New Zealand dollar strengthens mildly today after RBNZ key rates are unchanged at 2.50%, as expected. More importantly, RBNZ sounded optimistic as it mentioned in the statement that growth has "picked up" with increase in consumer spending and Canterbury rebuilding gaining momentum. Though, it also mentioned that "fiscal consolidation is constraining aggregate demand." Also, the central bank also warned that ND is "overvalued and overshoot March projection. And, "the high New Zealand dollar continues to be a significant headwind for the tradeable sector, restricting export earnings and encouraging demand for imports." RBNZ expects to keep OCR unchanged "through the end of the year". Overall, the accompanying statement is more neutral than expected. NZD is back above 0.8440 after dipping to 0.8360 earlier this week.

Aussie remains relatively soft as inflation data missed expectations. CPI rose 0.4% qoq in Q1 and accelerated to 2.5% yoy. However, that was below expectation of 0.7% qoq, 2.8% yoy. The RBA trimmed mean CPI has indeed moderated to 2.2% yoy even though the weighted mean CPI rose more than expected to 2.6% yoy. Overall, the data suggested there is scope for further policy easing from RBA should economy loose momentum. Markets are pricing in over 40% chance of rate cut by the central bank in May to boost non-mining activities.

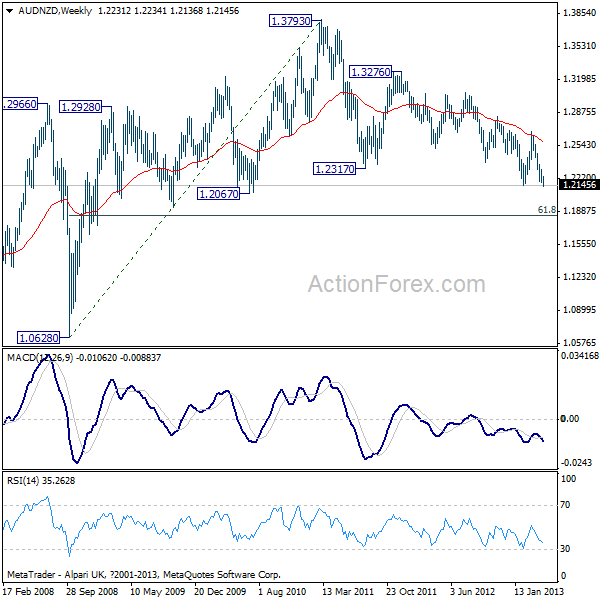

AUD/NZD drops to 1.2136 so far today and breached February's low of 1.2142. The development suggests that fall from 1.3276 as well as the medium term down trend from 1.3793 has resumed. As noted before, we'd expect such down trend to target long term fibonacci level of 61.8% retracement of 1.0628 to 1.3793 at 1.1837 in medium term. AUD/NZD" title="AUD/NZD" width="600" height="600">

AUD/NZD" title="AUD/NZD" width="600" height="600">

Euro continues to hover around 1.3 level against dollar and remains soft as yesterday's PMI data raised the concern that weakness in the peripherals, which has spread to France, is now starting to affect Germany. And there is continuous speculation of rate cut from ECB. German Ifo will be a focus today and is expected to show mild deterioration in April. Euro would be pressured if the data miss expectations. Other data to be watched include Swiss UBS consumption indicator, UK BBA mortgage approvals, CBI reported sales and US durable goods.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NZD Lifted By RBNZ, AUD Lower On CPI

Published 04/24/2013, 05:30 AM

Updated 03/09/2019, 08:30 AM

NZD Lifted By RBNZ, AUD Lower On CPI

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.