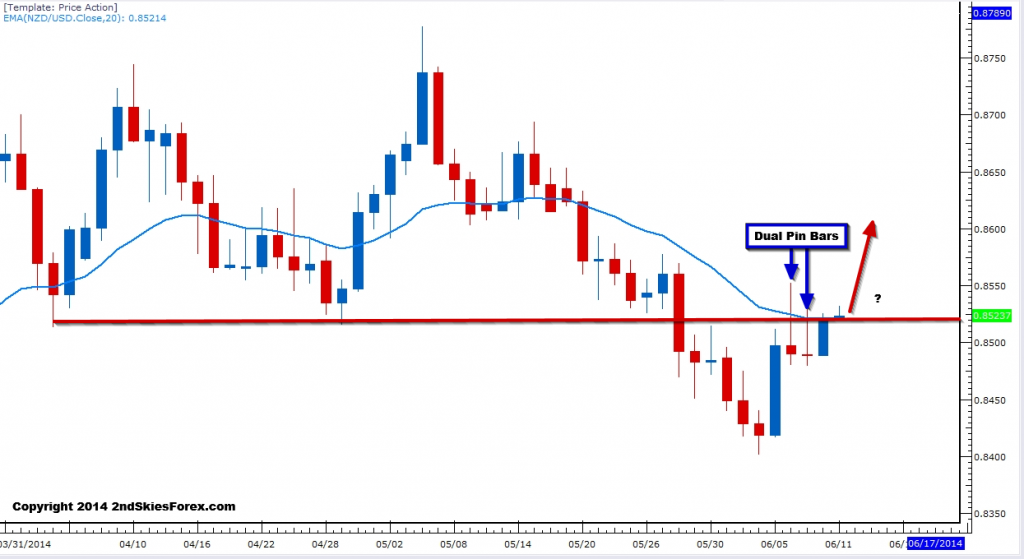

NZD/USD – As We Suggested, Bullish Pressure Continues

In yesterday’s members commentary, we discussed the dual pin bars, but commented how we did not like to short these in particular, because we felt the underlying price action, especially after the second pin bar, suggested short term there would be bullish pressure likely to close above the key level at 8515.

Today the Kiwi did just that, and this goes to show the importance of being able to understand the price action context. Today’s close was right on the daily 20 ema, so bears may still reject it lower.

Our Trade Idea: For now, we are sitting aside to see how it reacts to the daily 20 ema. If we can take out the highs from two days ago, then we’ll mark this 8515 level as ‘recovered’, and will expect the short term bullish price action to continue.