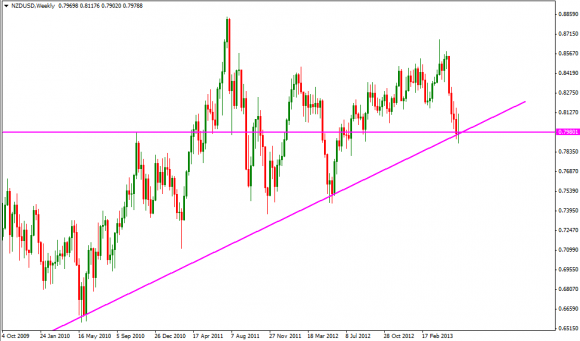

Weekly Chart

After seemingly bouncing higher off the multi-year trendline, NZD/USD has been trading lower, with the latest decline happening during the final few hours of US trading session which was further extended during the Asian trading session. All in all, the decline brought price back to the multi-year trendline once again, with price looking especially precarious due to the fact that price was able to shrug off the initial rally brought about by USD weakness during early US session.

There is something to be said regarding current fx movements. EUR and GBP are looking stronger, while AUD and NZD are currently looking more weak. This is a very interesting split as all 4 currencies are regarded as “risk currency”, which is supposed to track global equities ups and downs. AUD/USD and NZD/USD has been doing this rather well, but the European currencies (CHF inclusive) appears to be immune to the dips seen in risk appetite recently. The difference in fortune between currencies of the 2 continents can be easily explained – Central Banks of the European countries are less dovish as compared to the ones found in Oceania. Furthermore, the 2 Oceanic countries Central Bank rates are currently 2 of the highest as long as major currencies go, which means there are ample room for rate cuts (whether NZ can afford to cut rates is another separate issue).

With regards to the apparent “immunity” of the European currencies, we can point at USD which is the smoking gun. Commodities are currently trading higher than before despite current global pessimism (see Nikkei 225), which suggest that the move is purely a valuation issue due to USD’s weakness. USD has been driven weaker than before, which allowed the normally positively “risk” correlated EUR and GBP to maintain afloat. Certainly for GBP there are good fundamental reasons why the currency should be stronger, but we still cannot ignore the impact of USD nonetheless.

If the above assertion is correct, then that would be a even stronger bearish verdict on AUD and NZD, as it simply means that prices are so bearish such that the weakness in USD is not able to stop current decline. That being said however, with NFP coming later, coupled with the fact that current USD correlation with US Stocks is peculiar to say the least, traders may wish to avoid the volatile Greenback and choose to pair GBP/NZD or GBP/AUD to capture the current fundamental difference between European Central Banks and the Oceania Central Banks’ outlook.

From a technical perspective, if price manages to close below the intersection point this week, we could potentially see quick bearish acceleration towards 0.75 with 0.78 interim support along the way. If price manage to hold above current level, keep a keen lookout for directional movement either way.

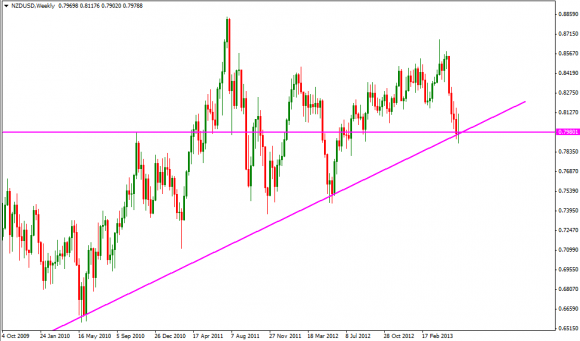

After seemingly bouncing higher off the multi-year trendline, NZD/USD has been trading lower, with the latest decline happening during the final few hours of US trading session which was further extended during the Asian trading session. All in all, the decline brought price back to the multi-year trendline once again, with price looking especially precarious due to the fact that price was able to shrug off the initial rally brought about by USD weakness during early US session.

There is something to be said regarding current fx movements. EUR and GBP are looking stronger, while AUD and NZD are currently looking more weak. This is a very interesting split as all 4 currencies are regarded as “risk currency”, which is supposed to track global equities ups and downs. AUD/USD and NZD/USD has been doing this rather well, but the European currencies (CHF inclusive) appears to be immune to the dips seen in risk appetite recently. The difference in fortune between currencies of the 2 continents can be easily explained – Central Banks of the European countries are less dovish as compared to the ones found in Oceania. Furthermore, the 2 Oceanic countries Central Bank rates are currently 2 of the highest as long as major currencies go, which means there are ample room for rate cuts (whether NZ can afford to cut rates is another separate issue).

With regards to the apparent “immunity” of the European currencies, we can point at USD which is the smoking gun. Commodities are currently trading higher than before despite current global pessimism (see Nikkei 225), which suggest that the move is purely a valuation issue due to USD’s weakness. USD has been driven weaker than before, which allowed the normally positively “risk” correlated EUR and GBP to maintain afloat. Certainly for GBP there are good fundamental reasons why the currency should be stronger, but we still cannot ignore the impact of USD nonetheless.

If the above assertion is correct, then that would be a even stronger bearish verdict on AUD and NZD, as it simply means that prices are so bearish such that the weakness in USD is not able to stop current decline. That being said however, with NFP coming later, coupled with the fact that current USD correlation with US Stocks is peculiar to say the least, traders may wish to avoid the volatile Greenback and choose to pair GBP/NZD or GBP/AUD to capture the current fundamental difference between European Central Banks and the Oceania Central Banks’ outlook.

From a technical perspective, if price manages to close below the intersection point this week, we could potentially see quick bearish acceleration towards 0.75 with 0.78 interim support along the way. If price manage to hold above current level, keep a keen lookout for directional movement either way.