The New Zealand Dollar is a hard one to trade for a lot of people, especially long term trend traders who are big on large, sustained moves. Sadly though, the New Zealand Dollar is not one of those currencies. It instead prefers to trade between market channels and support and resistance lines, and seems to have a solid range for the moment of around 80-85 cents.

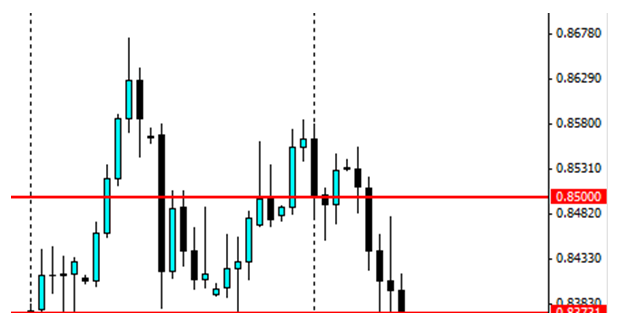

What happens to moves above 85 cents?

We tend to find very sharp pullbacks occur after touching this mark. Economically speaking 85 cents is at the upper edge of competitiveness for the NZD when it comes to exporting, so sell offs are warranted. Technically speaking, markets will push back on reaching the 85 cent mark, and we start to push into overbought territory on the RSI, leading to sellers jumping in to cash in on the action.

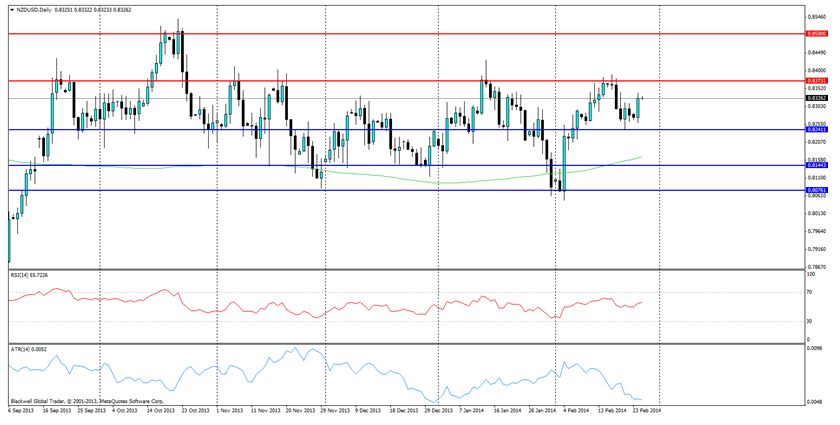

Optimal trading points for the Kiwi should be support and resistance levels that are obvious in the markets.

NZD/USD Daily" title="NZD/USD Daily" height="242" width="474">

NZD/USD Daily" title="NZD/USD Daily" height="242" width="474">

As can be seen above, the 0.8373 resistance level is extremely solid and market momentum has been to bounce off this point and head lower as it ranges. While Support, for example, at 0.8076 is very solid, any movments this low would certainly be looking to push back upwards.

Many readers will now be saying, what else can I use to help trade the NZDUSD? I personally use RSI ATR. It’s quite common for traders to pull back upon touching oversold or overbought points in the NZD/USD.

As I have said, we tend not to get big, long, trending spikes up and down, but a ranging pattern which has been in place over the last couple of years. ATR allows for volatility to be seen and also tells you if there is enough momentum for a break out of a key support or resistance level. A low reading generally implies that while it might be trending up, it certainly won’t be breaking through anytime soon, unless there is a sudden impact of economic news.

All up the NZD/USD pair is a great pair to trade. When thinking of strategies, look no further than the basics for catching momentum up and down. Don’t rely on big swings that will break through key levels, but instead look for price action on these key levels as the NZD looks to find its way across the charts. Lastly, also pay attention to economic data which could affect these levels, while break outs are rare (especially above north), they can happen. However, they generally are brought back in line with the current range I have spoken in detail about.