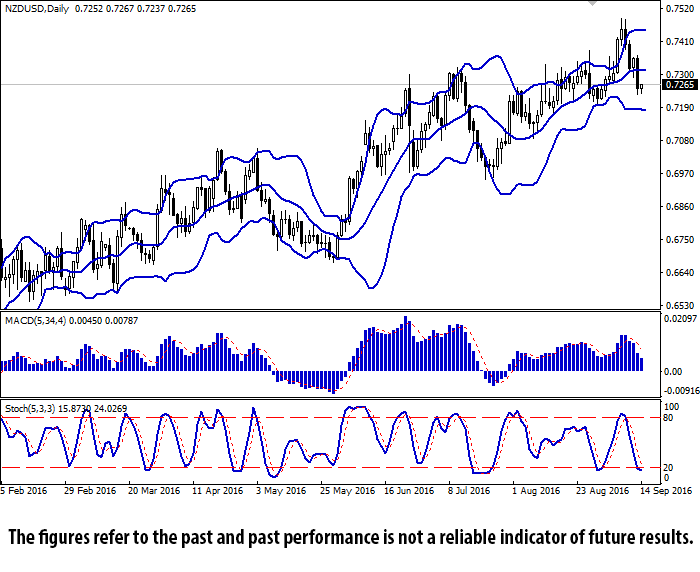

Bollinger Bands on the daily chart is moving horizontally while the price range remains unchanged. MACD is falling and giving a quite strong sell signal. Stochastic is trying to turn up having reached the border of the oversold zone.

The indicators recommend waiting for clearer trading signals.

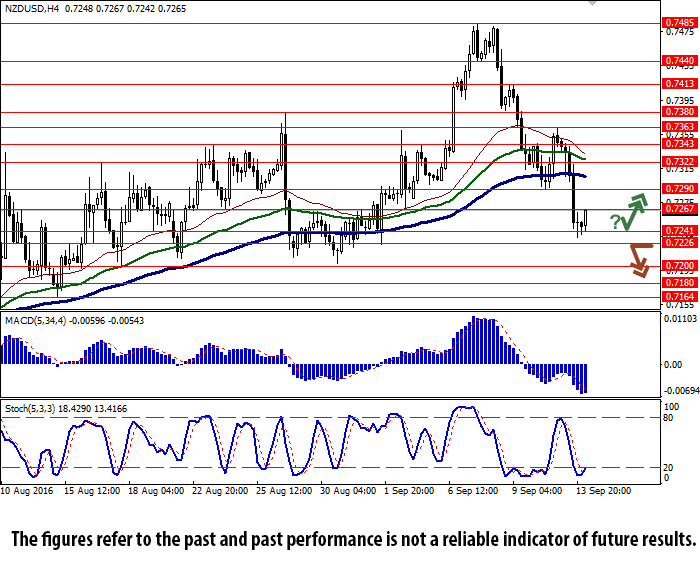

Support levels: 0.7241 (local low), 0.7226, 0.7200 (17 August low), 0.7180, 0.7164 (15 August low).

Resistance levels: 0.7267 (local high), 0.7290, 0.7322, 0.7343, 0.7363 (local high), 0.7380, 0.7413 (9 September high), 0.7440, 0.7485 (7 September high).

DISCLAIMER: This website/communication is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. It has been prepared by Mayzus Investment Company Limited without taking into account any particular person's objectives, financial situation or needs. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision. Past performance is not indicative of future performance. The future value of your investment may rise and fall with the changes in the market.