The pair is demonstrating growth for the second trading session amid a weakening in the US dollar against all other major currencies. In the end of this week, volatility on the market is expected to be high due to important macroeconomic publications in the US.

Today, attention needs to be paid to data on the ISM and Markit Services PMIs. The forecasted fall in the ISM index could increase pressure on the American currency. In addition, data on the US labour market is due tomorrow. According to preliminary forecasts, the Unemployment Rate is expected to increase from 4.6% to 4.7% that could also have a negative impact of the US dollar.

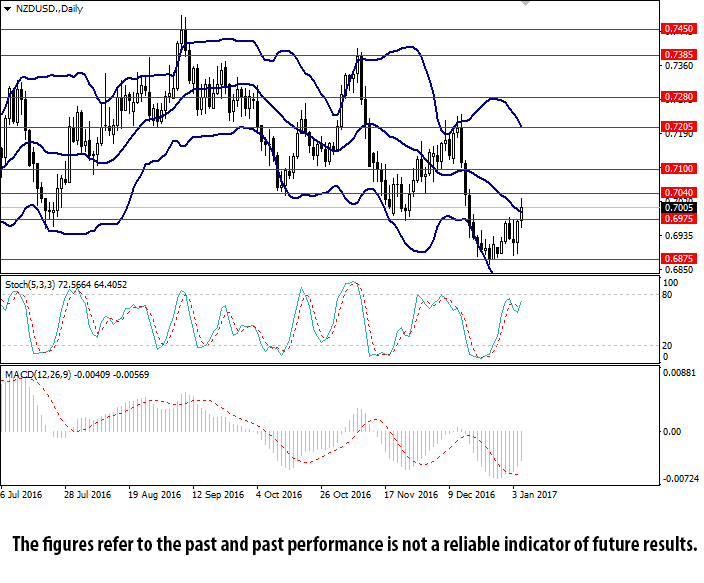

On the daily chart, the pair is trading near the middle MA of Bollinger® Bands while the price range remains wide. MACD histogram is in the negative zone and its volumes are falling. Stochastic turned up again near the border of the overbought zone.

- Support levels: 0.6975, 0.6875.

- Resistance levels: 0.7040, 0.7100, 0.7205, 0.7280, 0.7385, 0.7450.