A worrying data set from PMI and risk aversion for FX markets sees NZD/JPY on the cusp of breaking to new lows.

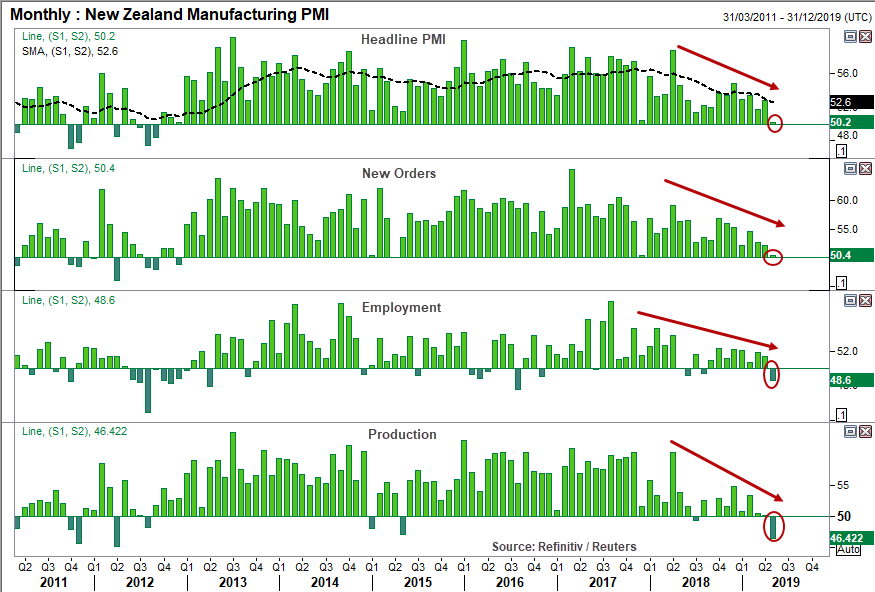

Manufacturing PMI expanded at its slowest rate since December 2012. At a mere 50.2, it is close to contraction and, whilst we could hope this is just a blip, its 12-month average points markedly lower to suggest their business cycle has most likely peaked.

There are also some worrying signs of weakness within the sub-indices:

- New orders are expanding at their lowest rate since December 2017 and close to contraction

- Employment has contracted, and at its fastest rate since September 2016

- Production contracted for the first time since May 2015, and at its fastest in 7 years

- All trends are pointing lower to suggest NZ could be headed for a recession

However, these are leading indicators and will take time to filter through to the economy (and eventually weigh on growth). Yet as markets are forward looking, they’re acting now and pushing NZD markedly lower. Furthermore, any weakness in NZ (and visa versa) tends to have an impact their neighbours Australia, which has seen their US-10 year crash to a new historical low of just 1.37%.

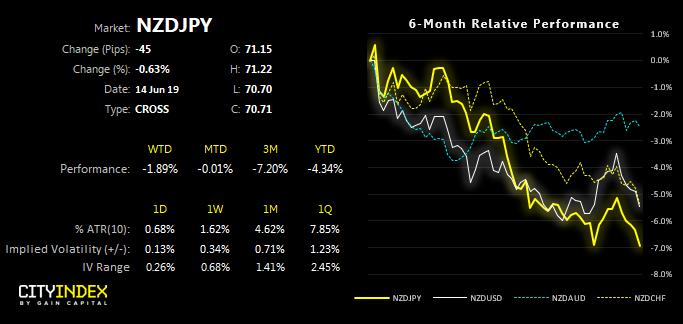

There’s a slight risk-off vibe on FX markets surrounding Middle East tensions (even if stocks are shrugging them off, for now) which is weighing on NZD/JPY and AUD/JPY. That NZ saw such shocking PMI today makes NZD the weakest major by an easy margin.

- We can see on the daily chart that the trend structure is firmly bearish. A bearish engulfing candle marked a prominent swing high at a resistance zone and, at the time of writing, NZD/JPY is on the cusp of testing its cycle low. Moreover, bearish momentum suggests a downside break could be imminent.

- Whilst support could give way at any moment, we consider fading into minor rallies below the 38.2% retracement level and targeting the 2019 lows. Even if sentiment surrounding Iran were to reverse, it doesn’t remove issue of weak domestic data and likely calls for RBNZ to cut and follow a dovish RBA in lockstep.