The New Zealand Dollar (NZD) finally broke through its bullish trend line after all its solid gains over the past month. Many had been talking down the fact that the NZD was due for some sort of minor correction lower, given that anything over 85 cents is disliked by the market. However, it has taken a while and even with government comments in the past, from the likes of the Finance minister Bill English in mid February, who commented that “the NZD may be 20% overvalued”, did not stop the upward momentum at all.

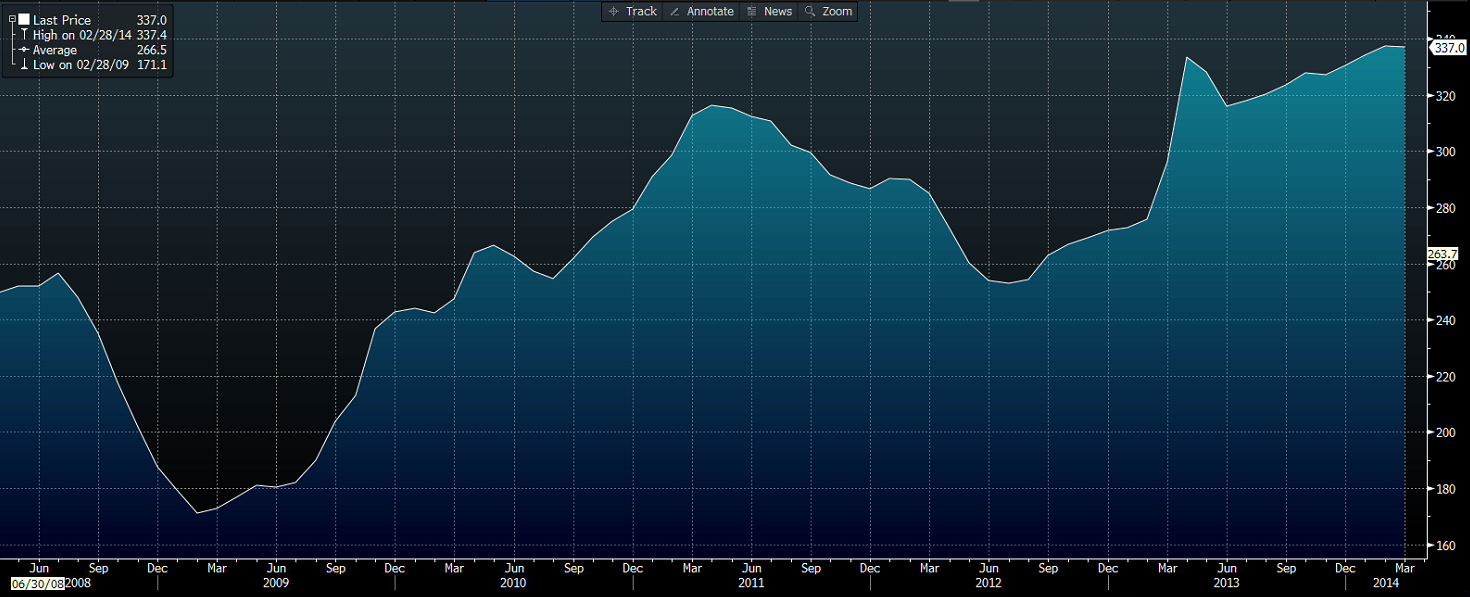

Source: Bloomberg (NZ trade weighted index)

The trade weighted index certainly shows the power of the Kiwi Dollar as it has climbed against all of its major partners, but the catalyst for these major climbs in recent times and the market optimism has been led in part by the commodity sector in New Zealand. More specifically, the dairy sector, which has risen to power under the Fonterra cooperative. This shouldn’t come as too much of a surprise to most traders, as the New Zealand Dollar is a ‘commodity currency’ after all.

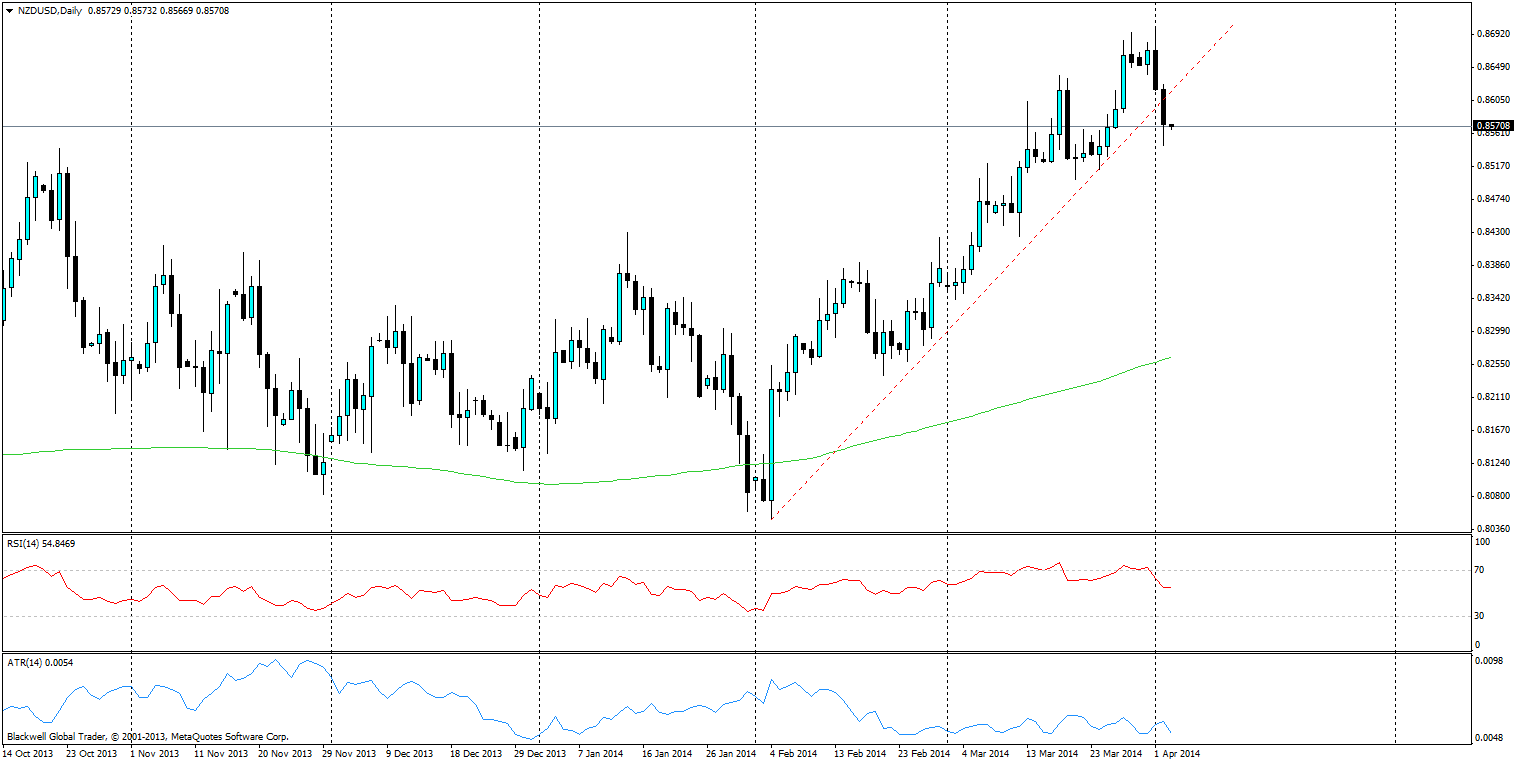

Source: Bloomberg (ANZ commodity world price index NZD)

The commodity index has been incredibly high and had hit a record high back in February. It has since tapered off a bit and it looks likely that it may fall further in the coming months. Record prices for dairy has started to slow down considerably with last night’s Fonterra dairy auction having its biggest drop in almost 20 months, falling 8.9%. That being said, a high currency will lead to a drop off in the sale of dairy for the NZ economy as it starts to become slightly more expensive.

The NZD is starting to look like a good shorting opportunity, especially given last night’s events and the current highs of the NZD. Despite further interest rate rises predicted, the market has likely priced these in and valued accordingly. A stronger US recovery and more support from the FED has not entirely been priced in and many people are now predicting the US economy will pick up the pace come the northern summer andalso a return of a much stronger U.S. Dollar.

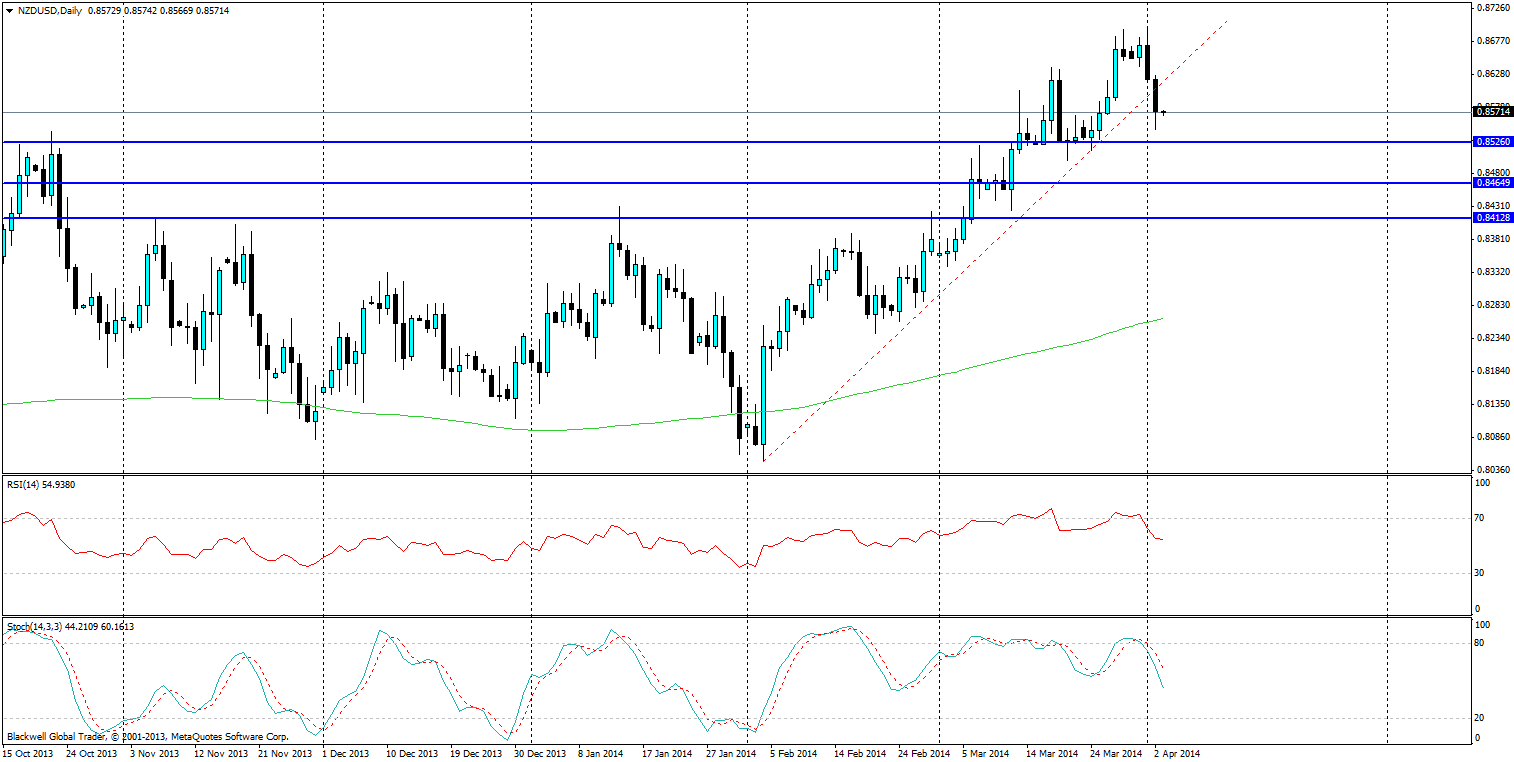

The technical side of things is starting to look a little more bearish. The breakthrough of the bullish trend line was expected and movements lower are now likely to be stronger. I’m still looking for a few more lower lows to confirm bearish movements instead of a ranging market which the NZD likes to do from time to time.

Indicators are showing bullish signs. The RSI is showing a dive from the previous overbought conditions which it has been showing in the last few days. The stoch has shown a clear divergence and a steep dive lower in momentum as markets start to look very much bearish. Moves lower certainly seem to be on the cards after the break through and the indicators pointing to lower lows.

Support levels are likely to be found at 0.8526, 0.8464 and 0.8412. Any resistance is likely to be found on the 0.8600 level as the market will likely use the psychological level as the ceiling for further movements over the next 24-48 hours.

The market certainly has opportunities for movements lower and traders will certainly be looking to strike with the current position the NZD is in. With the terms of trade abhorrently high and the milk prices taking a solid dive, coupled with the US economy coming back into strength, I would expect to see further falls for the NZD back into the low 80-83 cent range. Anything lower than that seems unlikely given the recent interest rate rise as well as future ones that the RBNZ has priced in.