The New Zealand dollar is trading lower against the US dollar for a fourth consecutive day in Tuesday's London trading session.

The Reserve Bank of New Zealand (RBNZ) bi-annual financial stability report is due for release this week. The financial stability report covers the soundness and efficiency of the New Zealand financial system as well as outlining the key policy measures that the central bank is undertaking.

The market will be attuned to whether RBNZ Governor Graeme Wheeler will try to 'talk down' the Kiwi dollar. Governor Wheeler stated at the last RBNZ meeting that the strong New Zealand dollar gives the central bank “greater flexibility as to the timing and magnitude” of future interest rate increases. The RBNZ benchmark interest rate currently stands at 2.5%.

The US dollar has seen broad strength following the positive economic data of last week. Last Thursday's GDP report showed that the US economy expanded faster than expected in Q3. On Friday, the non farm payrolls report from the Bureau of Labor Statistics far surpassed expectations.

The robust economic data out of the US has fueled speculation that the Federal Reserve may begin tapering their $85 billion a month bond purchases as soon as their meeting in December.

San Francisco Fed president John Williams said the jobs report was encouraging and Atlanta Fed President Dennis Lockhart said the Fed can't rule out QE tapering next month. Speaking to reporters in Mississippi he stated “the question of changing the mix of accommodative tools ought to be on the table at every meeting for the foreseeable future.”

Another factor powering the rally in the greenback was the surprise rate cut from the European Central Bank last week. The ECB lowered their benchmark rate to a record low of 0.25 percent amid concerns over below target inflation levels.

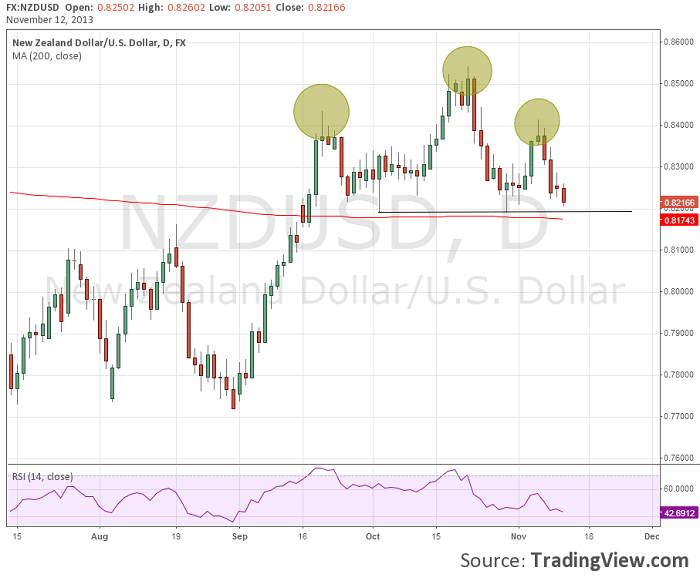

NZD/USD Daily Chart

The daily chart of NZD/USD shows a well defined head and shoulders top pattern, with price nearing the neckline at 0.8190. The nearby 200 period moving average at 0.8175 underscores this area as a key inflection zone. NZD/USD" border="0" height="581" width="700">

NZD/USD" border="0" height="581" width="700">

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NZD/USD Forms Head And Shoulders Top Ahead Of RBNZ Report

Published 11/12/2013, 05:19 AM

Updated 05/14/2017, 06:45 AM

NZD/USD Forms Head And Shoulders Top Ahead Of RBNZ Report

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.