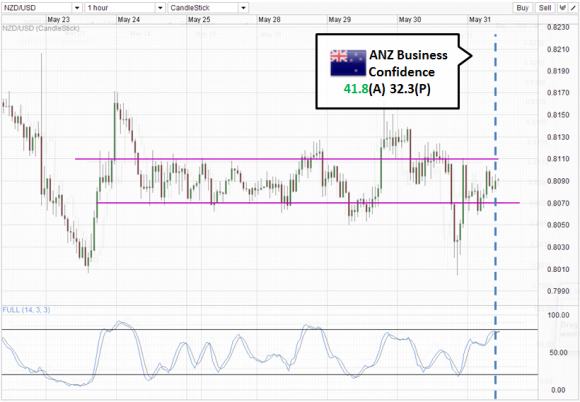

Despite the threat of China’s economic slowdown, businesses are remaining highly bullish. Business Confidence numbers came in at 41.8 for the month of April, a huge leap from previous month’s 32.3 and the highest since 2011 July. However, NZD/USD did not react much to the numbers, with price continuing to stay within the consolidation zone of 0.806 – 0.811.

Hourly Chart NZD/USD_1" title="NZD/USD_1" width="580" height="402">

NZD/USD_1" title="NZD/USD_1" width="580" height="402">

From a technical perspective, recent movements below and above the consolidation zone are merely whipsaws instead of indication of bull/bear intentions. Furthermore, if we zoom out slightly, we can actually see a wider consolidation between 0.801 – 0.817, with the core consolidation between 0.806/11. What does this mean to NZD/USD? With the week and the month coming to a close today, we could see yet more potential whipsaws as liquidity dries up, yet price is unlikely to move away from current consolidation narrative.

Daily Chart NZD/USD_2" title="NZD/USD_2" width="580" height="400">

NZD/USD_2" title="NZD/USD_2" width="580" height="400">

How does the better Business Confidence numbers fit into a longer-term fundamental narrative? NZD/USD tend not to have any strong long term correlation with Business Confidence figures. However, with business confidence being stronger than before, the pressure will be off for RBNZ to cut its policy rates and incentivize Gov Wheeler to embark on further weakening of NZD. Astute market watchers may disagree, suggesting that the reason why confidence level is growing is primarily due to the lower NZD/USD, which trumps even the threat of global economic slowdown. The dichotomy of these 2 possible interpretation could possibly explain the non-reaction of Kiwi post announcement, as traders are at a loss of what to truly make out of it.

From a technical viewpoint, price is undoubtedly in a downtrend starting from 1st May, with a move above 0.818 needed to invalidate current bearish pressure. Stochastic readings suggest that a bull cycle is currently underway, which makes a a move back towards 0.818 possible. With the possibility of USD weakening due to slowing down of US stocks, there is a good case for NZD/USD to retest 0.818 to be made. However, given the ambiguity of fundamentals and short-term technicals, traders should lookout for further confirmation during such volatile times.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NZD/USD: Business Confidence Hits 20 Months High

Published 05/31/2013, 04:02 AM

Updated 07/09/2023, 06:31 AM

NZD/USD: Business Confidence Hits 20 Months High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.