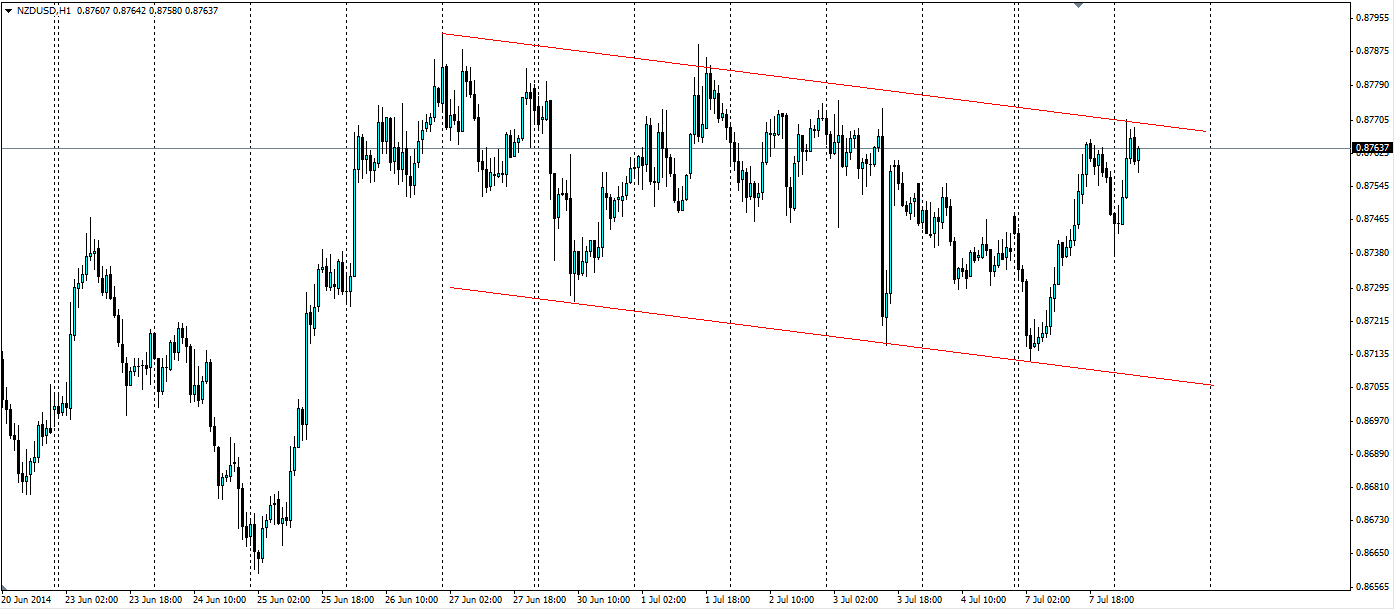

The NZD/USD pair has reached the heady heights close to the 0.88c mark and the market has made it clear it does not belong there. As a result, the Kiwi dollar is now following a bearish channel which should see it return to the low 87s in the near term.

The bullish sentiment in the Kiwi dollar looks to have run out of steam for now. Weak US data atthe end of June, combined with a strong NZ trade balance and speculation the RBNZ will stick to its plans to increase interest rates to 4.5% by the end of next year, pushed the Kiwi close to the post float high against the US dollar of 0.8850.

However, recent data out for New Zealand has taken the shine off the Kiwi dollar. Building Consents have fallen -4.6% as higher interest rates and restrictions on lending act to cool an overheated housing market. ANZ’s Business Confidence survey fell from 53.5 to 42.8 and commodity prices fell once again for the fourth month in a row, down -0.9%. Today saw the New Zealand Institute of Economic Research’s (NZIER) Business Confidence survey echo the ANZ report last week as it fell to 32 from 52. Above zero is optimism, but the falling trend is a worry for the New Zealand economy.

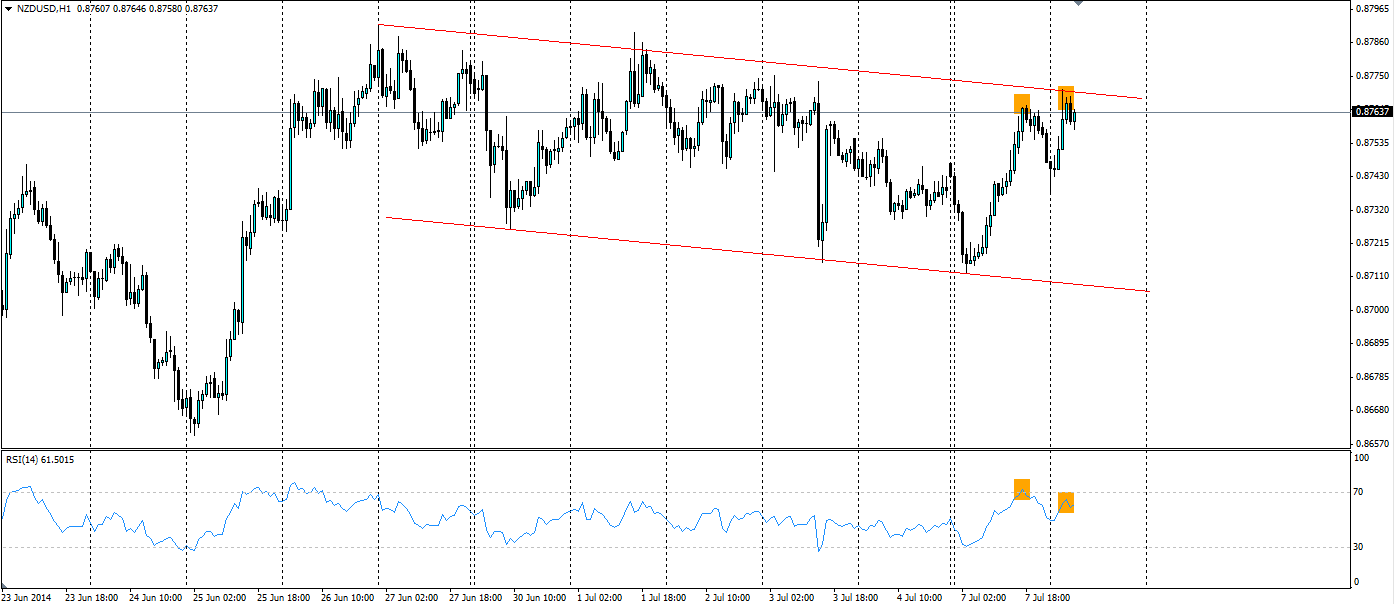

The net result of the last two weeks of negative data is the downward sloping channel the Kiwi finds itself in. The support line has been tested three times and the price has bounced off it every time. The Resistance line has today been tested for the third time and has so far held firm as the price looks to head back to the bottom.

Further evidence of a movement down to the support line is the bearish divergence in the RSI.The price posted a higher high in the last 24 hours, however, the RSI posted a lower high. This is a bearish reversal signal, which combined with the touch of the upper line of the channel, points to a movement back down to the bottom.

Source: Blackwell Trader

The Kiwi looks like a good short play at the current levels. A stop loss for this set up should be placed above the resistance line, outside the channel. An obvious target for this trade would be the bottom of the channel, however, traders may look for the previous support at 0.8737 as a primary target.

The NZD/USD looks to have formed a bearish channel as recent fundamental news disappointed the market. Divergence between the price and the RSI looks to predict a reversal down to the bottom of the channel.